Mid Cap Best & Worst Report

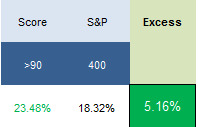

The highest scoring names in mid cap from 1 year ago returned 516 bps more than the S&P 500. The best performers have been TRN up 118%, UA up 79%, ACT up 71%, OTEX up 61%, GMCR up 56%, and CW up 53%.

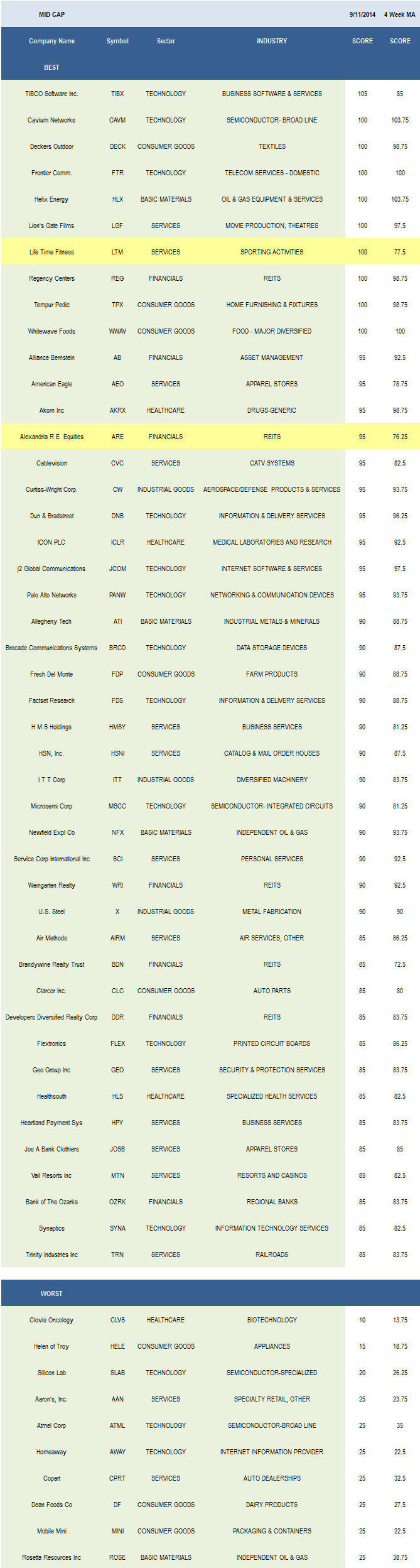

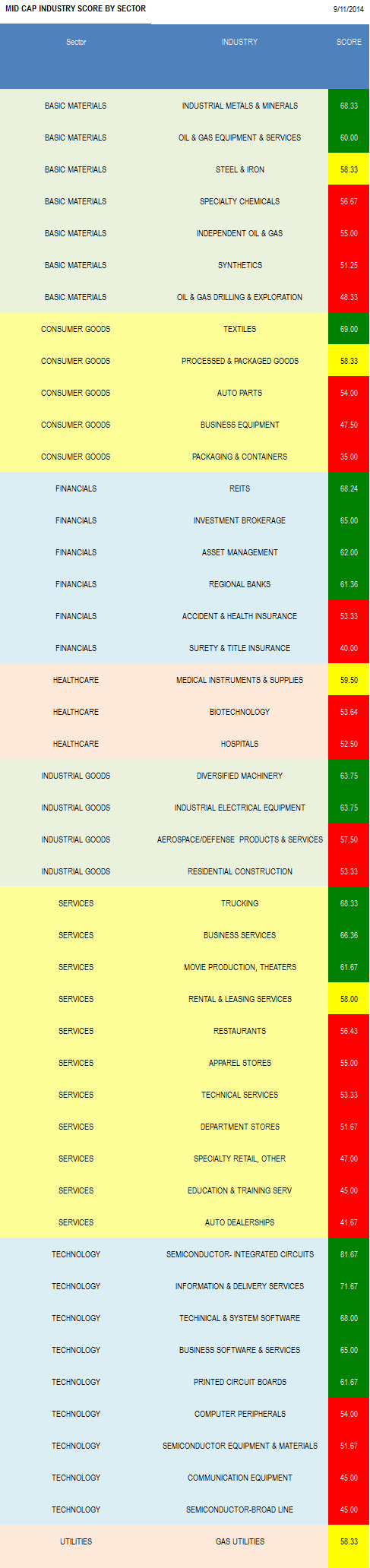

- The top scoring mid cap sector is technology.

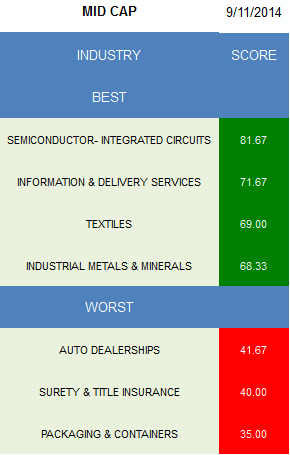

- The best scoring mid cap industry is semi ICs

The average mid cap score is 58.75, below the four week moving average score of 59.19. The average mid cap stock is trading -13.23% below its 52 week high, 2.62% above its 200 dma, has 7.79 days to cover held short, and is expected to post EPS growth of 19.12% next year.

Technology is the top scoring mid cap sector, followed by financials. Healthcare and services score in line. Industrial goods, basic materials, consumer goods, and utilities score below average.

Semi ICs (MSCC, IRF, FCS) score best across mid cap and benefit from industrial demand. Information and delivery services (DNB, FDS) are high scoring into budget season. Textiles (DECK, SKX, CRI) offer upside exiting back-to-school ahead of holiday shopping demand. Rising airplane production rates support specialty metals (ATI). Utility coal stocks are more than 20% lower year-over-year, supporting coal (ARLP).

In mid cap basics, buy industrial metals and minerals and oil and gas equipment and services (HLX, EXH). In consumer, textiles is the only group that scores above average. REITs (REG, ARE, WRI, DDR, BDN, BMR), investment brokerage (GHL, GBL), and asset managers (AB, EV) score best in financials. No healthcare groups score above average -- trade up in market cap instead. In industrials, concentrate on diversified machinery (ITT, MIDD, NDSN) and industrial electrical equipment (RBC, AOS). The top services industries this week are trucking (HTLD), business services (HMSY, HPY, RBA), and movies (LGF, CNK, RGC). Across technology, focus on semi ICs, information and delivery services, and technical and system software (CDNS, MCRS, TYL).

Disclosure: None.