Mid Cap Best And Worst Report

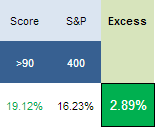

The highest scoring names in mid cap from 1 year ago returned 289 bps more than the S&P 500. The best performers have been UA up 89%, ACT up 72%, STZ up 72% and GMCR up 63%.

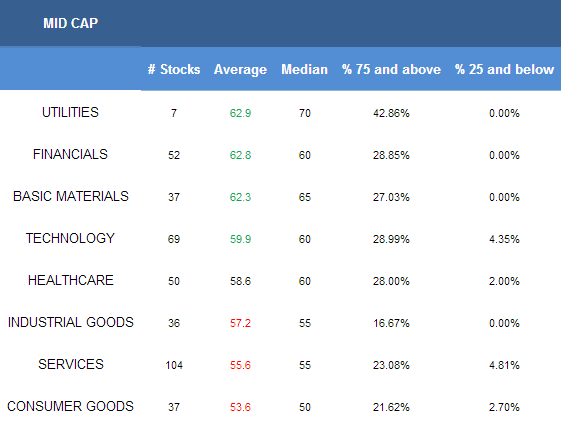

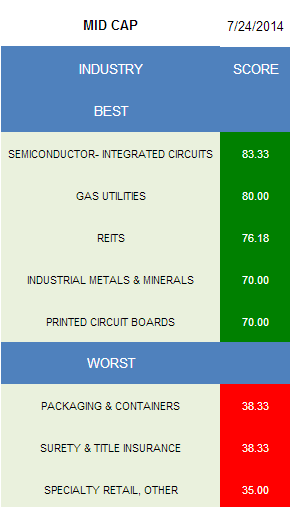

- Utilities are top scoring across mid cap.

- Semi ICs are the top scoring mid cap industry.

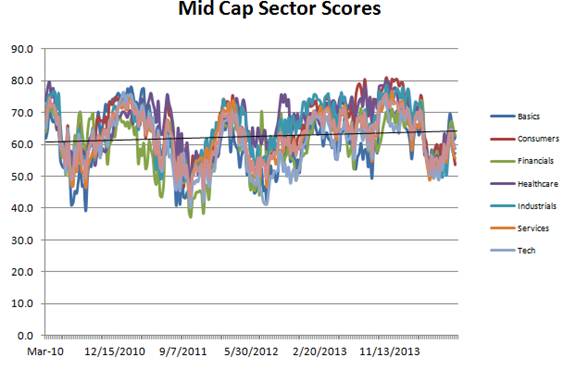

The average mid cap stock score is 58.42, below the 61.42 four week moving average. The average mid cap is trading -13.79% below its 52 week high, 1.32% above its 200dma, has 7.82 days to cover held short, and is expected to post EPS growth of 19.5% next year.

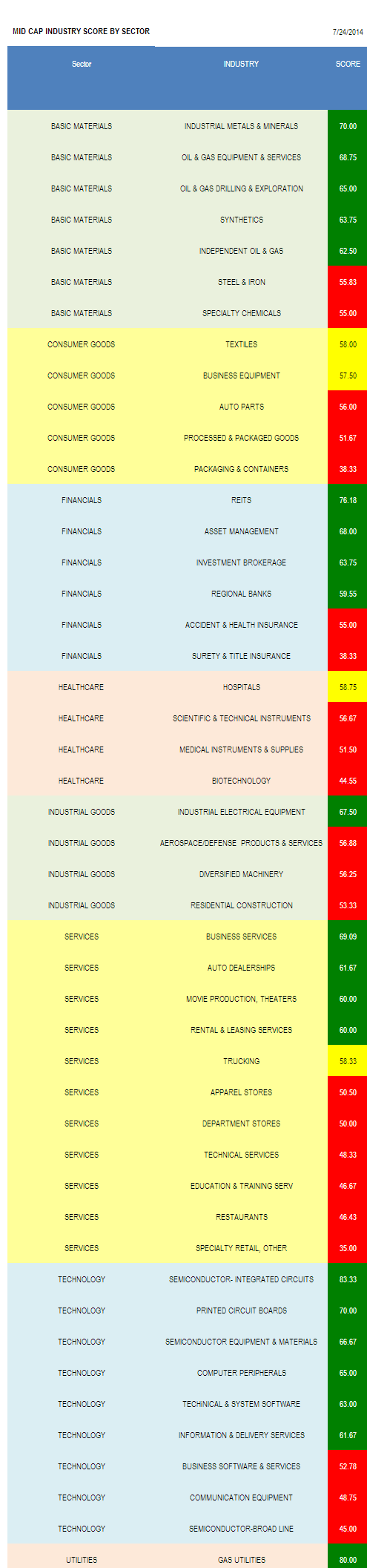

Utilities, financials, basics, and technology score above average. Healthcare scores in line. Industrial goods, services, and consumer goods score below average.

