Large Cap Best And Worst Report

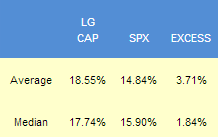

Since 2010, the top scoring stocks in our weekly large cap report have returned an average 371 bps of excess to the SPX in the following year. The best performers from our list one year ago include CLR up 74%, MYL up 67%, ITT up 58%, AMP up 49%, CELG up 48%, and LO up 48%.

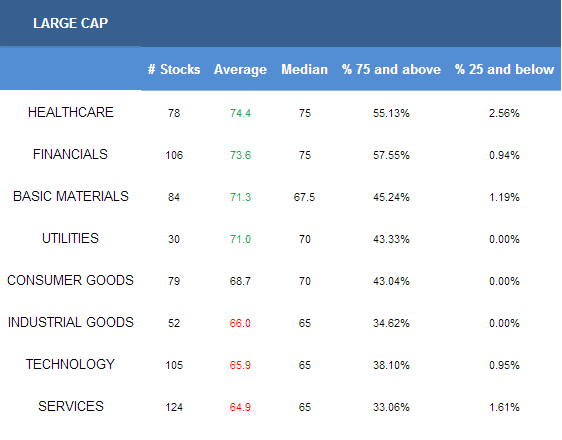

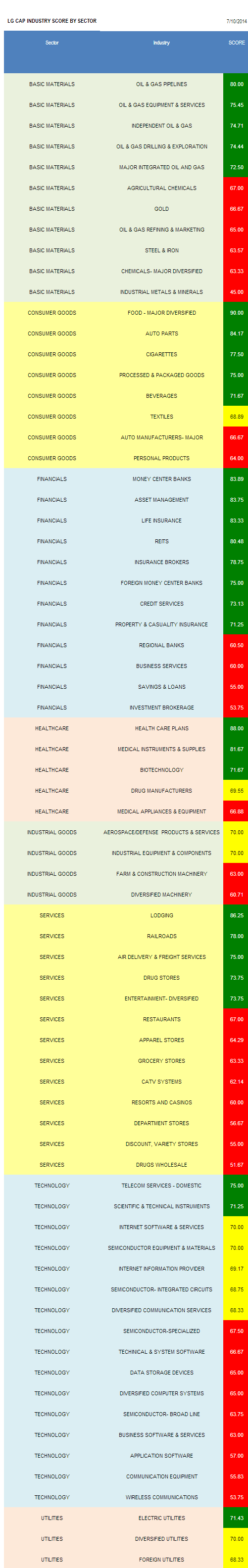

- Healthcare is the top large cap sector.

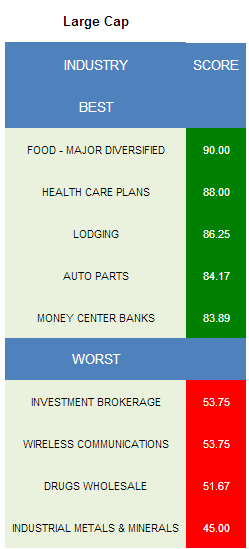

- Major food is the best scoring large cap industry.

The average large cap score is 69.14, above the four week moving average score of 64.98. The average large cap stock is trading -7.73% below its 52 week high, 5.31% above its 200 dma, has 4.49 days to cover held short, and is expected to post EPS growth of 13.48% next year.

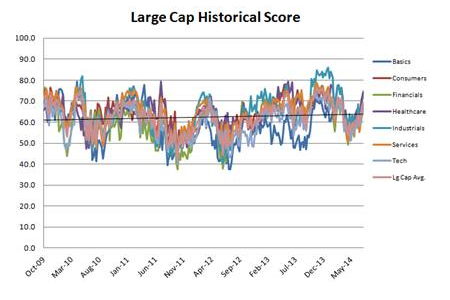

Healthcare is the top scoring large cap sector, followed by financials, basics, and utilities. Consumer goods score in line. Industrial goods, technology, and services score below average.

