Morning Call For Aug. 8, 2014

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU14 +0.17%) this morning are down -0.17% at a 2-1/2 month low and European stocks are down -0.25% at a 4-3/4 month low on rising global geopolitical tensions after President Obama authorized the use of airstrikes against militants in Iraq and after Israel renewed airstrikes in Gaza after militants there broke a cease-fire and fired rockets into Israel. President Obama said the U.S. will strike Islamic State militants if they move toward the Kurdish city of Erbil, where the U.S. has diplomatic personnel. Asian stocks closed mostly lower: Japan -2.98%, Hong Kong-0.23%, China +0.16%, Taiwan -0.50%, Australia -1.34%, Singapore -0.76%, South Korea -1.36%, India -1.02%. Japan's Nikkei Stock Index tumbled to a 2-1/4 month low on rising geopolitical concerns and also after the yen climbed to a 2-week high against the dollar on a flight to safety. China's Shanghai Stock Index bucked the trend and closed higher after China's trade surplus surged to a record last months as exports accelerated by the most in 1-1/4 years. Commodity prices are mixed. Sep crude oil (CLU14 +0.53%) is up +0.79%. Sep gasoline (RBU14 +0.35%) is up +0.52%. Dec gold (GCZ14 +0.27%) is up +0.54% at a 3-week high as falling global equities and rising geopolitical concerns boost the safe-haven demand for gold. Sep copper (HGU14 -0.22%) is down -0.16%. Agriculture and livestock prices are lower. The dollar index (DXY00 -0.14%) is down -0.18%. EUR/USD (^EURUSD) is up +0.23%. USD/JPY (^USDJPY) is down -0.27% at a 2-week low on increased safe-haven demand for the yen. Sep T-note prices (ZNU14 +0.21%) are up +13.5 ticks at a 2-1/2 month high as falling global equities and rising geopolitical concerns fuel safe-haven demand for government bonds that has also reduced the yield on the 10-year German bund to a record low 1.023%.

The China Jul trade balance widened to a record surplus of +$47.30 billion, much larger than expectations of +$27.40 billion and the most since Chinese trade data were first compiled in 1986. China Jul exports rose +14.5% y/y, more than double expectations of +7.0% y/y and the most in 15 months. Jul imports unexpectedly fell -1.6% y/y, weaker than expectations of +2.6% y/y.

The German Jun trade balance shrank to a surplus of +16.5 billion euros, less than expectations of +18.9 billion euros. Jun exports rose +0.9% m/m, better than expectations of +0.8% m/m. Jun imports jumped +4.5% m/m, more than four times expectations of +1.0% m/m and the most in 3-1/2 years.

UK Jun construction output rose +1.2% m/m and +5.3% y/y, more than expectations of +1.0% m/m and +4.7% y/y.

Japan Jun eco watchers survey outlook fell -1.8 to 51.5. The Jul eco watchers survey current rose +3.6 to 51.3, better than expectations of +0.8 to 48.5.

U.S. STOCK PREVIEW

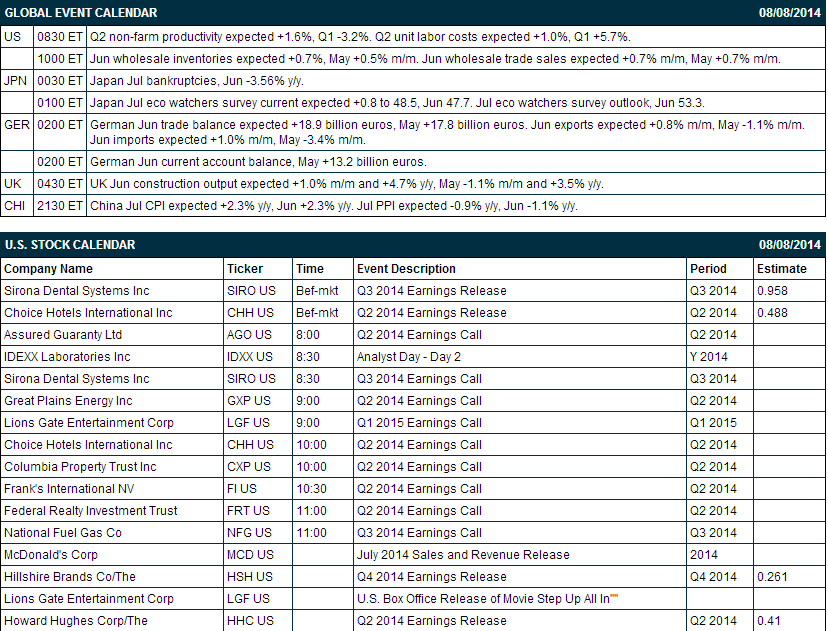

Today’s Q2 non-farm productivity report is expected to show an increase of +1.6% after the 3.2% dip seen in Q1. Meanwhile, Q2 unit labor costs are expected to ease to +1.0% from +5.7% in Q1.

