Is A Big Pop Coming In Tech Stocks?

Breakout From Bullish Pattern

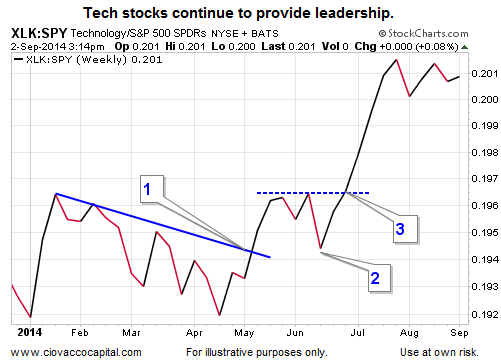

Regular readers know we are not big fans of forecasting outcomes in the financial markets. However, assessing investment probabilities based on evidence we have in hand is a value-add exercise. One way to monitor the probability of success is via chart patterns. The chart below shows the performance of technology stocks (QQQ) relative to the S&P 500 (SPY). The pattern, known as an inverse head-and-shoulders pattern, tells us the probability of good things happening in tech stocks is higher today than it was prior to the push above the blue neckline in the chart below.

More M&A Could Be Coming

When cash begins to pile up on balance sheets, mergers and/or acquisitions become viable options to gain a competitive advantage or improve efficiency. Technology companies have a fair amount of cash to spark additional M&A activity, which adds to the appeal of the tech sector. From Street Insider:

Goldman Sachs increased its price target on Yelp (YELP), WebMD Health Corp. (WBMD), TrueCar (TRUE), and Demand Media (DMD). Changes reflect rising potential for M&A. Analyst Heath Terry said potential for additional M&A is increasing given high cash balances, increasing disparity in valuations, and growing benefits of scale.

The Big Picture

Since the NASDAQ and S&P 500 are highly correlated, it is prudent for technology investors to keep an eye on the broader market. This week’s stock market video looks at recent improvements in the stock market’s risk-reward profile.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Tech’s Achilles Heel?

Longer-term, the technology sector will have to deal with a familiar concern about the global labor force. From CNBC:

One of the major hurdles revolves around skills and access to talent. In every technology sector around the world, a shortage of talent needs to be addressed for the industry to fully flourish. Why? Firstly, we rely on tech talent as a source of innovation and ground-breaking, disruptive ideas. Secondly, we need a skilled tech industry to ensure those ideas fulfil their potential, scale-up and change the world.

Internet stocks have been providing leadership in 2014, but longer-term the industry could run into a shortage of skilled workers.

Investment Implications – The Weight Of The Evidence

Monday’s lackluster trading session did little to alter the market’s appetite for risk. Therefore, we continue to hold a portfolio of U.S. stocks (VOO), leading sectors (XLK), and a relatively small and offsetting exposure to bonds (TLT). The chart below shows the tech sector recently completed the three steps needed for a bullish trend change relative to the S&P 500.