Morning Call For Aug. 29, 2014

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU14 +0.29%) this morning are up +0.28% at a record high on optimism over the U.S. economic outlook and European stocks are up +0.32%. Strength in European stocks was limited after German Jul retail sales unexpectedly fell by the most in 2-1/2 years. Russia's Micex Stock Index fell -0.53% and the ruble slumped to a record low of 37.026 per dollar amid concern Russia may face more sanctions as fighting intensifies in Ukraine. NATO said that more than 1,000 Russian troops are operating inside Ukraine, manning sophisticated weaponry and advising local separatists. Asian stocks closed mixed: Japan -0.23%, Hong Kong unch, China +1.17%, Taiwan -0.44%, Australia +0.03%, Singapore -0.09%, South Korea -0.29%, India closed for holiday. Commodity prices are mixed. Oct crude oil (CLV14 +0.33%) is up +0.44% at a 2-week high as stronger-than-expected U.S. growth bolsters the demand outlook for crude. Oct gasoline (RBV14 +0.25%) is up +0.27%. Dec gold (GCZ14 -0.28%) is down-0.35%. Sep copper (HGU14 +0.64%) is up +0.46%. Agriculture and livestock prices are mostly higher. The dollar index (DXY00 unch) is up +0.01%. EUR/USD (^EURUSD) is up +0.02%. USD/JPY (^USDJPY) is up +0.23%. Sep T-note prices (ZNU14 -0.07%) are down -2.5 ticks.

The Eurozone Aug CPI estimate rose +0.3% y/y, right on expectations. The Aug core CPI rose +0.9% y/y, a faster pace of increase than expectations of +0.8% y/y.

The Eurozone Jul unemployment rate remained unchanged at 11.5%, right on expectations.

German Jul retail sales unexpectedly fell -1.4% m/m, weaker than expectations of +0.1% m/m and the steepest slide in 2-1/2 years. On an annual basis, Jul retail sales rose +0.7% y/y, less than expectations of +1.5% y/y.

UK Aug nationwide house prices rose +0.8% m/m and +11.0% y/y, better than expectations of +0.1% m/m and +10.2% y/y.

UK Aug GfK consumer confidence rose +3 to 1, better than expectations of +1 to -1 and matched its highest level in 11-3/4 years.

Japan Jul overall household spending fell -5.9% y/y, move than twice expectations of -2.9% y/y.

Japan Jul retail sales unexpectedly fell -0.5% m/m weaker than expectations of +0.3% m/m, while on an annual basis Jul retail sales rose +0.5% y/y, better than expectations of -0.2% y/y.

Japan Jul industrial production rose +0.1% m/m and fell -0.9% y/y, weaker than expectations of +1.0% m/m and -0.1% y/y.

Japan Jul national CPI rose +3.4% y/y, right on expectations. Jul national CPI ex-fresh food rose +3.3% y/y, right on expectations, and Jul national CPI ex food & energy rose +2.3% y/y, right on expectations.

The Japan Jul jobless rate unexpectedly rose +0.1 to an 8-month high of 3.8%, more than expectations of unch at 3.7%. The Jul jo-to-applicant ration remained unch at 1.10, right on expectations and the highest in 22 years.

