Medtronic Buys Covidien, But What Will Johnson & Johnson Do Now? Bidding War?

Every once and a while as a Portfolio Manager/Analyst you get lucky when you have one of the bargain stocks you picked for your Clients get bought out for a nice premium. But the deal announced yesterday of Medtronic (MDT) buying Covidien (COV) is even better, especially when you are also a shareholder in the acquirer as well. This is a brilliant merger by both companies as the synergies are just as perfectly aligned as it can get as it allows the “new” Irish based Medtronic to take on medical device powerhouse Johnson & Johnson (JNJ) on a more equal footing. The benefits that will come from this deal can only be summed up as 1+1 = 3. Medtronic will have greater access to the European marketplace and will not have to pay US taxes on the $14 Billion in cash that they have parked overseas, as it will put that cash to use in this deal. It will move its headquarters to Ireland and make this deal very accretive just from the corporate tax savings that they will not need to pay the US government for many years to come.

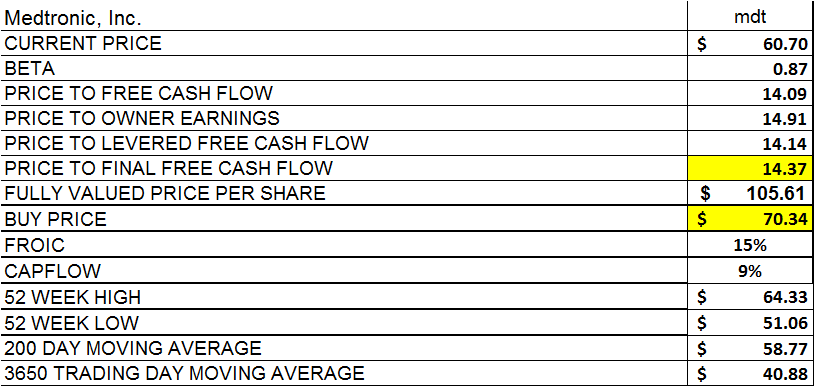

From a FROIC or Free Cash Flow Return on Invested Capital point of view, Medtronic will put the cash that they were getting about 2% return on in the bank and invest it in Covidien, which has a FROIC of 15%. Covidien will benefit as Medtronic will bring in it amazing management into the fold, who are cost control specialists, as they have one of the lowest CapFlows in the Industry. CapFlow is capital spending as a percentage of cash flow and the lower the CapFlow of a company the better its cost controls are.

Medtronic plans to pay about $93 a share for Covidien, which is a great deal as my research says that Covidien would be fully valued at $110.21. Therefore you may just see Covidien trade much higher than $93 in the near future as I am sure Johnson & Johnson’s management is not unaware of this deal and may just make an offer as well. Thus ladies and gentleman, we may eventually have a full scale bidding war battle on our hands for control of Covidien. Medtronic must pay whatever they have to in order to get Covidien, because they cannot let it fall into the hands of JNJ. My clients are also shareholders in Johnson & Johnson, so no matter who wins the bidding, in the end we will benefit as either our Medtronic or Johnson & Johnson will continue to benefit from owning Covidien. No matter what happens this is the best result you can hope for as a shareholder.

I am usually not a big fan of mergers as I put a ton of research into finding stocks to buy for my clients and usually get them at bargain prices. When you don’t own the acquirer in a deal, then your only benefit is a short term gain, instead of a possible triple digit percentage gain over a longer term time horizon. But I must say this deal is as about as close to Nirvana as you can get as a shareholder.

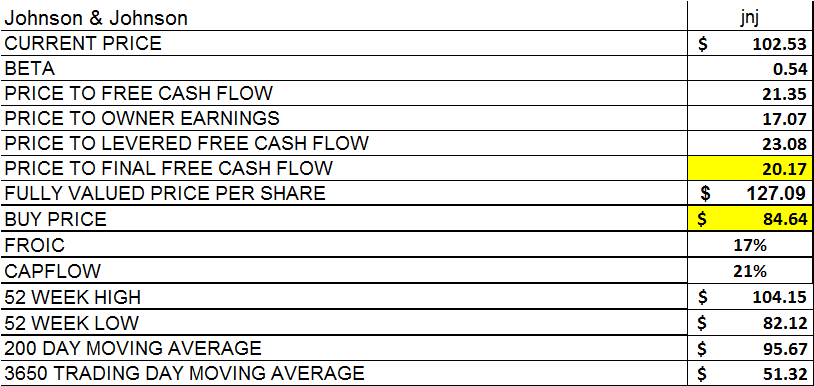

In closing here are the company profiles as well as my firm’s research on each of the three players involved in this deal.

