Investing In Semiconductor Earnings Growth

Headquartered in San Jose, CA and Singapore, Avago Technologies Limited (AVGO) is a designer, developer and global supplier of a broad range of analog semiconductor devices and digital, mixed-signal and optoelectronics components and subsystems.

Avago started as HP semi division and was later a part of Agilent that was spun-off from HP. It was spun-off from Agilent in 2005 and had its IPO in 2009. Avago is currently the 9th largest semiconductor company (excluding memory business) in the world. The company makes radio frequency chips that are used in smartphones by Apple, Samsung and other mobile device manufacturers.

Avago products primarily serve four markets: Enterprise Storage (38% of FY 2013 revenue), Wireless Communications (25%), Wired Infrastructure (23%), and Industrial & Other (14%). It has a diversified revenue model with 37% of its FY 2013 revenue derived from China, 20% from North America, 10% from Europe and 33% from the rest of the world.

Solid Second Quarter FY 2014 Results

On May 29, Avago reported its financial results for Q2 of its fiscal year 2014, ended May 4. Net income for the quarter was $158 million or $0.61 per share, up from net income of $134 million or $0.53 per share for the prior quarter and net income of $113 million or $0.45 per share in Q2 last year.

According to the management, “our wireless business came in significantly above our expectations due to strong product ramps for our FBAR-related products into multiple Asian Smartphone OEMs. We also saw resurgence in Industrial re-sales through our distributors, especially in Europe and Japan”.

On May 6, Avago closed the acquisition of LSI Corporation. Subsequent to the acquisition Avago joined the S&P 500 index, replacing LSI.

On June 5, AVGO announced a quarterly cash dividend of $0.29 per share.

Positive Earnings Estimates Revisions

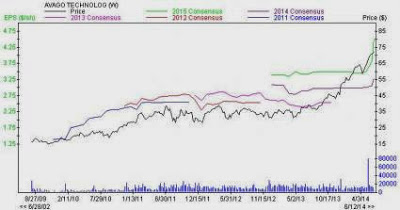

As a result of continued solid performance, the Zacks Consensus Estimates for FY 2014 and 2015 have increased to $3.29 per share and $4.51 per share, from $3.07 per share and $3.68 per share, 30 days ago. The chart below shows the recent positive earnings momentum for the company.

Solid Industry Outlook

Semiconductor industry is currently ranked 42 out of 265 Zacks industries (top 16%). With rising earnings estimates, companies in this space are likely to outperform the broader markets in the coming months.

Zacks Initiates Coverage

On May 30, Zacks initiated coverage on Avago with an ‘Outperform’ recommendation. Per Zacks Investment Research report “Avago expects to further strengthen its position through organic growth across the industry verticals and increased market penetration buoyed by the LSI acquisition. In addition to cost synergies from a combined resource pool, the acquisition is likely to improve the operating margin and create greater scale to further drive innovation”.

The Bottom Line

With a strong industry outlook and rising earnings estimates, Avago looks set to reward investors in the coming months.

None.