Large Cap Best And Worst Report

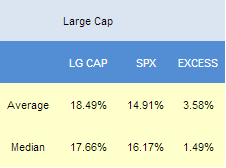

Since 2010, the top scoring stocks in our weekly large cap report have returned an average 358 bps of excess to the SPX in the following year. The best performers from our list one year ago include ITT up 58%, MYL up 55%, LEA up 46%, AMP up 40%, and DIS up 36%.

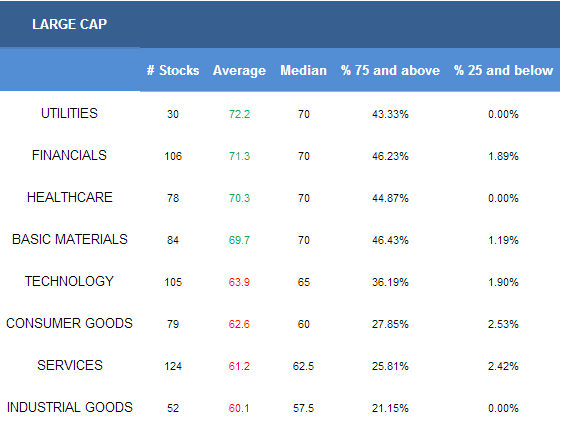

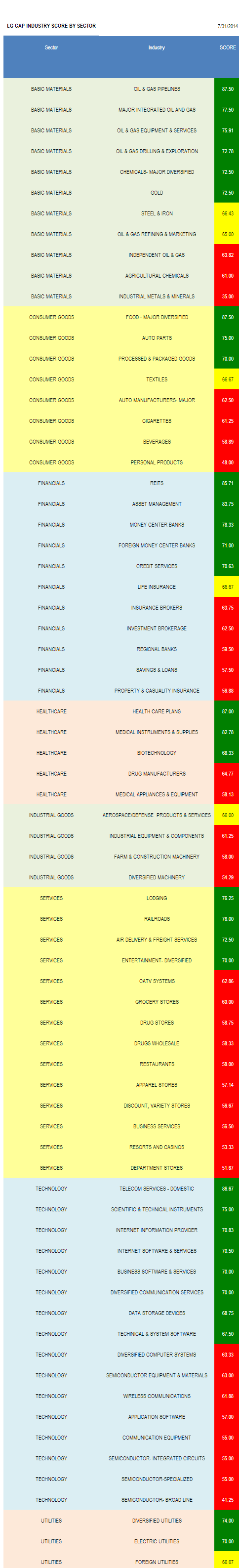

- The top scoring large cap sector is utilities.

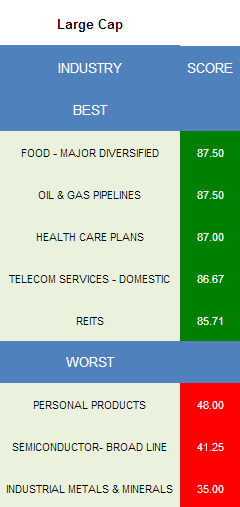

- The best scoring industry is major food.

The average large cap score is 65.89, below the four week moving average score of 66.60. The average large cap stock is trading -9.1% below its 52 week high, 3.69% above its 200 dma, has 4.49 days to cover held short, and is expected to post EPS growth of 13.5% next year.

Utilities, financials, healthcare, and basics score above average. Technology, consumer goods, services, and industrial goods score below average.

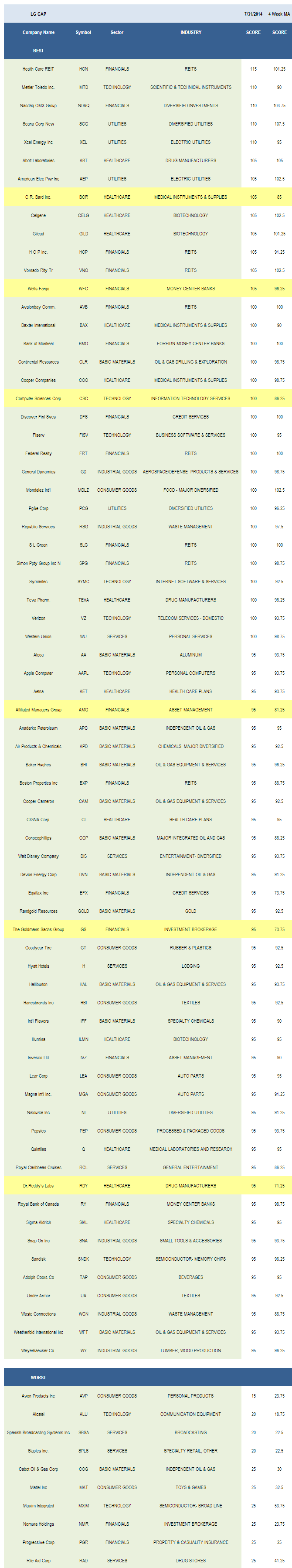

The best scoring large cap industry this week is major food (MDLZ, ADM). Oil & gas pipelines (WMB, SE) offer upside thanks to rising volume/capacity additions. Healthcare plan (CI, AET, HUM, UNH) revenue benefits from reform driven membership enrollment growth for exchange plans and Medicaid. ARPU at domestic telecom (VZ, CTL, T) benefits from video consumer demand. Plan and hardware pricing innovation offers additional opportunities. Dividend paying REITs (HCN, VNO, HCP, SPG, SLG, FRT, AVB) benefit from seasonal tailwinds tied to summertime manager de-risking. Cheap financing is being leveraged by new projects for FFO growth.

Pipelines, major oil & gas, and oil & gas equipment & services (WFT, HAL, CAM, BHI, SLB, NOV) score highest across basic materials. In consumer goods, focus on major food, auto parts (MGA, LEA, TRW), and processed & packaged goods (PEP, MJN, GMCR, MKC). The top financials names include REITs, asset managers (IVZ, AMG, PFG, BEN, AMP), and money center banks (WFC, RY, BNS, BK). In healthcare, concentrate on healthcare plans, medical instruments (BCR, COO, BAX, COV, CFN), and biotechnology (GILD, CELG, ILMN, MDVN). None of the large cap industrial goods groups score above average this week; however, aerospace/defense (GD, NOC, LMT, TDG) score in line. At Farnborough, Boeing and Airbus locked up orders for 697 aircraft, adding to an already high backlog and supporting additional production line increases. Lodging (H, MAR, WYN), rails (CP, NSC, CSX), and air deliver/freight (CHRW, EXPD) score highest across services. In technology, buy domestic telecom, scientific & technical instruments (MTD, GRMN), and Internet information providers (FB, EXPE, LNKD, GOOG).

Disclosure: None.