Morning Call - 11/7/2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.05%) this morning are down -0.01% ahead of the release of Oct non-farm payrolls and European stocks are down-0.90%, led by a slide in bank stocks as National Bank of Greece SA and Credit Agricole Sa are both down more than 4%. Limiting losses in European stocks is the +5.5% m/m increase in German Sep exports, the most since May 2010, along with a rally in Allianz SE, Europe's biggest insurer, which is up over 4% after earnings beat estimates. The ruble weakened to a record low of 48.6495 per dollar after Ukraine said dozens of tanks and other military vehicles crossed the border into Ukraine from Russia. Ongoing skirmishes in eastern Ukraine between Ukraine forces and pro-Russian rebels threatens to break a 2-month-long truce. Asian stocks closed mixed: Japan +0.52%, Hong Kong -0.42%, China -0.16%, Taiwan +0.24%, Australia +0.78%, Singapore -0.14%, South Korea +0.08%, India -0.17%. China's Shanghai Stock Index fell back from a 2-1/2 year high and closed lower after China Railway Group Ltd. and China Railway Construction Corp. both fell more than 4% to lead the overall market lower after Mexico canceled a $4.3 billion contract for the construction off a high-speed train by the Chinese companies. Commodity prices are mixed. Dec crude oil (CLZ14 +0.47%) is up +0.24%. Dec gasoline (RBZ14 +0.11%) is down -0.02%. Dec gold (GCZ14 +0.04%) is up +0.08%. Dec copper (HGZ14 -0.02%) is down -0.02%. Agriculture prices are mixed. The dollar index (DXY00 +0.03%) is unchanged. EUR/USD (^EURUSD) is up +0.14%. USD/JPY (^USDJPY) is unchanged. Dec T-note prices (ZNZ14 -0.12%) are down -3.5 ticks.

German Sep industrial production rose +1.4% m/m, less than expectations of +2.0% m/m, although Aug was revised up to -3.1% m/m from the originally reported -4.0% m/m. On an annual basis, Sep industrial production fell -0.1% y/y, a smaller decline than expectations of -0.6% y/y.

The German Sep trade balance widened to a surplus of +21.9 billion euros, more than expectations of +19.0 billion euros. Sep exports rose +5.5% m/m, more than double expectations of +2.7% m/m and the biggest increase in 4-1/3 years. Sep exports rose +5.4% m/m, more than expectations of +1.1% m/m and the biggest increase in 4-1/3 years.

The German Sep current account balance widened to +22.3 billion euros, more than expectations of +18.0 billion euros and the most in 10 months.

U.S. STOCK PREVIEW

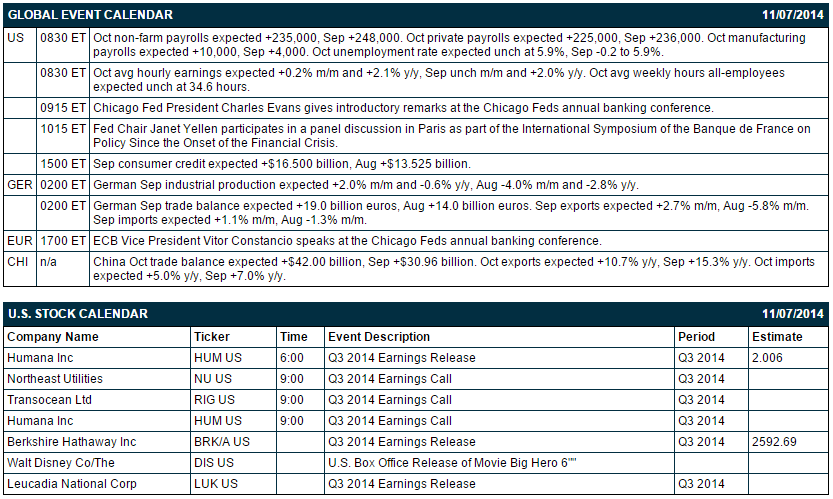

Today’s Oct unemployment report is expected to show a +232,000 gain in payrolls and an unchanged unemployment rate from Sep’s 6-1/4 year low of 5.9%. Today’s Sep consumer credit report is expected to show another large increase of +$16.5 billion, rising from +$13.525 billion in August. There are 3 of the S&P 500 companies that report earnings today: Humana (consensus $2.01), Berkshire Hathaway (2592.69), Leucadia National. Equity conferences today include: BancAnalysts Association of Boston Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Humana (HUM +0.67%) reported Q3 EPS of $1.85, weaker than consensus of $2.01.

Consolidated Edison (ED -2.15%) reported Q3 EPS of $1.49, higher than consensus of $1.43.