Covidien plc develops, manufactures, and sells healthcare products for use in clinical and home settings worldwide. The company’s Medical Devices segment develops, manufactures, and sells endomechanical instruments, such as laparoscopic instruments, surgical staplers, and interventional lung solutions; energy devices, including vessel sealing, electrosurgical, and ablation products and related capital equipment; and soft tissue repair products comprising sutures, mesh, biosurgery products, and hernia mechanical devices. This segment also offers vascular products, such as compression, dialysis, venous insufficiency, thrombectomy, neurovascular, and peripheral vascular products; oximetry and monitoring products, including sensors, monitors, and temperature management products; and airway and ventilation products comprising airway, ventilator, breathing systems, and inhalation therapy products. Its products are used primarily by hospitals and ambulatory care centers, as well as alternate site healthcare providers, such as physician offices. The company’s Medical Supplies segment develops, manufactures, and distributes nursing care products comprising incontinence, wound care, enteral feeding, urology, and suction products; medical surgical products, such as operating room supply products related accessories, electrodes, thermometry, and chart paper product lines; SharpSafety products, including needles, syringes, and sharps disposal products; and original equipment manufacturer products. Its products are used primarily in hospitals, surgi-centers, and alternate care facilities, such as homecare and long-term care facilities. The company markets its products through direct sales force and third-party distributors. Covidien plc is based in Dublin, Ireland.

Medtronic, Inc. manufactures and sells device-based medical therapies worldwide. The company operates in two segments, Cardiac and Vascular Group, and Restorative Therapies Group. The Cardiac and Vascular Group’s products include pacemakers; implantable defibrillators; leads and delivery systems; ablation products; electrophysiology catheters; products for the treatment of atrial fibrillation; information systems for the management of patients with cardiac rhythm disease management (CRDM) devices; coronary and peripheral stents and related delivery systems; therapies for uncontrolled hypertension; endovascular stent graft systems; heart valve replacement technologies; cardiac tissue ablation systems; and open heart and coronary bypass grafting surgical products. The Restorative Therapies Group offers products for various areas of the spine; bone graft substitutes; biologic products; trauma, implantable neurostimulation therapies, and drug delivery devices for the treatment of chronic pain, movement disorders, obsessive-compulsive disorder (OCD), overactive bladder, urinary retention, and fecal incontinence and gastroparesis; external insulin pumps; subcutaneous CGM systems; products to treat conditions of the ear, nose, and throat; and devices that incorporate advanced energy technology. It also manufactures and sells image-guided surgery and intra-operative imaging systems; and provides Web-based therapy management software solutions. The company serves hospitals, physicians, clinicians, and patients in approximately 140 countries. Medtronic, Inc. was founded in 1949 and is headquartered in Minneapolis, Minnesota.

Johnson & Johnson, together with its subsidiaries, is engaged in the research and development, manufacture, and sale of various products in the health care field worldwide. The company operates in three segments: Consumer, Pharmaceutical, and Medical Devices and Diagnostics. The Consumer segment offers a range of products used in the baby care, skin care, oral care, wound care, and women’s health fields, as well as nutritionals, over-the-counter pharmaceutical products, and wellness and prevention platforms under the JOHNSONS, AVEENO, CLEAN & CLEAR, DABAO, JOHNSONS Adult, LUBRIDERM, NEUTROGENA, RoC, VENDÔME, LISTERINE, BAND-AID, NEOSPORIN, STAYFREE, CAREFREE, o.b. tampon, SPLENDA, TYLENOL, SUDAFED, ZYRTEC, MOTRIN IB, and PEPCID brand names. This segment markets its products to the general public, as well as to retail outlets and distributors. The Pharmaceutical segment provides various products in the areas of anti-infective, antipsychotic, cardiovascular, contraceptive, gastrointestinal, hematology, immunology, infectious diseases, metabolic, neurology, oncology, pain management, thrombosis, and vaccines. This segment distributes its products directly to retailers, wholesalers, and health care professionals for prescription use. The Medical Devices and Diagnostics segment offers various products to treat cardiovascular disease; orthopedic and neurological products; blood glucose monitoring and insulin delivery products; general surgery, biosurgical, and energy products; professional diagnostic products; infection prevention products; and disposable contact lenses. This segment distributes its products to wholesalers, hospitals, and retailers, used principally in the professional fields by physicians, nurses, hospitals, and clinics. Johnson & Johnson was founded in 1885 and is based in New Brunswick, New Jersey.

Always remember that these are the results of our research based on the methodology that I have outlined above and in other articles previously published. This research is provided as an ...

more