Mid Cap Best & Worst Report

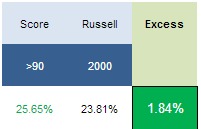

The highest scoring names in mid cap from 1 year ago returned 184 bps more than the S&P 500. The best performers have been UA up 98%, ACT up 80%, RFMD up 79%, CW up 79%, GMCR up 73%, and STZ up 72%

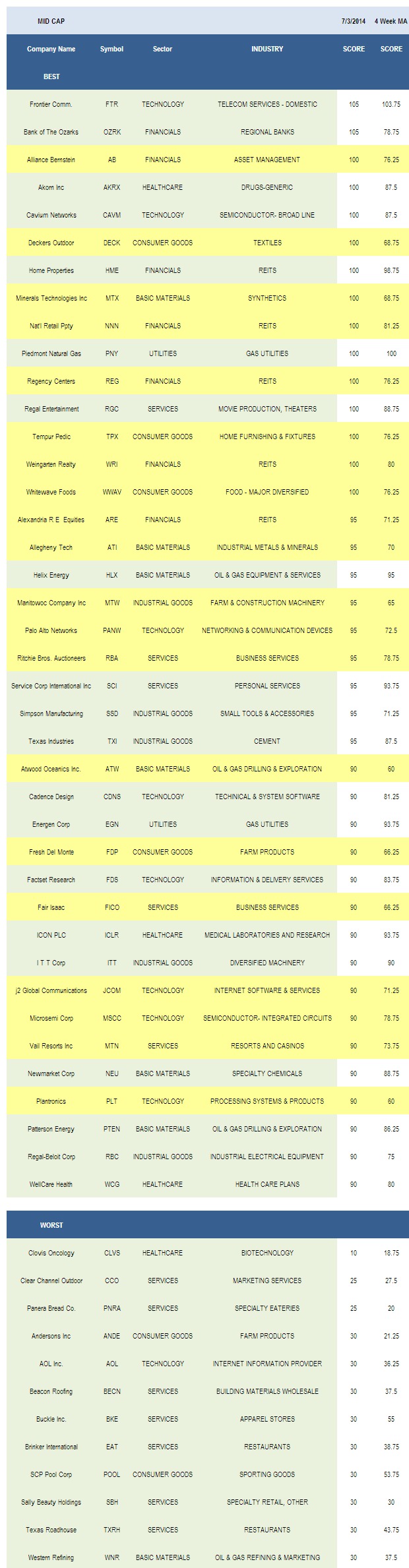

- Utilities score best across mid cap.

- The best mid cap industry is gas utilities.

The average mid cap score is 64.13, above the four week moving average score of 60.17. The average mid cap stock is trading -10.95% below its 52 week high, 5.04% above its 200 dma, has 7.83 days to cover held short, and is expected to post EPS growth of 19.7% next year.

Utilities, basic materials, and financials score above average. Industrial goods and healthcare, and technology score in line. Consumer goods and services score below average.

The following chart reflects historical mid cap scores by sector since 2010.

Gas utilities (PNY, EGN) score high as customer acquisition remains strong. For example, PNY added 3700 new customers in its FYQ2, thanks in part to new residential construction. Synthetics (MTX, POL) offer upside on expansion in emerging markets. REITs (WRI, REG, NNN, HME, ARE) are attractive thanks to ongoing improvement in office vacancy rates and effective rents. Drillers (PTEN, ATW) benefit from increased utilization through summer. Semi ICs (MSCC, IRF) are strong scoring; however, the book-to-bill historically peaks in the second quarter and declines in the third quarter.

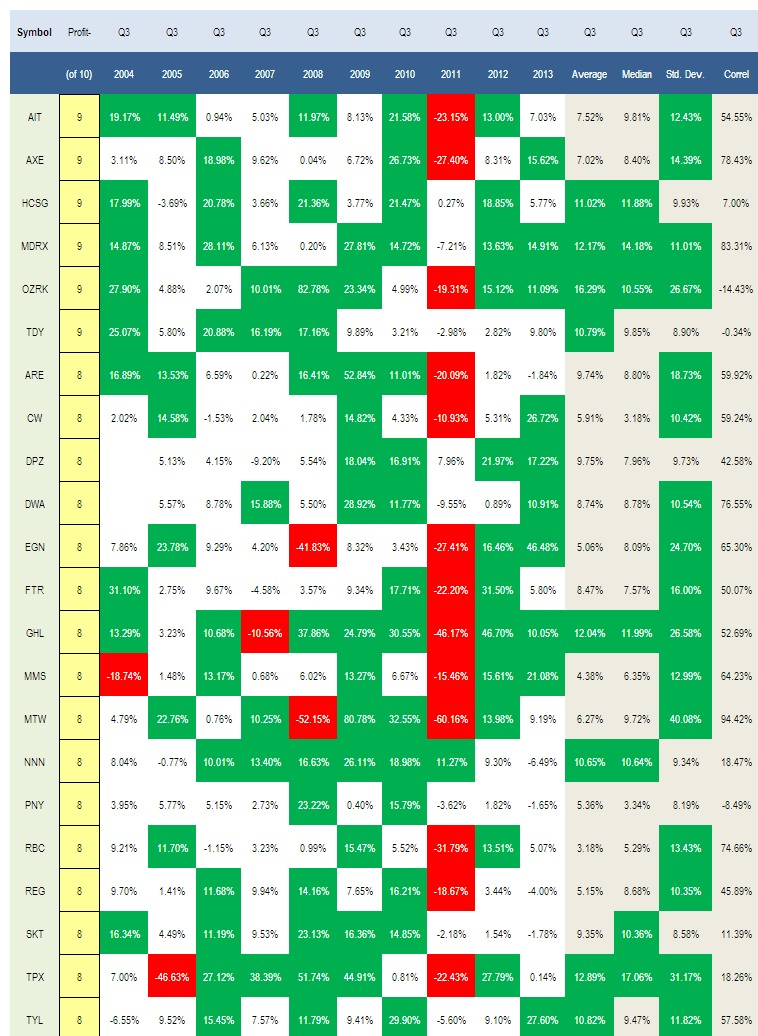

The following table breaks out the seasonally strongest mid cap stocks for the third quarter. Each has posted gains in at least eight of the past 10 years. Historically, large cap offers better seasonality than mid and small cap this quarter.

Basics offer robust seasonality and only steel & iron score below average. The best basics industries are synthetics, drillers, and oil & gas equipment & services (HLX, PDS). Auto parts (FDML, CLC, TEN) and business equipment (HNI) score highest in consumer goods. Ward's estimates that the U.S. light vehicle daily sales rate is up 6% year to date through June. Recovery in Europe is also adding demand for parts suppliers. REITs and asset managers (AB, JNS) are top scoring across financials. No healthcare groups score above average -- trade up in market cap instead. In industrials, buy industrial electrical (RBC, BDC), diversified machinery (ITT, SPW), and residential construction (KBH). Year to date, construction spending through May is up 8.2% from 2013. In May, residential construction spending was 7% higher than a year ago. The best services baskets include movies (RGC), business services (RBA, FICO), and auto dealers (PAG, GPI). In technology, focus on semi ICs, printed circuit boards (JBL, FLEX), and semi equipment & materials (ENTG).

Disclosure: None.