How I Beat Warren Buffett

Today you can read about how I beat Warren Buffett. The billionaire Oracle of Omaha told CNBC that his investment in Tesco Plc (TSCDY) was a “huge mistake,” as the U.K. supermarket leader’s share price remains close to an 11-year low amid declining sales and an accounting probe. “I made a mistake on that one,” Buffett, 84, said in an interview. “That was a huge mistake by me.”

There are a couple of reasons why I beat Buffett, and it is not because I am smarter than he is or a more successful stock picker.. He is the winner with Berkshire Hathaway, one of the most successful investment vehicles the world has ever seen. My edge is because I am younger than Buffett, a woman who buys groceries, and a global traveler.

We had owned Tesco for ages when I put a sell on it on January 23, 2012. You can verify the details by clicking in to www.global-investing.com and visiting the Performance Table called “Closed Positions” which is public. We sold for a profit at $15.75 per share. Today the stock is barely over half that price level, at $8.59. Here's why I put a sell on Tesco.

Buffett-Blessed

Tesco's Fresh & Easy chain being built out in the US West Coast was yet another attempt by a grocer from across the pond to sell in the USA, which is a tough market to crack. British, Dutch, Belgian, French, German firms keep trying to add a trophy US supermarket arm to be more global. It usually fails. But the Tesco idea seemed particularly stupid: to offer Califormians fresh produce and no coffee, in a state where so much fresh food is grown and sold via short-chain grocers, many of them in ethnic neighborhoods. Why would anyone drive 13 miles to visit the TSCDY arm?

-

Its UK business was under increasing threat from el cheapo discount German firms like LIDL (pronounced little) and Aldi, which carry a much reduced line of groceries, and don't even bother stacking stuff on shelves to keep prices low. They started out refusing credit card payments and making you put a coin into the shopping cart (retrievable at the end of your visit), and also had limited parking. But as they got to know the British shopper better these annoyances were removed. They also started to add fresh produce to their offerings, and upmarket or ethnic goods, based on the neighborhood where the German stores were located in.

-

Meanwhile Tesco, the dominant player, was building huge new suburban stores, with more options than most shoppers need, running loss-leader sales, and diversifying without good reason into banking and computer-cellphone businesses. They kept building big stores.

-

This wild and illogical diversification was needed to keep firm afloat because its huge aircraft carrier-sized stores had to be paid for. The supposed “moat” that would protect Tesco from rivals (including a WalMart sub called ASDA) would not work against smaller stores located on British High Streets (their version of Main Street) which were taking over small grocers had closed because they couldn't match the Big Box store prices. Now these stores were part of the German invasion. And Tesco was not trying the Fresh & Easy concept in Britain for fear it would hurt its market dominance with the suburban mall stores.

In case it is not obvious, my information on the UK market did not come from studies by marketing experts, as these only came much later. They came because I go to the supermarket when I am in London, sometimes alone, and sometimes with my British sister-in-law.

And of course when I sold the Warren Buffett-blessed Tesco stock I was frightened that I had missed some advantage the billionaire knew about. I even warned my readers that I was doing the opposite of what Buffett had done.

But thinking it through I decided that I was better informed on this particular share than the Master.

We also in 2008 had turned down a reporter's push for another Buffett-blessed stock, BYD of China. That gave me courage.

European shares this morning suffered the largest drop in a 15 months and Italy fell more than in the prior 19 months. We are in Euroland but (phew) sold out of Italy in time. However the Brazilian market is up after falling too far for fear that Dilma Rousseff would sweep the presidential poll to a first round victory Sunday.

The hot German Rocket IPO today opened below its issue price. I warned against this block box share last week. It makes Alibaba look well-priced.

