Large Cap Best And Worst Report

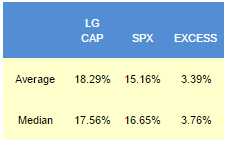

Since 2010, our top scoring weekly has outpaced the SPX by a median 376 bps in the following year. The best performers from our list one year ago are MU up 69%, RCL up 64%, FB up 63%, and AAPL up 57%

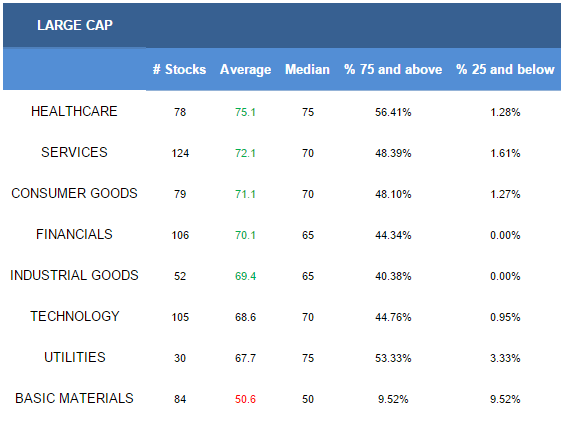

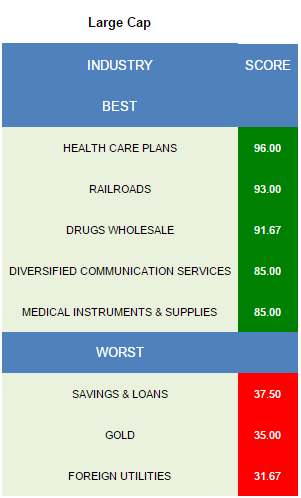

- Healthcare is the best large cap sector.

- The top large cap industry is healthcare plans.

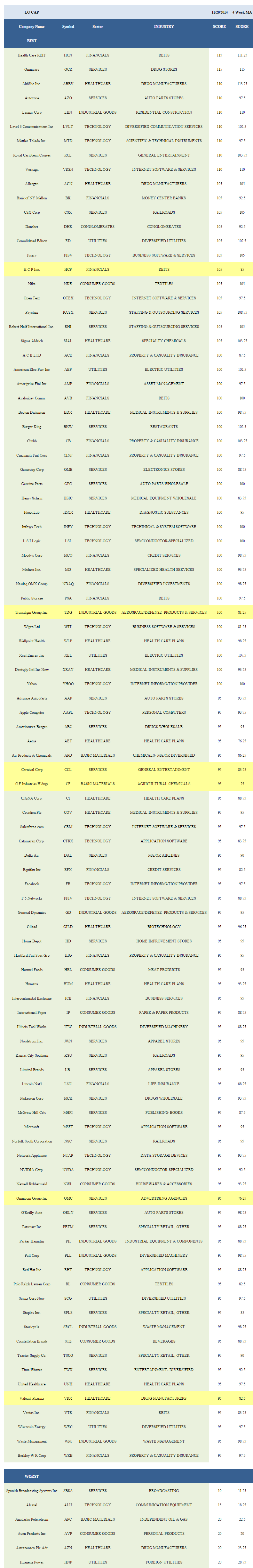

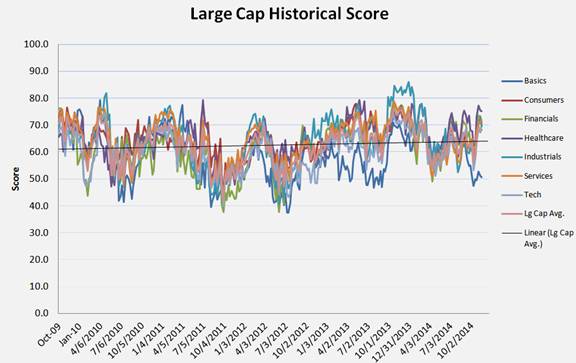

The average large cap score is 68.31, above the four week moving average score of 67.91. The average large cap stock is trading -10.27% below its 52 week high, 2.75% above its 200 dma, has 3.57 days to cover held short, and is expected to see EPS growth of 10.77% next year.

