Morning Call For November 20, 2014

OVERNIGHT MARKETS AND NEWS

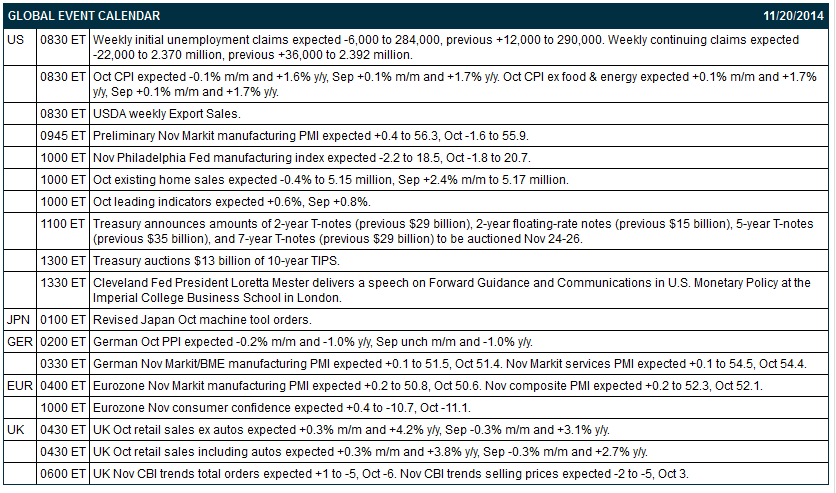

December E-mini S&Ps (ESZ14 -0.43%) this morning are down -0.48% and European stocks are down -1.26% on global growth concerns after manufacturing activity slowed in China and in the Eurozone. A gauge of Chinese manufacturing activity dropped to a 6-month low and the Eurozone Nov composite PMI unexpectedly fell to its slowest pace of growth in 16-months. Asian stocks closed mixed: Japan +0.07%, Hong Kong -0.10%, China unch, Taiwan +1.29%, Australia -0.98%, Singapore -0.57%, South Korea -0.55%, India +0.12%. Japanese stocks closed higher on signs that the weaker yen is positive for the Japanese economy after Japan Oct exports rose more than expected by the most in 8 months. Chinese stocks erased losses and closed little changed on speculation that the fall in Chinese factory activity to a 6-month low will prompt the government to increase stimulus measures. Commodity prices are mixed. Dec crude oil (CLZ14 +0.19%) is up +0.09%. Dec gasoline (RBZ14 +0.08%) is down -0.17%. Dec gold (GCZ14-0.10%) is up +0.03%. Dec copper (HGZ14 -1.22%) is down -1.17%. Agriculture prices are mixed. The dollar index (DXY00 +0.05%) is up +0.04%. EUR/USD (^EURUSD) is down -0.14%. USD/JPY (^USDJPY) is up +0.19% at a new 7-year high on speculation Japanese Prime Minister Abe will win elections and extend his economic stimulus program. Dec T-note prices (ZNZ14 +0.20%) are up +9.5 ticks.

The China Nov HSBC manufacturing PMI fell -0.4 to 50.0, a bigger decline than expectations of -0.2 to 50.2 and the slowest pace of expansion in 6 months.

The Eurozone Nov Markit manufacturing PMI unexpectedly slipped -0.2 to 50.4, weaker than expectations of a +0.2 increase to 50.8. The Nov composite PMI unexpectedly fell -0.7 to 51.4, weaker than expectations of +0.2 to 52.3 and the slowest pace of expansion in 16 months.

The German Nov Markit/BME manufacturing PMI unexpectedly fell -1.4 to 50.0, weaker than expectations of +0.1 to 51.5.

German Oct PPI fell -0.2% m/m and -1.0% y/y, right on expectations.

The Japan Nov Markit/JMMA manufacturing PMI unexpectedly fell -0.3 to 52.1, weaker than expectations of +0.3 to 52.7.

The Japan Oct trade balance unexpectedly shrank to a deficit of -710.0 billion yen from a revised -960.6 billion yen deficit in Sep, better than expectations for the deficit to widen to 1.027 trillion yen and the smallest deficit in 16 months. Oct exports rose +9.6% y/y, over double expectations of +4.5% y/y and the most in 8 months. Oct imports rose +2.7% y/y, less than expectations of +3.4% y/y.

UK Nov CBI trends total orders rose +9 to 3, better than expectations of +1 to -5. Nov CBI trends selling prices rose +2 to -1, better than expectations of-2 to -5.