Exiting Pimco

*The exit from Pimco funds continues and shows that I bought Allianz Versicherung (AZSEY) too soon. In Germany, Allianz has let it be known that the CEO, Michael Diekmann, will be asked to step down, contrary to what I had predicted, and not be kept on for longer than six months after he hits the retirement age of 60 in Dec. It appears that during his last year on the job Bill Gross's eccentric screeds about his late cat (or moggie) had already turned clients off. The Pimco Total Return Fund, run by the super-star manager, lost $23.5 bn in assets last month, only two working days of which occurred after the Gross news came out. Note that in the period between Jan. and Aug., the same fund had already lost $42 bn in assets under management, nearly double as much, on the assumption that Gross would stay on the job and comfort himself with a new cat.

At the end of August, Pimco Total Return Fund has $201.6 bn under management. But there is plenty more in Pimco's stable, starting with the Pimco Income Fund which beat 99% of rival bond funds over the past 3 and 5 years according to Bloomberg. Its manager was Daniel Ivascyn who has just replaced Gross. Pimco has a host of closed-end funds in the bond and muni bond space whose investors have no reason to walk. Fitch wrote today that Pimco funds are unlikely to suffer any decline in net asset values, presumably meaning it can sell assets to meet withdrawals for its funds or switch panickers to Mr. Ivascyn's fund..

*That is not to say there won't be a lot of stress in bond markets. Pimco liquidations cut its position in Canadian bonds from 7% at the end of August to 2% now. That is the easiest market for US bond funds to exit. But overall, with the SEC and the Fed watching to see what the market impact from the Pimco crisis will be, I think US issues, notably the inflation-indexed T-bonds Mr. Gross was so fond of, will be sold off less strongly than foreign bonds.

Still to come because of the need to coordinate with Munich over the euro will be sell-offs in euro-denominated bonds. For now we only own US$ denominated bonds directly (although what is in our bond closed-end funds is hard to track more frequently than monthly).

And as I keep saying, Pimco may build up its equity side on the sly, by substituting low-priced high-yield foreign blue chip stocks with rising dividends for some of those bonds. I am looking out for data from Pimco as it comes out but we are already in the yield stock space.

I don't expect Pimco will sell foreign bank preferreds from Royal Bank of Scotland. They are actually a favorite of the fund which Gross will now be running.

*Agrium forecast 45 loony cents of earnings in the current quarter while Bay Street expected 60 cents. This results, Martin Ferera writes, “despite or rather because of record North American harvests, which pushed down grain prices and farm income.” He points out that the low earnings number also reflects two of “AGU facilities being down, the Vascoy potash mine in Saskatchewan for an expansion project and the Redwater nitrogen plant in Alberta for an equipment upgrade.” AGU is down ~4%. Martin says it is unlikely to suffer long-term as food demand is growing and “it is still the best placed fertilizer stock given its large and growing retail business.”

Exceptions to Rules

*Australia faces ballooning costs to bring its natural gas projects to fruition so the stuff can be frozen and shipped to China. Martin, who likes exceptions to the rule, writes that his Down Under pick in the gas liquefaction space, Origin Energy, is further along in the race than other Ozzies with its stake in the APLNG project. Alast year, OGFGF shares were hit when it warned that the cost of the project might come in 10% over budget. Now that looks piffling compared to what competitor gas exporters face with projects further from completion.

*Back in his homeland, Canada, Martin points out that British Columbia faces a threat that Petronas will pull out of buying gas fields there because of tax uncertainty both in Vancouver and in Toronto. And then there are the Vancouver greens (among whom I suspect Martin is a member as he lives in Vancouver). That makes the future of Veresen, building its pipeline network and its LNG plant in Washington state another exception to the rule and likely winner. FCGYF is collecting permits in the USA west coast rather than in its native Canada and Martin figures they will be in place in the nedt 3 to 6 months. That means construction can start early in 2015 and production go live by 2017.

*My screed yesterday about how e-trade is removing access to trading on the London Alternative Investment Market has triggered a sell-off in all the shares we owned traded there with the exception of Camkids, which was tipped in the Investors Chronicle earlier this week. Since I wrote the piece Interactive Brokers and Scottrade also say they will not trade electronically stocks on the AIM.

