Morning Call For Aug. 7, 2014

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU14 +0.21%) this morning are up +0.16% as Q2 stock earnings results continue to surprise on the upside, while European stocks are down -0.36% after German industrial output rose less than expected along with concern the Ukraine conflict and sanctions against Russia will undermine the European economy. Russia's Micex Stock Index tumbled to a 3-month low as retailers plunged on concern a ban on food imports from sanctioned countries will cut earnings after Russian President Putin ordered restrictions on food and agricultural imports for one year from countries that have imposed or supported sanctions against Russia. Limiting losses in European stocks is the fall in the 10-year German bund yield to a record low 1.078% ahead of today's ECB meeting. Asian stocks closed mostly lower: Japan +0.48%, Hong Kong -0.80%, China -1.51%, Taiwan -0.14%, Australia -0.05%, Singapore -0.18%, South Korea -0.36%, India -0.30%. Commodity prices are mostly lower. Sep crude oil (CLU14-0.02%) is down -0.33% at a fresh 6-month low. Sep gasoline (RBU14 +0.07%) is down -0.11%. Dec gold (GCZ14 -0.05%) is down -0.09%. Sep copper (HGU14 +0.16%) is up +0.14%. Agriculture and livestock prices are mostly lower with Oct lean hogs down -0.71% at a 3-1/2 month low. The dollar index (DXY00 +0.02%) is up +0.05%. EUR/USD (^EURUSD) is down -0.06%. USD/JPY (^USDJPY) is up +0.20%. Sep T-note prices (ZNU14+0.16%) are up +4.5 ticks on positive carry-over from a rally in German bunds.

German Jun industrial production rose +0.3% m/m and unexpectedly fell -0.5% y/y, weaker than expectations of +1.2% m/m and +0.3% y/y with the-0.5% y/y drop the largest annual decline in 11 months.

As expected, the BOE maintained its benchmark rate at 0.50% and kept its asset purchase target at 375 billion pounds.

U.S. STOCK PREVIEW

Today’s U.S. weekly unemployment claims report should continue to show a slowly-improving layoff picture. Today’s initial unemployment claims report is expected to show a slight +3,000 increase to 305,000 after last week’s +23,000 gain to 302,000. Today’s June U.S. consumer credit report is expected to show another strong increase of +$18.700 billion, close to May’s increase of +$19.602 billion.

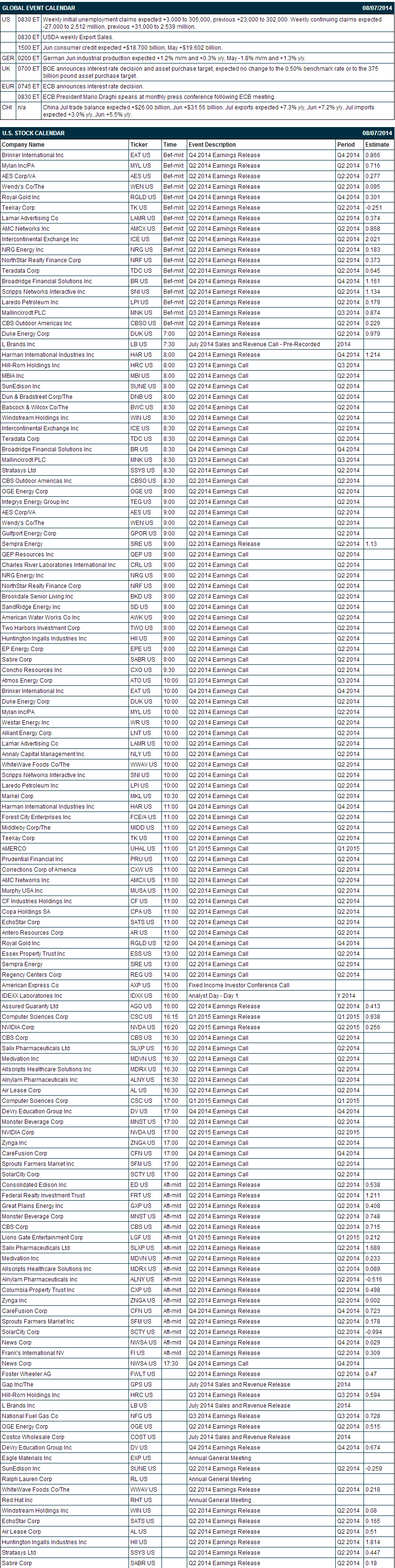

There are 17 of the S&P 500 companies that report earnings today with notable reports including: Mylan (consensus $0.72), AES Corp. (0.28), Wendy's (0.10), InterContinentalExchange (2.02), Scripps Networks (1.13), Duke Energy (0.98). Equity conferences for the remainder of this week include: Black Hat USA 2014 on Wed-Thu and Needham Advanced Industrial Technologies Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Duke Energy (DUK -1.61%) reported Q2 EPS of $1.11, well above consensus of 98 cents.

