Investing In Chicken Sales Earnings Growth

Sanderson Farms, Inc. (SAFM - Trend Report) is benefiting from the record high beef prices as more consumers switch to chicken. This Zacks Rank #1 (Strong Buy) recently blew by the Zacks Consensus in the fiscal second quarter by 32% as chicken volumes spiked.

Sanderson Farms produces fresh and frozen chicken in the United States.

Huge Beat in Fiscal Q2

On May 29, Sanderson Farms reported its second quarter results and beat the Zacks Consensus by 53 cents. Earnings were $2.21 compared to the consensus of just $1.68.

Sales rose 6.4% to $660.7 million from $621.2 million a year ago. The company saw a higher gross profit per pound as volumes spiked on strong demand, there were lower grain costs and chicken prices remained stable.

Summer Grilling Season is Here

The summer is usually the peak season for chicken demand simply due to the fact that everyone is grilling out. This year, however, beef prices are at record highs. Already, Sanderson Farms has seen consumers rotating into chicken due to cost.

The company said it was "reasonably optimistic" heading into the summer. Chicken demand is expected to remain strong and supply is still constrained which should keep prices elevated.

The analysts are bullish on fiscal 2014. Earnings are expected to rise 36.9% to $7.78 per share this year.

Shares Soar But There's Still Value

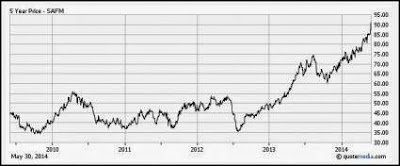

Shares have nearly doubled the last 2 years and are now at 5-year highs.

But despite the surge, there's still value. Sanderson Farms trades with a forward P/E of just 11.6.

It also has a price-to-sales ratio of just 0.8. A P/S ratio under 1.0 usually indicates the company is undervalued.

If you're looking for a food play to cash in on growing chicken demand, then Sanderson Farms should be on your short list.

None.