Large Cap Best & Worst Report

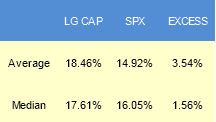

Since 2010, the top scoring stocks in our weekly large cap report have returned an average 354 bps of excess to the SPX in the following year. The best performers from our list one year ago are RCL up 59%, FTR up 54%, CLR up 50%, and ITT up 37%.

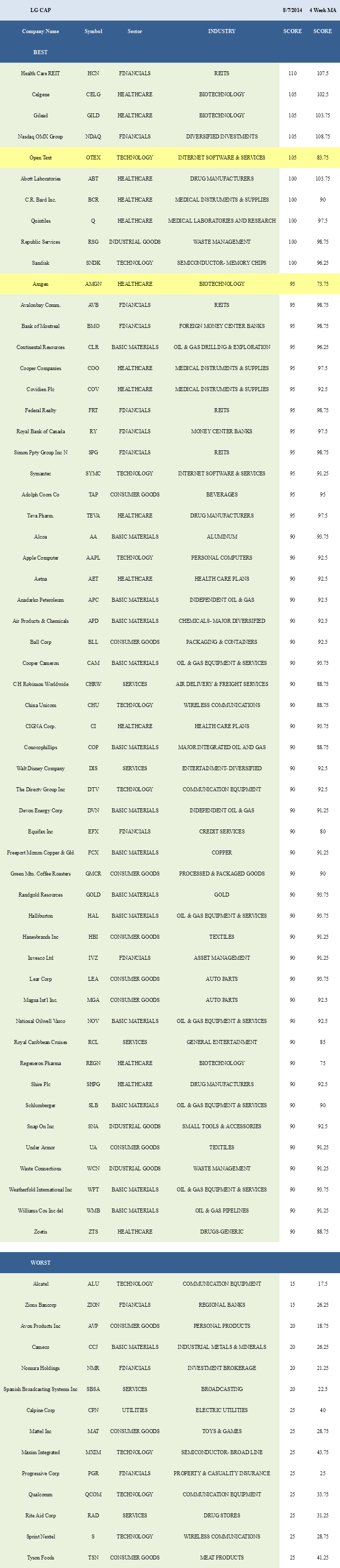

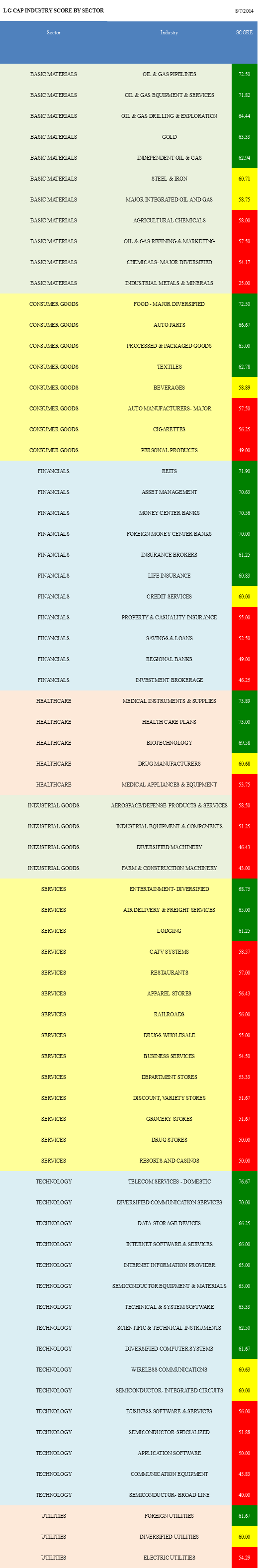

- Healthcare is the best scoring large cap sector.

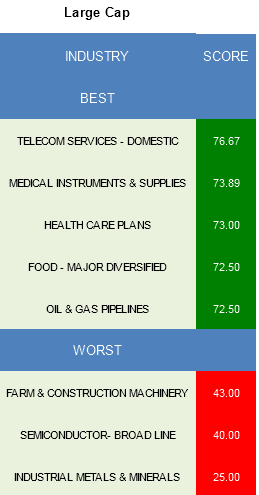

- The top scoring large cap industry is domestic telecom.

