Large Cap Best And Worst Report

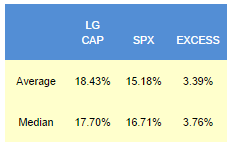

Since 2010, our top scoring weekly has outpaced the SPX by a median 376 bps in the following year. The best performers from our list one year ago are GILD up 63%, CMG up 51%, and FB up 47%.

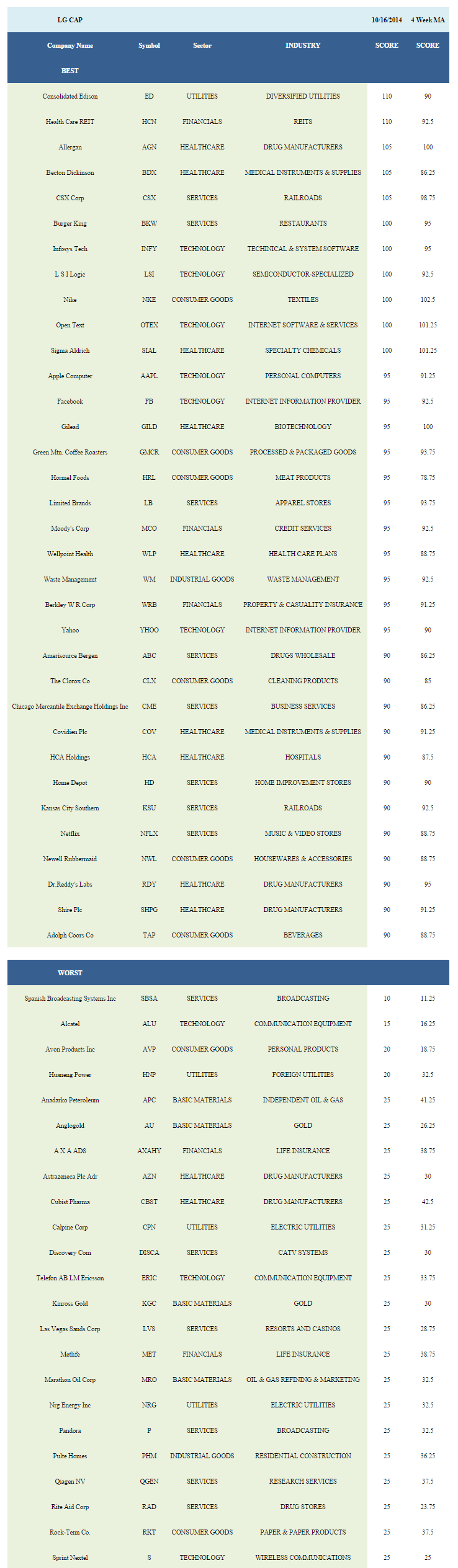

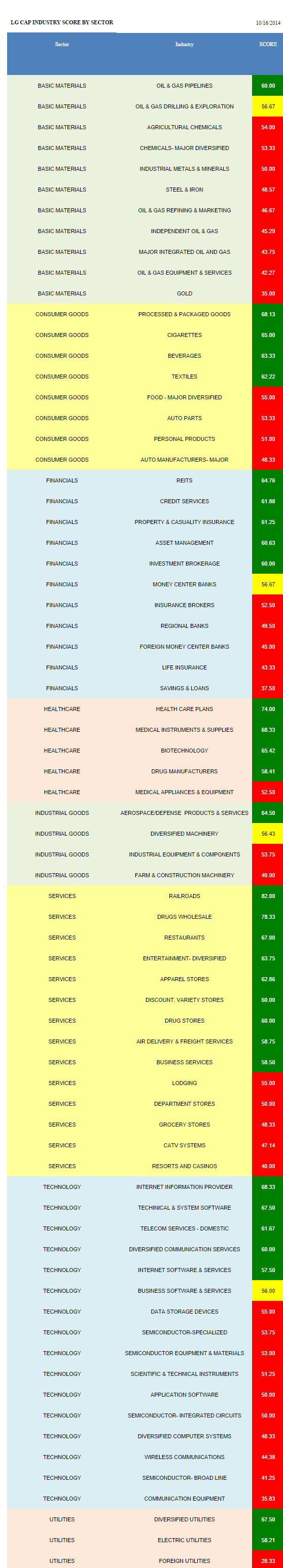

- Healthcare is the top scoring large cap sector.

