Kansas City Fed: Manufacturing Growth Strengthens In November 2014

Of the three regional manufacturing surveys released to date for November, all show manufacturing expansion.

The market was expecting a range between 4 to 7 (consensus 6) versus the actual at 7. A positive number indicates expansion.

GROWTH IN TENTH DISTRICT MANUFACTURING ACTIVITY EXPANDED FURTHER

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a slightly faster pace in November, and producers’ expectations for future activity increased further.

“Regional factory growth improved somewhat in November, although many contacts reported that the cost to retain or hire quality employees is rising, said Wilkerson. The majority of firms expected activity to improve considerably in the next six months.”

TENTH DISTRICT MANUFACTURING SUMMARY

Tenth District manufacturing activity expanded at a slightly faster pace in November, and producers’ expectations for future activity increased further. Firms reported rising difficulties in attracting and retaining certain key workers, and several contacts cited increased labor costs. Price indexes were mixed with little change overall.

The month-over-month composite index was 7 in November, up from 4 in October and 6 in September (Tables 1 & 2, Chart). The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Producers of aircraft parts and equipment reported the strongest growth, while contacts at plastics and chemical plants reported a decline in activity. Most other month-over-month indexes were also higher than last month. The production index rose from 3 to 9, and the shipments, employment, and new orders for exports indexes also increased. The order backlog index moved into positive territory for the first time in four months, while the new orders index was basically unchanged. The finished goods inventory index jumped from -5 to 4, and the raw materials inventory index increased for the second straight month.

Most year-over-year factory indexes moderated somewhat. The composite year-over-year index fell from 17 to 9, and the production, shipments, and new orders indexes also moved lower. The employment index decreased from 16 to 10, and the capital expenditures index edged down after rising last month. In contrast, the order backlog index improved from 6 to 10, and the new orders for exports index moved into positive territory. Both inventory indexes fell further.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

/images/z richmond_man.PNG

Kansas Fed (hyperlink to reports):

/images/z kansas_man.PNG

Dallas Fed (hyperlink to reports):

/images/z dallas_man.PNG

Philly Fed (hyperlink to reports):

/images/z philly fed1.PNG

New York Fed (hyperlink to reports):

/images/z empire1.PNG

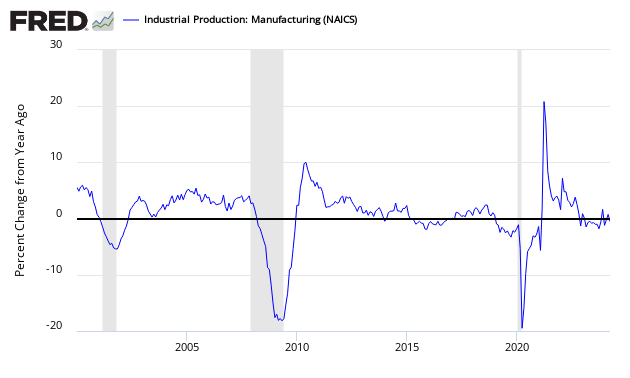

Federal Reserve Industrial Production - Actual Data (hyperlink to report)

Holding this and other survey's Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Kansas City Survey (pea-green bar).

Comparing Surveys to Hard Data

![]()

/images/z survey1.png

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!