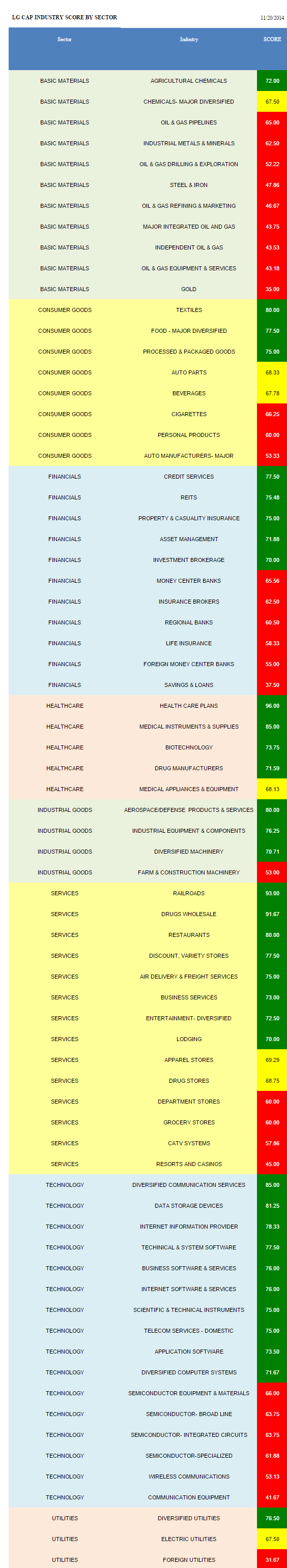

The top scoring large cap sector is healthcare. Services, consumer goods, financials, and industrial goods score above average. Technology and utilities score in line. Basics score below average.

The top scoring large cap industry is healthcare plans (WLP, UNH, HUM, CI, AET). Projections estimate that insurance membership on the exchanges will reach 9 million this year. According to Kaiser Family Foundation, the median premium for the second lowest cost silver plan is $257, which means that insurers will generate $2.3 billion in monthly premiums in 2015 (based on the 9 million member estimate). Railroads (CSX, NSC, KSU, UNP, CP) remain strong scoring as carload rates remain supported by carload volume growth. Intermodal remains particularly strong, reaching record levels in October. Wholesale drug (MCK, ABC, CAH) demand is trending higher thanks to rising enrollment in both exchanges and public programs including Medicare and Medicaid. Diversified communication services (LVLT, AMT) offer upside as fixed cost infrastructure is leveraged for data demand growth. Medical instruments (XRAY, BDX, COV, SYK, CFN, BCR, COO, BSX) are strong scoring and potentially may benefit if republicans look to dismantle the 2.3% medical device tax.

Only agricultural chemicals (CF, AGU) score above average in large cap basic materials. In consumer goods, focus on textiles (NKE, RL, LULU, VFC, PVH), major food (ADM), and processed & packaged goods (MJN, GMCR, CAG, PEP, CPB). The top financials baskets include credit services (MCO, EFX, SLM, ADS, DFS), REITs (HCN, HCP, PSA, AVB, VTR, SPG, FRT, DLR), and P&C insurers (CINF, CB, ACE, WRB, HIG, TRV, ALL). Revolving credit growth offers upside for credit services as loan standards ease and consumer spending climbs. Healthcare plans, medical instruments, and biotech (GILD, ILMN, REGN, INCY, CELG, MDVN) are best in healthcare. The best scoring industrial goods names are aerospace/defense (TDG, GD, RTN, NOC, COL, BA), industrial equipment (PH, ROP), and diversified machinery (PLL, ITW). In services, concentrate on rails, drugs wholesale, and restaurants (BKW, CMG, DRI, YUM, MCD). In technology, buy diversified communication services, data storage (NTAP, STX), and Internet information (YHOO, FB, EXPE, NTES). Diversified utilities (ED, WEC, SCG, AEE) are best in utilities.

Disclosure: None.