U.S. STOCK PREVIEW

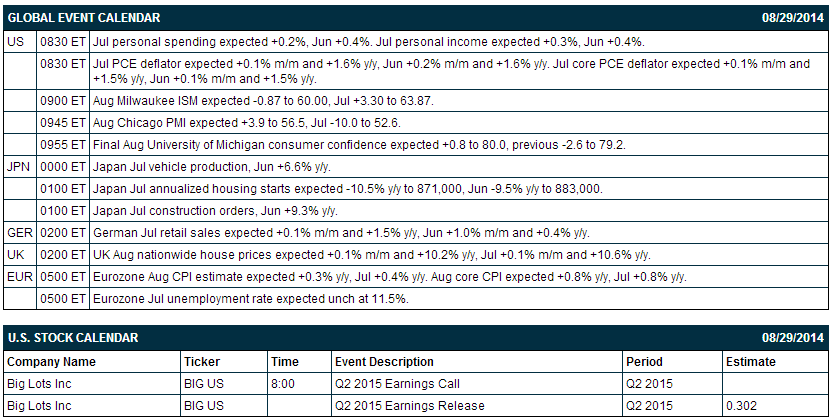

Today’s final-Aug U.S. consumer confidence index from the University of Michigan is expected to show a +0.9 point increase to 80.1 from the early-Aug level of 79.2. Today’s July PCE deflator is expected to be unchanged from June at +1.6% y/y. Meanwhile, today’s July core PCE deflator is expected to be unchanged from June at +1.5% y/y. Today’s Aug Chicago PMI is expected to show a +3.9 point increase to 56.5, rebounding a bit after July’s sharp decline of -10.0 to 52.6. There is one Russell 1000 company that reports earnings today: Big Lots (consensus $0.30). Equity conferences today include: MIT Sloan Latin America-China Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Big Lots (BIG -1.58%) reported Q2 continuing operations EPS of 31 cents, better than consensus of 30 cents.

Athlon Energy (ATHL -0.33%) was initiated with an 'Overweight' at Barclays with a price target of $58.

Casella Waste (CWST -5.26%) was downgraded to 'Neutral' from 'Outperform' at Wedbush.

Mobile TeleSystems (MBT -2.61%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

Stratasys (SSYS -0.14%) was initiated with a 'Buy' at Stifel with a price target of $150.

Riley Investment Partners reported a 8.2% passive stake in STR Holdings (STRI unch) .

OrbiMed reported a 7% stake in Intercept (ICPT -2.09%) .

3G Capital reported a 69.22% stake in Burger King Worldwide (BKW +3.16%) .

OmniVision (OVTI -0.04%) rose nearly 2% in after-hours trading after it reported Q1 Non-GAAP EPS of 91 cents, well above consensus of 53 cents.

Avago (AVGO +0.26%) climbed over 2% in after-hours trading after it reported Q3 EPS of $1.26, well above consensus of $1.06.

Fred's (FRED -1.51%) reported Q2 adjusted EPS loss of -19 cents, a bigger loss than consensus of -17 cents.

MARKET COMMENTS

Sep E-mini S&Ps (ESU14 +0.29%) this morning are up +5.50 points (+0.28%) at a fresh record high. The S&P 500 Index on Thursday closed lower: S&P 500 -0.17%, Dow Jones -0.25%, Nasdaq -0.17%. The main bearish factor for stocks Thursday was an escalation of the Ukraine crisis on strong evidence that Russian troops were assisting rebel forces inside Ukraine. Losses were limited on bullish factors that included (1) the unexpected upward revision to U.S. Q2 GDP to +4.2% from +4.0%, stronger than expectations for a downward revision to +3.9%, and (2) the +3.3% m/m increase in Jul pending home sales, much stronger than expectations of +0.5% m/m.

Sep 10-year T-notes (ZNU14 -0.07%) this morning are down -2.5 ticks. Sep 10-year T-note futures prices on Thursday climbed to a 1-week high and settled higher. Bullish factors included (1) increased safe-haven demand for T-notes on the escalation of the Ukraine crisis, and (2) carry-over support from a rally in European government bonds after the 10-year German bund yield tumbled to a record low of 0.866% on speculation the ECB will soon begin quantitative easing. Closes: TYU4 +5.50, FVU4 +3.50.

The dollar index (DXY00 unch) this morning is up +0.010 (+0.01%). EUR/USD (^EURUSD) is up +0.0002 (+0.02%) and USD/JPY (^USDJPY) is up +0.24 (+0.23%). The dollar index on Thursday closed higher. Bullish factors included (1) the unexpected upward revision to U.S. Q2 GDP, and (2) weakness in EUR/USD after Eurozone Aug economic confidence slipped to an 8-month low. Closes: Dollar index +0.049 (+0.06%), EUR/USD -0.0011(-0.08%), USD/JPY -0.156 (-0.15%).

Oct WTI crude oil (CLV14 +0.33%) this morning is up +42 cents (+0.44%) at a 2-week high and Oct gasoline (RBV14 +0.25%) is up +0.0071 (+0.27%). Oct crude and gasoline prices on Thursday closed higher with Oct crude at a 1-week high: CLV4 +0.67 (+0.71%), RBV4 +0.0003 (+0.01%). The main bullish factor for crude was the unexpected upward revision to U.S. Q2 GDP, which signals increased fuel demand and consumption. Gains were limited on bearish factors that included (1) a stronger dollar, and (2) the lack of disruption to gasoline output at the 405,000 bpd BP refinery in Whiting, Indiana because of a fire there Wednesday night.

Disclosure: None