Lumber Liquidators: The First Of Many Retailers To Disappoint This Quarter

Lumber Liquidators (LL) has been getting hammered lately and took a real tumble yesterday after the company issued a business update for the second quarter ended June 30 that showed only a small 2% sales improvement. Wall Street analysts had expected a 16% revenue gain, so that amounts to a serious miss. Comparable store sales dropped 7% as customer traffic levels sank, clearly showing that consumer spending (which is 70% of the economy) is in dire straits.

Lumber Liquidators Holdings, Inc. (LL)

$55.25

$-15.17

-21.54%

July 10,2014 4:01PM EDT

Earlier this week WD-40 (WDFC) and Helen of Troy (HELE) also missed Wall Street Analysts already lowered guidance. This morning The Gap (GPS) said its revenue for stores open at least a year fell 2 percent. This is considered a key indicator of a retailer's financial performance as it strips away the impact of recently opened and closed sites. Analysts polled by Thomson Reuters anticipated a 0.7 percent increase.

The results included a 7 percent drop at its Gap stores, a 7 percent drop at Banana Republic and the only reason the stock is not down 20% right now is because it had a surprising 7 percent increase at Old Navy?

Fastenal (FAST) The industrial supplier reported second quarter profit of 44 cents per share, matching estimates, though revenue fell short of consensus.

Then we have Rent-A-Center (RCII) which changed its forward guidance and is now forecasting a second quarter profit of 36 to 38 cents per share, short of the consensus estimate of 48 cents. The rent-to-own chain also predicts second quarter sales below forecasts, saying macroeconomic pressures are hurting its customers.

Finally we have the Apparel industry in what can only be seen as an industry wide recession. Just look at a long term chart of Aeropostale (ARO), Coach (COH) or American Apparel (APP) and you will clearly see an industry in serious trouble, that also speaks volumes about the American Consumer.

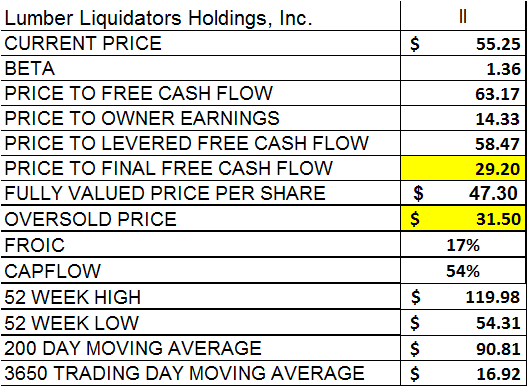

As for Lumber Liquidators it was seriously overvalued at $119.98 and needed to come back to earth as my firms research clearly shows:

Thus as these early earnings results are clearly showing, we can no longer blame the terrible weather from this past winter as the reason for retailers reporting terrible results. They are doing so because the consumer is feeling the pressure from the excessive debt that they have piled up over the last five years. The Federal Reserve has played a major part in making things much worse for the consumer as the value of the dollar has tanked as it now takes $1.36 to buy one Euro, and that speaks volumes about the state of the American Economy as the European Union is in really bad shape and reminds me of a Fellini movie. Thus if the European Union is in such bad shape, then why is the Euro kicking the U.S. Dollars butt?

For my part I have taken my clients more to cash, being now 55% in cash, as I expect that this five year Bull Run will slowly come to an end soon as consumer spending is 70% of our economy. There is only so much that those manipulating the markets currently can do to manipulate the numbers any more as they as they have exhausted their options. As the Federal Reserve finally stops its quantitative easing in October, we will have the greatest manipulator in history going to the sideline and Adam Smith will finally stop rolling in his grave.

Always remember that these are the results of our research based on the methodology that I have outlined above and in other articles previously published. This research is provided as an ...

more