*Apart from resurgent Rousseff runoff risks, another reason why Cosan is up today is that CZZ has delayed listing its spun off Cosan Log (logistics) share until Oct. 6 because of regulatory delays. In the interval CZZ now is traded in Brazil as a basket including the parent company and the Log arm which has taken over All America Logistics. I have received 3 conflicting “Fato Relevante” press releases on this matter in Portuguese and the above is the gist of the most recent corrected one. At some point we will get Log ADR shares from the succession but I await details from São Paulo.

*Nokia is among the few Euroland winners today as its HERE map and location system was shown as original equipment in most new cars exhibited today at the Paris Motor Show. NOK.

*Teva is also up 2.6% on optimism about how its patent suit over Copaxone will be handled in two weeks by the US Supreme Court. TEVA has a strong legal bench but I have learned to never try to call what the Supremes will rule. Yesterday Standpoint Research downgraded Teva to hold from buy.

*Our bond advisor David Landes of reports that Loomis Sayles bond manager Dan Fuss must have misled Bloomberg last week when he tipped Portuguese sovereign dollar bonds. The www.bondsonline.com expert says there are no $-denominated Portuguese bonds except maybe private placements. Don Fuss is 82 and is an even better bond guru than Bill Gross. Maybe he bought pp bonds; maybe he bought non-govt ones; maybe he bought euro ones and covered the foreign exchange risks.

Fund news:

*Our Yoma Strategic Holdings fund invested in Myanmar should gain from the opening of the country to foreign banks. According to Neue Zuercher Zeitung today, banking licenses were granted to 9 foreign banks by the Central Bank including: Bank of Tokyo-Mitsubishi, Sumitomo Mitsui Bank, and Mizuho Bank of Japan; OCBC and UOB of Singapore; Australia & New Zealand Bank; Maybank of Malaysia; Bangkok Bank of Thailand; and Industrial & Commercial Bank of China (Beijing.)

The Irish Contest

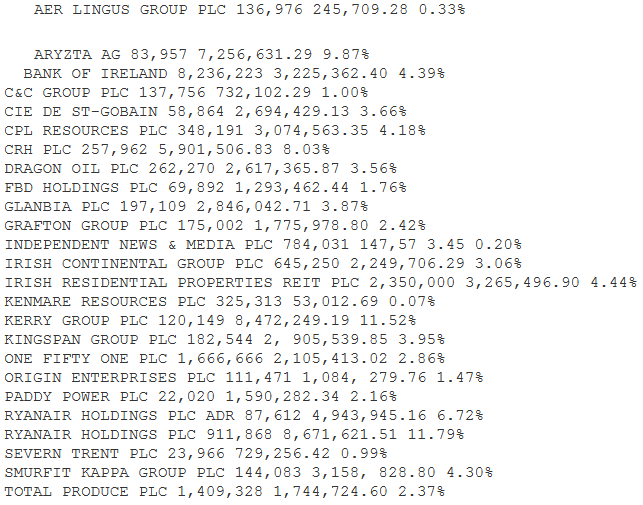

*New Ireland Fund's latest report suggests a stock buy from the Auld Sod with more appeal than Paddy Power plc, PDYPF, half sold. Not banking, or media, not dairy or supermarkets, and certainly not Ryanair as its is 19.51% of the portfolio of IRL and that means we have a lot of the discount airline already. I think my comments on how hard it is to transplant businesses across the pond (above) may suggest what I am thinking of. So here is a contest for the Yom Kippur weekend. By October 10 tell me which stock I may buy. Here is the list of IRL shareholdings from the most recent report. Note that Severn Trent and Cie de St-Gobain are not Irish. Which of these tempts me? Guess correctly and you get a free trial 1-yr subscription to send to a family member or friend:

Disclosure: None