Guideposts For An Indecisive Stock Market

Three Economic Strikes

Tuesday’s economic news carried a theme of “below expectations”. From The Wall Street Journal:

The Chicago Business Barometer, referred to as the Chicago PMI, fell to 60.5 in September from 64.3 in August. Economists surveyed by The Wall Street Journal had expected a reading of 62. The Conference Board’s index of consumer conference fell to 86 in September from 93.4 in August, missing expectations for a reading of 92.8. And the S&P/Case-Shiller Home Price Index showed U.S. home prices rose 5.6% in the 12 months ended in July, down from 6.3% in June. Economists surveyed by The Wall Street Journal had expected a 5.8% rise in the national index. The 20-city price index rose 6.7%, less than the 7.3% expected.

Short-Term Guideposts

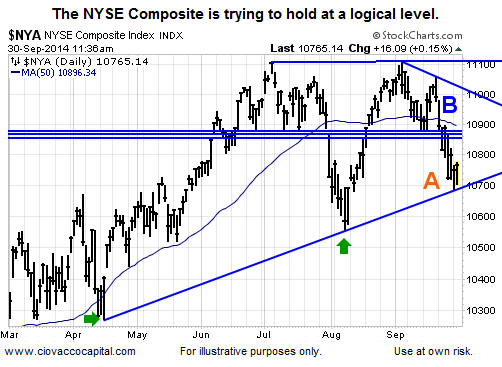

As noted in this week’s video, the broader equity market is showing some “pay attention” signals, along withdeteriorating market breadth. On the bullish side of the ledger, the longer-term charts still look good and we know an open mind is required when the S&P 500 is hovering near a flat 50-day moving average (as it is now). Therefore, drawing lines in the sand can help us balance the need to be patient with the need to protect capital in the event of ongoing weakness. In the short-term, if Monday’s lows are taken out, it increases the odds of additional weakness in stocks (see point A below). The odds of good things happening short-term will increase if the NYSE Composite can close above its 50-day (near point B).

The current state of weekly stock market momentum (very weak and vulnerable) tells us risk levels need to be watched closely. We are accounting for downside risks with a higher than normal stake in cash and IF, THEN contingency planning. Wednesday brings a report on manufacturing and Friday features the monthly labor report.

Disclosure: None.