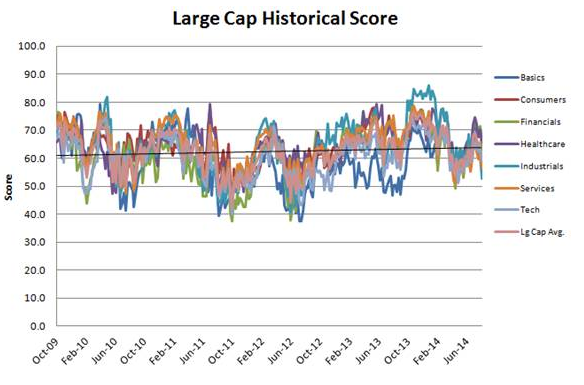

The average score across our large cap universe this week is 59.73, below the four week moving average score of 64.25. The average large cap stock is trading -11.37% below its 52 week high, 1.1% above its 200 dma, has 4.49 days to cover held short, and is expected to grow EPS by 13.38% next year.

Healthcare, basic materials, and financials score above average. Technology scores in line. Utilities, consumer goods, services, industrial goods score below average.

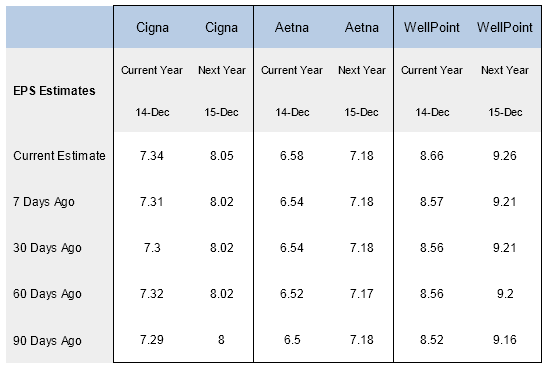

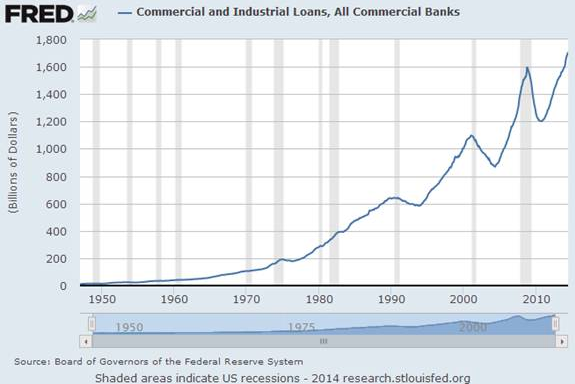

The best large cap industry is domestic telecom (CTL, T, VZ). New pricing models and ongoing growth in high bandwidth content consumption drive revenue growth. Medical instruments (BCR, COV, COO, BDX) are strong scoring. Reform enrollment growth and expansion into emerging markets offer sales and profit opportunities. Medicaid and private exchange enrollment growth are driving sales at healthcare plans (CI, AET, WLP) higher, while administrative expenses are falling relative to premiums collected. Major food (MDLZ) unit volume growth is supported by expansion into convenience store channels and into emerging markets. Pipeline (WMB) throughput volume thanks to capacity expansion tied to shale production continues to climb.

In large cap basic materials, concentrate on pipelines, oil & gas equipment & services (WFT, SLB, NOV, HAL), and drillers (CLR, PBR, NBR). The top scoring consumer goods groups are major food, auto parts (MGA, LEA), and processed & packaged foods (GMCR, MJN, MKC, K). In the first six months, European commercial and passenger vehicle registrations were up 9.3% and 6.5% year-over-year, respectively. In financials, focus on REITs (HCN, SPG, FRT, AVB, DLR), asset managers (IVZ, AMP), and money center banks (RY, BNS, BK, WFC, STI).

The best scoring healthcare industries are medical instruments, healthcare plans, and biotechnology (GILD, CELG, AMGN, REGN, MDVN). Services are typically weighed down through September by retailers, which face summer seasonal headwinds. Diversified entertainment (DIS, TWX) and air delivery and freight score (CHRW) best in the sector. Retail should regain upside momentum in the tail half of October, so managers should be using weakness over the next six to eight weeks to slowly boost exposure. In technology, buy domestic telecom, diversified communication services (AMT), and data storage devices (EMC, WDC).

Disclosure: None.