Fed Pivot Means Judgment Day For 3,200 Corporate Zombies

A day of reckoning is coming for zombie borrowers as the lower-for-longer rate environment that fed them on cheap credit is ending.

Photo by Dmitry Demidko on Unsplash

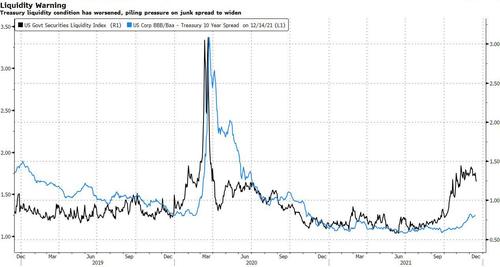

In a drastic policy shift, the Fed said it will double the pace of its bond tapering to begin raising rates next year. This looks to worsen liquidity condition in the Treasury market, piling pressure on junk yield spreads to widen.

The U.S. Govt Securities Liquidity Index, which measures in real time the yield dispersion of Treasuries relative to off-the-run bonds, has risen, showing tighter liquidity is leading to more frequent price dislocations. The U.S. junk yield spread tends to move in tandem. While that shift has already started, there may be a gap to close.

Troubles are ahead for companies with shaky finances. Out of 25,518 worldwide companies that were able to meet interest payments from income in 2019, more than 3,200 saw an average interest coverage ratio of below one over the last six quarters of the pandemic.

Disclaimer: Riki nema disclaimer.