Carnival Corp. (CCL +0.69%) rose nearly 3% in pre-market trading after BOA/Merril upgraded the stock to 'Buy' from 'Neutral.'

Aetna (AET -0.18%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

Esterline (ESL +0.14%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs who also raised their price target on the stock to $140 from $111.

Energy Transfer Partners (ETP -1.49%) reported Q2 EPS of 79 cents, higher than consensus of 64 cents.

Babcock & Wilcox (BWC -0.35%) sank over 12% in after-hours trading after it reported Q2 adjusted EPS of 44 cents, lower than consensus of 49 cents, and then lowered guidance on fiscal 2014 EPS view to $1.70-$1.85 from $2.00-$2.20, below consensus of $2.12.

Transocean (RIG -1.09%) rose over 2% in after-hours trading after it reported Q2 adjusted EPS of $1.61, well ahead of consensus of $1.12.

CF Industries (CF +1.36%) reported Q2 EPS of $6.10, well below consensus of $6.71.

Envision Healthcare (EVHC -0.62%) reported Q2 adjusted EPS of 28 cents, better than consensus of 25 cents, and then raised guidance on 2014 adjusted EPS view to $1.15-$1.20 from $1.10-$1.15, higher than consensus of $1.13.

CenturyLink (CTL -1.32%) rallied nearly 3% in after-hours trading after it reported Q2 adjusted EPS of 72 cents, higher than consensus of 64 cents.

Prudential (PRU +0.96%) reported Q2 EPS of $2.49, stronger than consensus of $2.35.

21st Century Fox (FOXA +3.29%) climbed over 2% in after-hours trading after it reported Q4 EPS of 42 cents, higher than consensus of 38 cents.

Symantec (SYMC -0.79%) reported Q1 EPS of 45 cents, better than consensus of 42 cents.

Keurig Green Mountain (GMCR +0.33%) fell over 2% in after-hours trading after it reported Q3 EPS of 99 cents, above consensus of 88 cents, and then raised guidance on fiscal 2014 EPS outlook to $3.71-$3.78 from $3.63-$3.73, although that is still below consensus of $3.78.

MARKET COMMENTS

Sep E-mini S&Ps (ESU14 +0.21%) this morning are up +3.00 points (+0.16%). The S&P 500 index on Wednesday opened lower at a 2-1/4 month low on geopolitical concerns after NATO said there's a risk of Russia sending troops into Ukraine under the "pretext" of a humanitarian or peacekeeping mission. Stock prices recovered, however, and closed little changed: S&P 500 unch, Dow Jones +0.08%, Nasdaq -0.02%. Bullish factors included (1) the U.S. Jun trade balance that unexpectedly narrowed to a -$41.5 billion deficit, better than expectations of an increase to a -$44.8 billion deficit and the smallest deficit in 5 months, which is positive for GDP growth, and (2) positive Q2 company earnings results as 75% of companies in the S&P 500 that have reported earnings thus far have beaten profit estimates.

Sep 10-year T-notes (ZNU14 +0.16%) this morning are up +4.5 ticks. Sep 10-year T-note futures prices on Wednesday climbed to a 2-month high on increased safe-haven demand after NATO said that there's a risk that Russia will invade Ukraine. Another positive was the Treasury's announcement that it will auction $67 billion of T-notes and bonds in next week's quarterly refunding, -$2 billion less than the prior refunding. T-notes came off of their best levels after the S&P 500 recovered from a 2-1/4 month low and. Closes: TYU4 +3.50, FVU4 +2.50.

The dollar index (DXY00 +0.02%) this morning is up +0.039 (+0.05%). EUR/USD (^EURUSD) is down -0.0008 (-0.06%) and USD/JPY (^USDJPY) is UP +0.20 (+0.20%). The dollar index on Wednesday posted a 10-3/4 month high on increased safe-haven demand over concern Russia may soon invade Ukraine. EUR/USD fell to an 8-3/4 month low on concern over the European economy after German factory orders unexpectedly fell -3.2% m/m, the largest monthly decline in 2-3/4 years, and after Italy Q2 GDP fell -0.2% q/q, which puts it into recession. EUR/USD recovered its losses and closed higher ahead of Thursday's ECB meeting. Closes: Dollar index +0.116 (+0.14%), EUR/USD +0.00067 (+0.05%), USD/JPY -0.494 (-0.48%).

Sep WTI crude oil (CLU14 -0.02%) this morning is down -32 cents (-0.33%) at a fresh 6-month low and Sep gasoline (RBU14 +0.07%) is down-0.0031 (-0.11%). Sep crude and gasoline prices on Wednesday settled mixed: CLU4 -0.46 (-0.47%), RBU4 +0.0270 (+0.99%). Crude oil fell back after the dollar index strengthened to a 10-3/4 month high and after crude supplies at Cushing, OK, the delivery point for WTI futures, rose +83,000 bbl, their first increase in a month. Gasoline closed higher after weekly EIA gasoline stockpiles unexpectedly plunged -4.387 million bbl, more than expectations for no change.

Disclosure: None