Darling (DAR -0.28%) reported Q3 adjusted EPS of 10 cents, well below consensus of 19 cents.

MRC Global (MRC -0.59%) reported Q3 adjusted EPS of 54 cents, stronger than consensus of 45 cents.

CareFusion (CFN +0.05%) reported Q1 adjusted EPS of 50 cents, better than consensus of 49 cents, and then raised guidance on fiscal 2015 EPS view to $2.80-$2.95 from $2.60 to $2.75, higher than consensus of $2.68.

NVIDIA (NVDA +0.45%) reported Q3 EPS of 39 cents, well above consensus of 29 cents.

DaVita (DVA +0.67%) reported Q3 EPS of 90 cents, right on consensus, although Q3 revenue of $3.25 billion was better than consensus of $3.19 billion.

Matson (MATX -0.14%) reported Q3 EPS of 50 cents, stronger than consensus of 44 cents.

Disney (DIS +1.10%) reported Q4 EPS of 89 cents, better than consensus of 88 cents.

Mettler-Toledo (MTD +1.47%) reported Q3 EPS of $2.89, higher than consensus of $2.86, and then raised guidance on fiscal 2014 EPS to $11.60-$11.65, better than consensus of $11.57.

Bruker (BRKR +2.00%) reported Q3 adjusted EPS of 14 cents, below consensus of 15 cents, and then lowered guidance on fiscal 2014 adjusted EPS to 72 cents-78 cents, weaker than consensus of 80 cents.

Monster Beverage (MNST +1.32%) reported Q3 EPS of 70 cents, higher than consensus of 67 cents.

King Digital (KING -3.01%) reported Q3 adjusted EPS of 56 cents, better than consensus of 47 cents.

The Gap (GPS +1.74%) rose over 3% in after-hours trading after it raised guidance on Q3 EPS to 78 cents-79 cents, above consensus of 71 cents, although reported Q3 net sales of $3.97 billion were below consensus of $4.05 billion.

Lionsgate (LGF +0.12%) climbed over 5% in after-hours trading after it reported Q2 adjusted EPS of 24 cents, more than double consensus of 11 cents

American Equity (AEL -0.27%) reported Q3 adjusted EPS of 81 cents, well above consensus of 50 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.05%) this morning are little changed, down -0.25 of a point (-0.01%). The S&P 500 index on Thursday climbed to a fresh all-time high and closed higher: S&P 500 +0.38%, Dow Jones +0.40%, Nasdaq +0.26%. Bullish factors included (1) the -10,000 decline in U.S. weekly initial unemployment claims, a bigger decline than expectations of -2,000 to 285,000, and (2) carry-over support from a rally in European stocks after ECB President Draghi said that ECB monetary stimulus will be expanded if needed.

Dec 10-year T-notes (ZNZ14 -0.12%) this morning are down -3.5 ticks. Dec 10-year T-note futures prices on Thursday closed lower: TYZ4 -7.00, FVZ4-4.00. Bearish factors included (1) the larger-than-expected decline in weekly unemployment claims, and (2) reduced safe-haven demand for Treasuries after the S&P 500 climbed to a new record high.

The dollar index (DXY00 +0.03%) this morning is unchanged. EUR/USD (^EURUSD) is up +0.0017 (+0.14%). USD/JPY (^USDJPY) is unchanged. The dollar index on Thursday rose to a new 4-1/3 year high and closed higher. Closes: Dollar index +0.568 (+0.65%), EUR/USD -0.01107 (-0.89%), USD/JPY +0.567 (+0.49%). Bullish factors included (1) the surge in USD/JPY to a 7-year high on divergent monetary policies between the Fed and BOJ, and (2) weakness in EUR/USD which sank to a 2-year low after ECB President Draghi said that ECB policy makers are ready to implement additional stimulus if needed.

Dec WTI crude oil (CLZ14 +0.47%) this morning is up +19 cents (+0.24%) and Dec gasoline (RBZ14 +0.11%) is down -0.0004 (-0.02%). Dec crude and Dec gasoline on Thursday settled mixed. Closes: CLZ4 -0.77 (-0.98%), RBZ4 +0.0434 (+2.08%). Crude prices fell on negative factors that included (1) a rally in the dollar index to a 4-1/3 year high, and (2) OPEC’s cut in its crude demand forecast for OPEC oil for the next two decades due to the boom in U.S. shale-oil production. Gasoline prices rose on bullish factors that included (1) the rally in the S&P 500 to a record high, which boosts optimism in the economic outlook, and (2) positive carry-over from Wednesday’s weekly EIA inventory data that showed a -1.38 million bbl decline in EIA gasoline stockpiles to a 23-month low of 201.76 million bbl.

Disclosure: None