Markets Have Not Seen This In Eight Years

Republicans Could Recapture Senate

The stock market has recently experienced unprecedented and rare moves. From a political perspective, it has been rare in recent years to see Republicans and majority used in the same sentence. That may be about to change. From The Wall Street Journal:

With 11th hour polls showing a number of tight races, Republicans still appear poised to capture a Senate majority for the first time in eight years, an achievement that would give the GOP control of Congress and increased leverage to push ahead on policy aims. Victory would also boost pressure on the party to overcome internal divisions to advance an agenda. The election looks set to remake the political landscape for Mr. Obama in the last quarter of his presidency, reducing his room for maneuver but also potentially opening new areas for compromise.

Should Wild Swings Continue

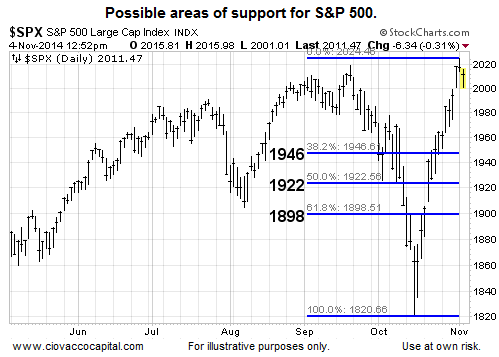

If the stock market (SPY) decides to swing wildly to the downside in the coming days, the Fibonacci retracement levels below may bring buying conviction back into the mix.

Lowest Level Since 2008

We can add the budget deficit to the list of “have not seen this in a while” events. It would be nice if the figures below were a reflection of compromise and unity in our nation’s capital. Unfortunately, that is not the case. However, improvement is improvement. From Bloomberg:

Robust economic growth has helped push the U.S. budget deficit down to the lowest level since 2008, marking the sharpest turnaround in the government’s fiscal position in at least 46 years. The shortfall of $483.4 billion in the 12 months ended Sept. 30 was 2.8 percent of the nation’s gross domestic product of $17.2 trillion over the same period, according to data compiled by Bloomberg using Commerce Department figures. The figure peaked at 10.1 percent of GDP in December 2009.

Investment Implications – The Weight Of The Evidence

Understandably, the markets seem to be consolidating their recent gains while waiting for election results. While the bulls made significant progress over the past two weeks, our model allocation still includes some exposure to bonds (TLT) which respects the bearish case still has some valid bullet points.

Disclosure: None.