UK Oct retail sales ex-autos rose +0.8% m/m and +4.6% y/y, stronger than expectations of +0.3% m/m and +4.2% y/y. Oct retail sales including autos rose +0.8% m/m and +4.3% y/y, stronger than expectations of +0.3% m/m and +3.8% y/y.

U.S. STOCK PREVIEW

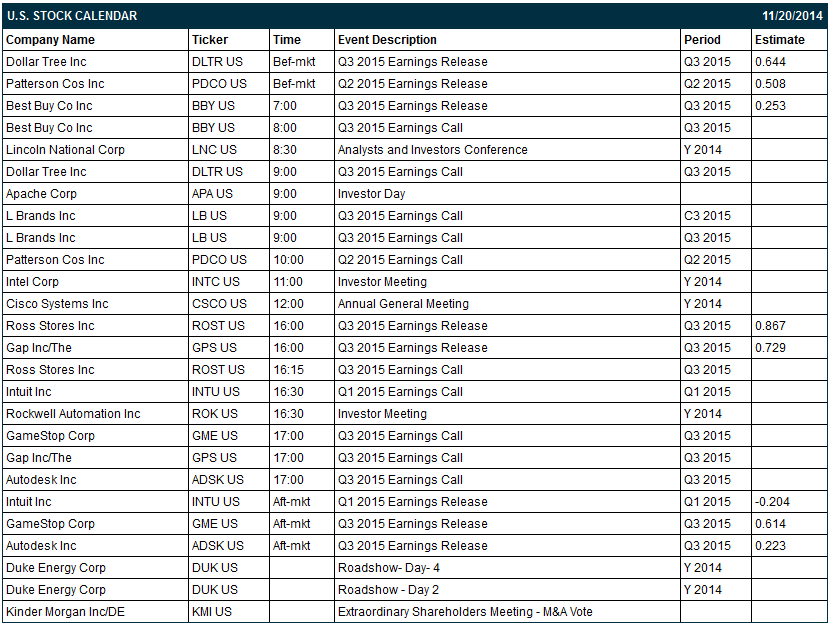

Today’s weekly initial unemployment claims report is expected to show a -6,000 decline to 284,000, reversing part of last week’s +12,000 increase to 290,000. Meanwhile, today’s continuing claims report is expected to show a -22,000 decline to 2.370 million, reversing part of last week’s +36,000 increase to 2.392 million. Today’s Oct CPI is expected to edge lower to +1.6% y/y from Sep’s +1.7% and for the Oct core CPI to remain unchanged from Sep’s +1.7% y/y. Today’s Oct existing home sales report is expected to show a small decline of -0.4% to 5.15 million, settling back after September’s +2.4% rise to a 1-year high of 5.17 million. Today’s Nov Philadelphia Fed manufacturing index is expected to fall by -2.2 points to 18.5, adding to the-1.8 point decline to 20.7 seen in October. There are 8 of the S&P 500 companies report earnings today: Best Buy (consensus $0.25), GAP (0.73), Dollar Tree (0.64), Patterson Cos (0.51), Ross Stores (0.87), Intuit (-0.20), Gamestop (0.61), Autodesk (0.22).

Equity conferences during the remainder of the week include: Los Angeles Auto Show-Press & Trade Days on Tue-Thu, Barclays Global Automotive Conference on Wed-Thu, Citigroup Global Financial Conference on Wed-Thu, Goldman Sachs Global Metals & Mining/Steel Conference on Thu, Wells Fargo Securities E-Cig Conference on Thu, Morgan Stanley European Technology, Media & Telecoms Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Target (TGT +7.39%) was downgraded to 'Hold' from 'Buy' at Evercore ISI.

Dollar Tree (DLTR +1.03%) reported Q3 EPS of 69 cents ex-items, better than consensus of 64 cents.

Children's Place (PLCE +1.38%) reported Q3 EPS of $1.70, weaker than consensus of $1.80.

Michaels (MIK -0.50%) reported Q3 EPS of 31 cents, above consensus of 26 cents.

Patterson Cos. (PDCO -0.56%) reported Q2 EPS of 54 cents, better than consensus of 51 cents.

Best Buy (BBY +1.83%) reported Q3 EPS of 32 cents, higher than consensus of 25 cents.