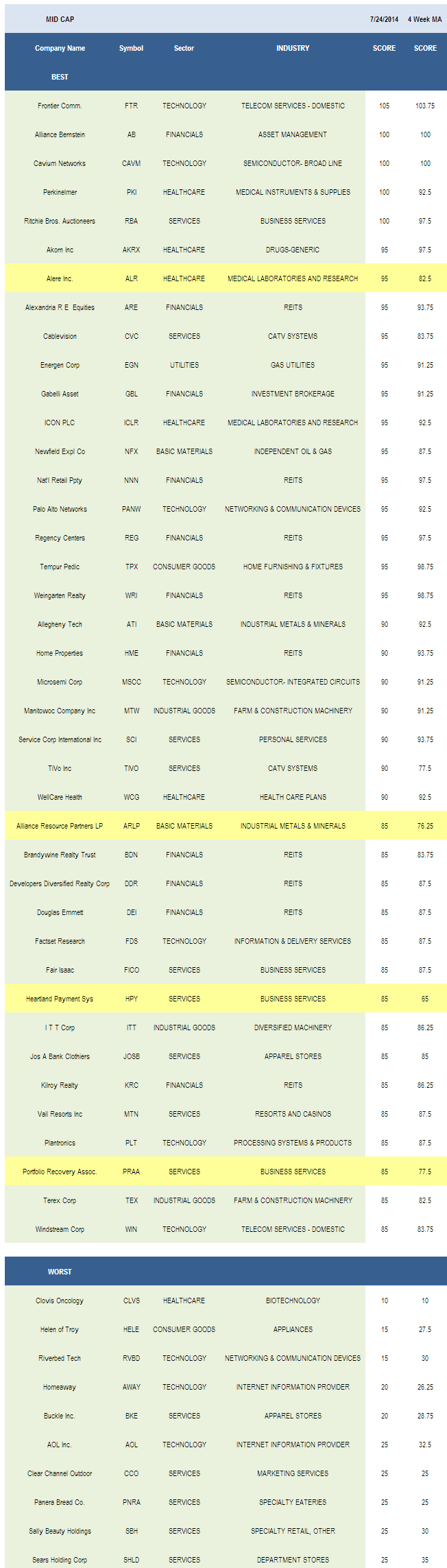

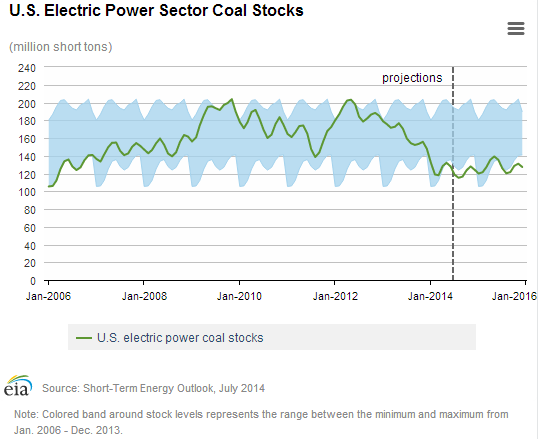

Semi ICs (MSCC, IRF) and printed circuit boards (FLEX) score high across mid cap; however, seasonality gets less supportive from here. Gas utilities (EGN) offer upside on higher demand tied to new customers/switching. Improving vacancy rates in commercial and office space and continuing low apartment vacancy rates support FFO growth at REITs (WRI, REG, NNN, ARE, HME, KRC) as higher effective rents are leveraged against cheap financing. Industrial metals & minerals (ATI, ARLP) also score highly thanks to rising coal demand from utilities, which drew down their inventory this past winter. As of April, coal stocks were 25.7% lower year-over-year at utilities. The EIA projects 2014 coal production will be up 2.7%.

In mid cap basic materials, buy industrial metals & minerals, oil & gas equipment & services (HLX), and oil & gas drillers (PTEN). No mid cap industries score above average; however, textiles (SKX, DECK) score in line. In financials, overweight REITs, asset managers (AB), and investment brokers (GBL). No mid cap healthcare industries score above average this week, but hospitals (SEM, LPNT) do score in line as Medicaid and exchange enrollment lower bad debt expense and investments in outpatient facilities pay off with higher same-facility sales. At HCA, second quarter same-facility admissions were up 1.2% and revenue per equivalent admission grew 5.4%. In industrial goods, buy industrial electrical equipment (RBC, BDC). The best services baskets include business services (RBA, PRAA, HPY), auto dealers (PAG), and movies (LGF). Retail is typically weak at this time of year, but improves in Q4. Use weakness over the next 6 weeks to increase exposure (take your time). In technology, semi ICs, printed circuits, and semi equipment (SPIL, ENTG) score highest.

Disclosure: None.