Gold & Gold Mining Stocks Are In Rotation

In the past month we are now starting to see a new bull market start and that is in the precious metals sector (gold, silver and mining stocks). Also we see commodities as a whole showing signs of a bull market. Commodities tend to perform the best when the US stock market is nearing a major top.

After exiting my gold investments in August 2011, gold and the entire precious metal sector has been in a large correction phase within its cyclical bull market. Crude oil has also been trading sideways for years. Because of this I have not been active in trading or investing in these two commodities.

These two commodities Gold and Oil are what I focused on trading when they were in strong rising or falling trends. That is how I came up with the name for my ETF trading newsletter TheGoldAndOilGuy.com.

Anyway, with that said, lets jump into some gold forecast and gold stock analysis because precious metals are firing up again and there are some big opportunities in 2014 emerging as we speak.

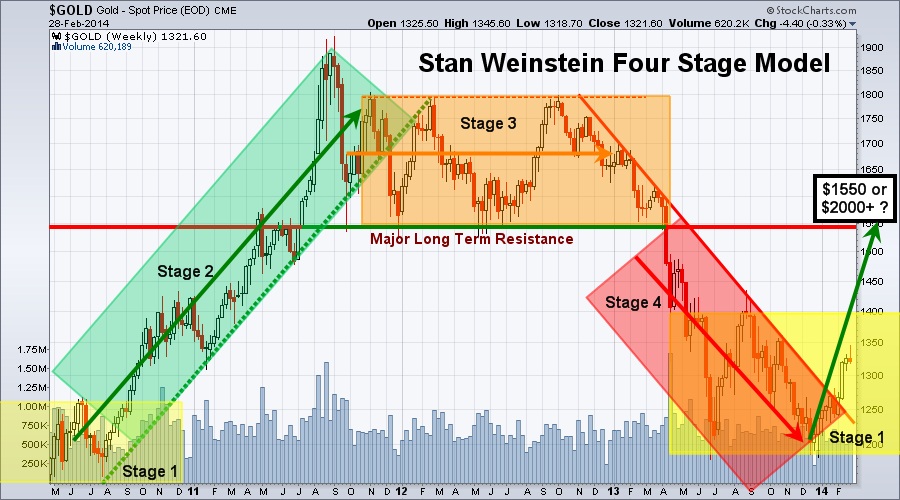

All trading and investing strategies should be based around trading with the underlying market trend. The best way to understand and identify what trend the market is in is through stage analysis. This theory because popular by Stan Weinstein as he explained how the market trades in four different stages which I explain in detail in my new book.

Gold and It’s Market Stage Analysis:

The key to investing is to be buying and holding investments which are starting a new bull market (Stage 1 & 2). You don’t want to be holding securities that are in a stage 3 or stage 4. Investing in overpriced assets that are showing signs of a market top similar to the 2000 technology sector, and 2008 financial crash is not where new investment capital should be put to work.

Most investors only focus on the major indexes to gauge the market strength and ignore other asset classes. But knowing that there is almost always a new bull market starting whether in a stock, sector, world index, commodity, real estate, bonds, or currency etc. So it only makes sense to rotate money out of mature markets and into new fresh investments that show growth potential.

Money Is Rotating Into Gold Stocks

In the last two months we have seen gold mining stocks surge in value and the best way to gauge this is through the $HUI gold bugs index chart.

Check out The Gold and Oil Guy's special here.

This material should not be considered investment advice. Chris Vermeulen and J.W. Jones are not registered investment advisors. Under no circumstances should any content from this website, article, ...

more