Lower Oil Prices And The U.S. Economy

For the last 4 years, the national average retail price of gasoline in the United States stayed within a range of $3.25-$4.00 a gallon. But that all changed this fall, with U.S. consumers now paying an average price of $2.82.

Source: New Jersey Historical Gas Price Charts Provided by GasBuddy.com

This usually is the time of year when gasoline prices tend to be at their lowest. But the current U.S. price of gasoline is exactly what we’d predict given the long-run relation between the price of gasoline and crude oil. There’s essentially no seasonal component in the price of crude. In other words, if crude stays at its current value (namely, Brent at $80), the lower price of gasoline is here to stay.

The current price of gasoline is 80 cents/gallon below what it has averaged over the last 3 years. Last year Americans consumed 135 billion gallons of gasoline. That means that if prices stay where they are, consumers will have an extra $108 billion each year to spend on other things. And if the historical pattern holds, spend it they will.

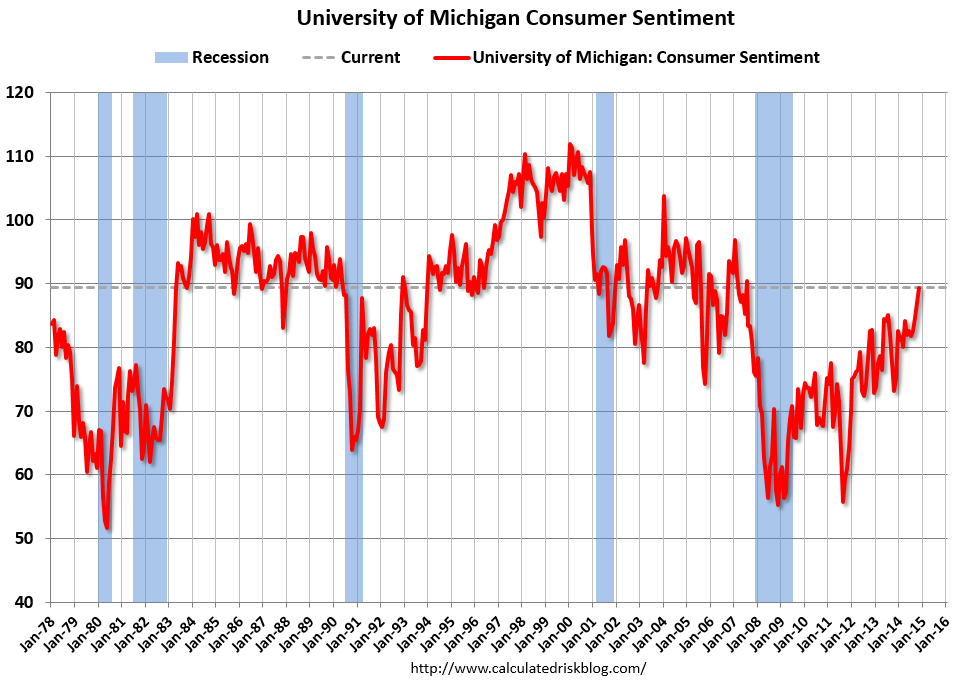

Lower gasoline prices likely also contributed to the recent rise in consumer sentiment. Historically a 20% drop in energy prices would predict a 15-point rise in consumer sentiment. That relation weakened considerably as consumers got accustomed to the up-and-down yo-yo of prices in recent years. Nonetheless, consumer sentiment is now at the highest level it’s been since the Great Recession.

Click on picture to enlarge

Source: Calculated Risk.

But another thing that’s changed is that much more of the oil we consume is now being produced right here at home. While lower prices are a boon for consumers, they pose a potential threat to producers, especially the higher-cost operators. Jim Brown reports that “the most recent companies to announce capex cuts are Exxon, Shell, Conoco, Continental Resources, Apache, Energy XXI and Hess.”

If there are employment cuts in places like Texas, Louisiana, and North Dakota, that would obviously offset some of the gains to consumers noted above, and ultimately undercut the major force keeping the price of crude low for the time being, that being the success of small U.S. oil producers.

Nevertheless, there should be no question that at this point this is a favorable development on-balance for the U.S. economy. We’re still importing 5 million more barrels each day of petroleum and products than we are exporting. Importing fewer barrels, and paying less for the barrels we do import, is a good thing.

Disclosure: None.