Copa Holdings (CPA +0.85%) reported Q3 adjusted EPS of $2.25, well above consensus of $1.99.

Caesar's (CZR -6.20%) surged over 15% in after-hours trading after Bloomberg reported that Caeser's released a plan to creditors that it would restructure its operating unit into a REIT.

L Brands (LB +0.45%) slid over 1% in after-hours trading after it reported Q3 EPS of 44 cents, stronger than consensus of 39 cents, and then raised guidance on fiscal 2014 EPS view to $3.21-$3.31 from $3.03-$3.18. This is still on the low end of consensus of $3.31.

Williams-Sonoma (WSM -0.26%) jumped over 5% in after-hours trading after it reported Q3 EPS of 68 cents, better than consensus of 63 cents.

Atento (ATTO +0.56%) reported Q3 adjusted EPS of 35 cents, less than consensus of 40 cents,

Salesforce.com (CRM -2.32%) fell over 4% in after-hours trading after it reported Q3 EPS of 14 cents, higher than consensus of 13 cents, but then said it sees Q4 EPS of 13 cents-14 cents, below consensus of 15 cents.

Keurig Green Mountain (GMCR -2.01%) reported Q4 adjusted EPS of 90 cents, well above consensus of 77 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.43%) this morning are down -9.75 points (-0.48%). The S&P 500 index on Wednesday closed lower: S&P 500 -0.15%, Dow Jones -0.01%, Nasdaq -0.46%. Bearish factors included (1) the unexpected -2.8% decline in U.S. Oct housing starts to 1.009 million, weaker than expectations of an +0.8% increase to 1.025 million, and (2) profit-taking after Tuesday's rally in the S&P 500 to a record high. Losses were limited after (1) U.S. Oct building permits rose +4.8% to 1.080 million, stronger than expectations of +0.9% to 1.040 million and the highest in 6-1/3 years, and (2) the minutes of the Oct 28-29 FOMC meeting which bolstered speculation that interest rates will remain low after many FOMC members said they should be on the lookout for a drop in longer-term inflation expectations.

Dec 10-year T-notes (ZNZ14 +0.20%) this morning are up +9.5 ticks. Dec 10-year T-note futures prices on Wednesday closed lower: TYZ4 -8.00, FVZ4-3.75. The main bearish factor was the larger-than-expected increase in Oct building permits, a proxy for future homebuilding, to a 6-1/3 year high. T-notes recovered from their worst levels on speculation the Fed may delay any hike in interest rates after the minutes of the Oct 28-29 FOMC meeting stated that policy makers should be on the lookout for signs of a decline in longer-term inflation expectations.

The dollar index (DXY00 +0.05%) this morning is up +0.037 (+0.04%). EUR/USD (^EURUSD) is down -0.0018 (-0.14%). USD/JPY (^USDJPY) is up +0.23 (+0.19%) at a new 7-year high. The dollar index on Wednesday closed higher. Closes: Dollar index -0.351 (-0.40%), EUR/USD +0.00859 (+0.69%), USD/JPY +0.209 (+0.18%). The dollar rallied due to weakness in the yen as USD/JPY posted a new 7-year high on speculation the BOJ may add to stimulus measures after BOJ Governor Kuroda warned that a slide in Japan's economy into recession could push inflation below 1.0%. The dollar fell back from its best levels after the minutes of the Oct 28-29 FOMC minutes said that many FOMC members were worried about a drop in inflation expectations, which may prompt the Fed to delay a hike in interest rates.

Dec WTI crude oil (CLZ14 +0.19%) this morning is up +7 cents (+0.09%) and Dec gasoline (RBZ14 +0.08%) is down -0.0034 (-0.17%). Dec crude and Dec gasoline on Wednesday settled mixed. Closes: CLZ4 -0.03 (-0.04%), RBZ4 +0.0006 (+0.03%). Bearish factors included (1) the unexpected +2.61 million bbl increase in weekly EIA crude supplies, more than expectations of a -1.5 million bbl decline, and (2) the +718,000 bbl increase in crude inventories at Cushing, OK, delivery point of WTI futures, to a 6-month high of 23.245 million bbl. Bullish factors included (1) speculation OPEC may cut crude production when it meets next Thursday after Libyan OPEC governor Kamal said the cartel should reduce oil output by -500,000 bpd, and (2) the-2.06 million bbl decline in weekly EIA distillate inventories to a 6-month low of 114.8 million bbl.

Disclosure: None