There are 4 of the S&P Midcap 400 companies that report earnings today with notable reports including: Sirona Dental Systems (consensus $0.96), Choice Hotels International (0.49), Hillshire Brands (0.26), Howard Hughes (0.41). There are no equity conferences today.

OVERNIGHT U.S. STOCK MOVERS

Dillard's (DDS -0.50%) was downgraded to 'Neutral' from 'Buy' at Buckingham.

Activision Blizzard (ATVI -2.40%) was upgraded to 'Buy' from 'Neutral' at Longbow.

Ann Inc. (ANN -5.31%) was downgraded to 'Neutral' from 'Buy' at UBS.

Hibbett Sports (HIBB -1.22%) was downgraded to 'Underperform' from 'Neutral' at Credit Suisse.

Allergan (AGN -3.30%) was upgraded to 'Outperform' from 'Market Perform' at Leerink.

Tang Capital reported an 11.4% stake in La Jolla (LJPC -0.10%) .

lululemon (LULU -2.35%) jumped over 5% in after-hours trading after Dow Jones says founder Chip WIlson will sell half his stake to private equity firm Advent for $845 million.

NVIDIA (NVDA -1.02%) reported Q2 EPS of 30 cents, well above consensus of 20 cents, and then was upgraded to 'Buy' from 'Hold' at Needham.

CSC (CSC -1.24%) reported Q1 EPS of $1.03, higher than consensus of 94 cents.

Gap (GPS -0.67%) climbed ove 4% in after-hours trading after it said it sees Q2 EPS ex-benefits of 68 cents-69 cents with Q2 net sales of $3.98 billion, better than consensus of 66 cents and Q2 sales of $3.96 billion.

Monster Beverage (MNST -1.42%) rose nearly 3% in after-hours trading after it reported Q2 EPS of 81 cents, better than consensus of 75 cents.

News Corp. (NWSA -1.19%) reported Q4 adjusted EPS of 1 cents, below consensus of 3 cents.

CBS (CBS -1.30%) reported Q2 adjusted EPS of 78 cents, higher than consensus of 72 cents.

MARKET COMMENTS

Sep E-mini S&Ps (ESU14 +0.17%) this morning are down -3.25 points (-0.17%) at a fresh 2-1/4 month low. The S&P 500 index on Thursday erased an early rally and tumbled to a 2-1/4 month low and closed lower: S&P 500 -0.56%, Dow Jones -0.46%, Nasdaq -0.42%. The main bearish factor for stocks was long liquidation spurred on by concern that rising tensions between Ukraine and Russia will undercut the European economy and drag the global economy lower as well. Stocks had risen in early trade after U.S. weekly initial unemployment claims unexpectedly fell -14,000 to 289,000, better than expectations of +3,000 to 305,000.

Sep 10-year T-notes (ZNU14 +0.21%) this morning are up +13.5 ticks at a 2-1/2 month high. Sep 10-year T-note futures prices on Thursday climbed to a 2-1/4 month high and closed higher. Bullish factors included (1) increased safe-haven demand as stocks fell on concern Russia may soon invade Ukraine, and (2) carry-over support from a drop in the German 10-year bund yield to a record low of 1.058%. The rally in T-notes was limited after weekly U.S. jobless claims unexpectedly declined. Closes: TYU4 +13.50, FVU4 +7.75.

The dollar index (DXY00 -0.14%) this morning is down -0.148 (-0.18%). EUR/USD (^EURUSD) is up +0.0031 (+0.23%) and USD/JPY (^USDJPY) is down -0.28 (-0.27%) at a 2-week low. The dollar index on Thursday closed higher, but remained below Wednesday's 10-3/4 month high. Bullish factors included (1) weakness in EUR/USD after ECB President Draghi said that real interest rates will remain negative in the Eurozone for a "much longer time" than in the U.S. and that risks to the Eurozone economy are increasing from geopolitics worldwide, and (2) increased safe-haven demand for the dollar as global stocks fell. Closes: Dollar index +0.080 (+0.10%), EUR/USD -0.00191 (-0.14%), USD/JPY -0.006 (-0.01%).

Sep WTI crude oil (CLU14 +0.53%) this morning is up +77 cents (+0.79%) and Sep gasoline (RBU14 +0.35%) is up +0.0145 (+0.52%). Sep crude and gasoline prices on Thursday closed higher: CLU4 +0.42 (-0.43%), RBU4 +0.0349 (+1.27%). Sep crude recovered from a 6-month low and closed higher as signs of strength in the U.S. economy fueled short-covering in crude after weekly U.S. jobless claims unexpectedly declined. Gains in crude were muted as the dollar strengthened.

Disclosure: None