Modest Growth Expected For US Housing Sector

The monthly housing numbers for October start rolling in next week, which will renew the focus on the key question: Is this crucial sector of the US economy still a risk factor for the business cycle? Recent data looks a bit more encouraging vs. the softer trend from earlier in the year, but housing’s growth remains sluggish compared with the robust gains in 2012 and 2013. For the moment, however, the worst fears have receded, although it’s still unclear if the trend will stabilize at a lesser growth rate. We’ll have a clearer picture of what lies ahead after the next batch of figures arrive, starting with next week’s update (Nov. 19) on new residential construction. Meantime, let’s review how the numbers stack up on three key indicators: new home sales, existing home sales, and housing starts, followed by a look at the outlook for prices.

Measured by year-over-year changes, starts and sales of newly built units have rebounded moderately after dipping into negative territory earlier this year. But the good news is mixed at best. Indeed, existing home sales, which dominate transaction activity, are still falling in annual term, although the numbers seem to be showing tentative signs of rebounding.

Factors that imply that housing overall will remain a net positive for the economy include low mortgage rates and persistent growth in US payrolls of late. But the outlook for construction remains subdued, according to the October sentiment reading for homebuilders. The National Association of Home Builders/Wells Fargo Housing Market Index (HMI) eased a bit in October to a moderately positive 54 after reaching a nine-year high in September.

“While there was a dip [in October], builders are still positive about the housing market,” said NAHB Chief Economist David Crowe last month. “After the HMI posted a nine-year high in September, it’s not surprising to see the number drop in October. However, historically low mortgage interest rates, steady job gains, and significant pent up demand all point to continued growth of the housing market.”

Cautious optimism is also the view via the Federal National Mortgage Association (Fannie Mae), the government’s mortgage financing unit that provides the lion’s share of liquidity for US home purchases. “We anticipate that overall home sales will be weaker in 2014 than in 2013,” Fannie Mae’s chief economist Doug Duncansaid late last month. ” For 2015, we expect only a moderate pickup in total home sales but enough to post the best performance since 2007,”

The outlook from the vantage of Main Street is also mildly positive, according to Fannie Mae’s October 2014 National Housing Survey. According to Duncan:

Consumers are growing more optimistic about the housing market in the face of broader improvement in economic sentiment. The share of consumers who expect their personal finances to get better is near its highest level since the survey’s inception, while those expecting their finances to get worse reached a survey low.

Meanwhile, the growth rate for housing prices continues to decelerate. The S&P/Case-Shiller 20-City Composite Home Price Index slipped to a 5.6% increase (unadjusted terms) in August vs. a year ago—the smallest gain in nearly two years. In late-2013, by contrast, this benchmark of US housing prices was rising at 13%-plus rates.

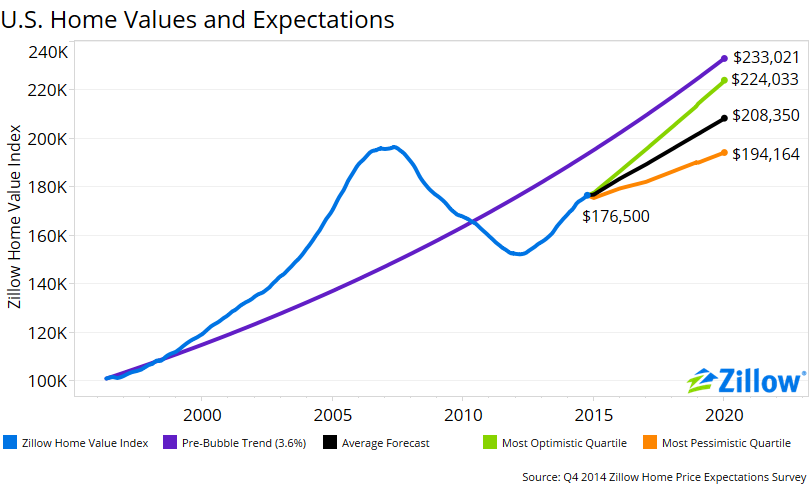

Price gains are slowing but are expected to remain modestly positive on the future, according to this week’s release of the Zillow Home price Expectations Survey. Real estate analysts project that prices for all of 2014 will advance 4.8% on average and increase 23.5% cumulatively through 2019.

“We’ve reached a point in the recovery where the only real cure-all is time,”explains Zillow chief economist Stan Humphries. “The market remains very challenging for younger, first time home buyers who face an uphill battle saving for a down payment, qualifying for a mortgage and finding an affordable home to buy.”

Overall, expectations for a slow, uneven but ongoing recovery reflect the dominant view these days. The spectacular gains are history. But with the US economy continuing to post modest growth, the odds look reasonably good for expecting that the housing sector’s sluggish recovery will survive.

Disclosure: None.