- The top scoring large cap industry is railroads.

The average large cap score is 56.20, below the four week moving average score of 60.87. The average large cap is trading -15.77% below its 52 week high, -4.43% below its 200 dma, has 4.56 days to cover held short, and is expected to post EPS growth of 12.78% next year.

The best scoring large cap sector is healthcare, followed by consumer, utilities, services, and financials. Industrial goods scores in line. Technology and basic materials score below average.

aqqql.png)

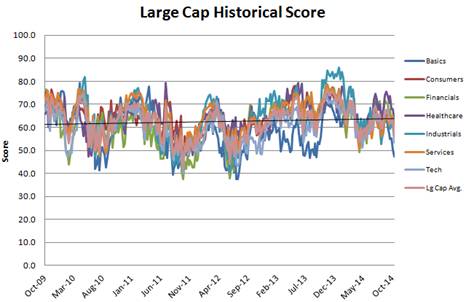

The following chart shows large cap scores since 2010. Scores are in the process of retreating toward prior levels that have proven actionable since the end of the recession.

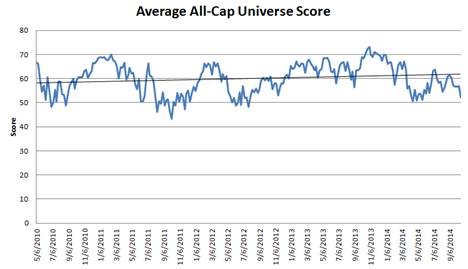

This next chart shows average universe score across our entire universe, which shows that the average stock across our universe is similarly nearing those actionable levels.

258.png)

Rail (CSX, KSU, CP) carload volume continues to support pricing. Rail volume is up 4.5% year-over-year through the first 40 weeks of this year. Wholesale drug (ABC, CAH) volume is being driven higher by rising insurance enrollment. Patent expiration continues to offer opportunities for generic fill rate expansion. The ACA's second open enrollment and additional states adopting Medicaid expansion will support healthcare plan (WLP, UNH, CI) membership in 2015. Watch Q3 EPS reports for MCR/MLR trend impacts (i.e. potential warehousing of patients ahead of Harvoni and exchange member utilization). Internet information (YHOO, FB, NTES, GOOG) content demand continues to benefit from mobile data consumption trends. Medical instruments (BDX, COV, XRAY, BAX) growth is supported by next generation R&D.

The only basics industry that scores above average this week is oil & gas pipelines (WMB). Throughput capacity continues to expand and support dividend growth. Processed & packaged goods (GMCR, PEP, CAG, MKC), cigarettes (MO, RAI), and beverages (TAP, MNST, KO, STZ) score best in consumer goods. REITs (HCN, DLR, SLG, PSA, HCP, AVB), credit services (MCO, SLM, EFX, COF), and P&C insurers (WRB, CB, CINF, ACE) are best in financials. In healthcare, focus on healthcare plans, medical instruments, and biotechnology (GILD, CELG, BMRN, REGN, MDVN). In industrial goods, only aerospace/defense (BA, TDG, LMT) score above average. The top services groups are rails, wholesale drugs, and restaurants (BKW, CMG, YUM). The Nat'l Restaurant Association monthly survey shows improving trends in current and anticipated foot traffic and same store sales ahead of the holiday season.

In technology, buy Internet information providers, technical & system software (INFY, CNQR, ANSS, ADSK), and domestic telecom (T, VZ). In Q2, AT&T's wireless billings posted 20% year-over-year growth; watch EPS on October 22nd to see if the pace slows.

Disclosure: None.