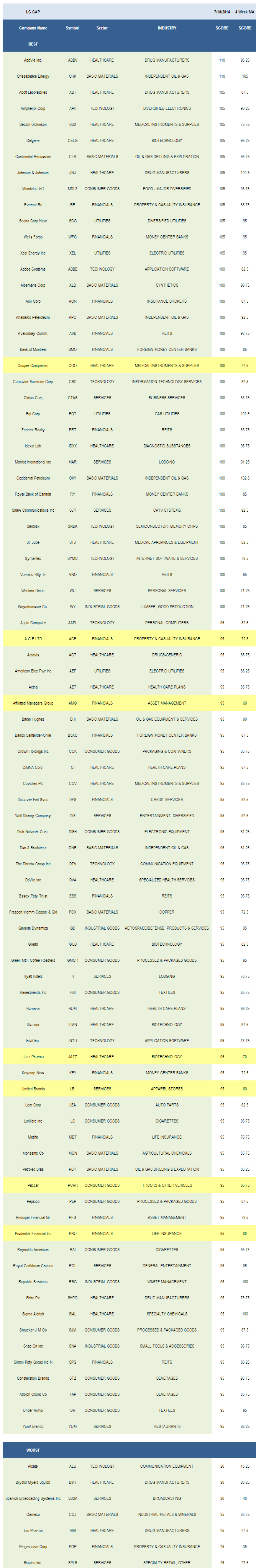

The best large cap industry is major food (MDLZ, ADM). Healthcare plans (AET, CI, HUM, UNH) score above average heading into second quarter earnings releases. Second quarter reports will give us our most complete look at the impact of the ACA to date. Lodging (MAR, H, HOT) scores highly. In the week ending June 28th, U.S. occupancy and RevPAR increased 4.2% and 9.3% year-over-year, respectively.

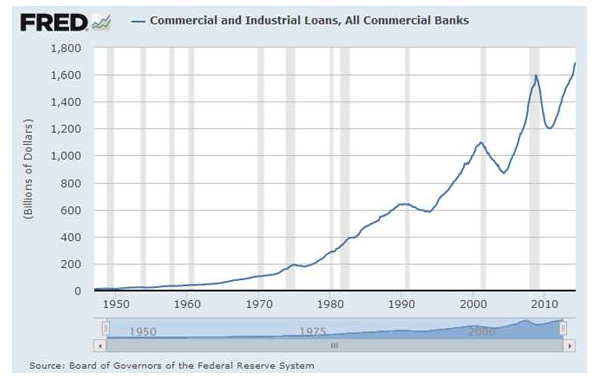

Auto parts (LEA, JCI, MGA) benefit from rebounding growth in Europe. European passenger car registrations increased 4.5% year-over-year in May, the most recently reported month. Money center banks (WFC, RY, KEY, BNS) have seen their scores improve markedly following the roll to third quarter seasonality. Commercial and industrial volume loans continued higher in May reaching 1691 billion, up from 1610 billion in January and 1530 billion a year ago.

In large cap basics, focus on pipelines (SE, WMB), oil & gas equipment & services (BHI, HAL, SLB, WFT, CAM, NOV), and independent oil & gas (CHK, APC, OXY, DNR, ECA, NBL, DVN). As of July 3rd, there were 117 more active rigs in operation in the U.S. than a year ago. In consumer goods, buy major food, auto parts, and cigarettes (LO, RAI). In financials, concentrate on money centers, asset managers (AMG, PFG, AMP, BEN), and life insurance (PRU, MET, SLF). REITs (AVB, FRT, VNO, ESS, SPG, HST, O, SLG) also score highly and benefit from seasonal support. Healthcare plans, medical instruments (COO, COV, SYK, CFN), and biotech (CELG, JAZZ, GILD, ILMN) score best in healthcare. None of the industrial goods industries score above average; however, aerospace (GD, SPR, BEAV, HON) scores in line. Watch for order news out of Farnborough at mid month. In 2012, the last time the event was held in Farnborough, orders totaled $72 billion. In services, discretionary is typically weak through summer. Lodging, rails (CP, NSC, CSX), and air freight (CHRW) score highly. In technology, only domestic telecom (CTL, VZ) and scientific & technical instruments (GRMN, MTD) score above average. In utilities, focus on electric power producers (XEL, AEP, PPL, AES).

Disclosure: None.