Morning Call For November 25, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.08%) this morning are up +0.08% and European stocks are up +0.79% at a 2-month high. European bank stocks gained and government bond yields dropped to record lows on the prospects for further easing by the ECB after the OECD said the ECB should expand its monetary support due to the weak Eurozone economy and risk of deflation. Asian stocks closed mixed: Japan +0.29%, Hong Kong -0.21%, China +1.37%, Taiwan -0.07%, Australia -0.50%, Singapore +0.13%, South Korea -0.25%, India -0.57%. Chinese stocks continue to find support from Friday's surprise interest rate cut by the PBOC as the Shanghai Stock Index posted a new 3-year high. Commodity prices are mostly higher. Jan crude oil (CLF15 +0.59%) is up +0.36% on speculation that OPEC may try to cut crude output at Thursday's cartel meeting after Iraqi Oil Minister Adel Abdul Mahdi said that action must be taken to boost prices because current levels are "unacceptable." Jan gasoline (RBF15 +0.93%) is up +0.77%. Dec gold (GCZ14 +0.30%) is up +0.34%. Dec copper (HGZ14 +0.22%) is up +0.15%. Agriculture prices are mixed. The dollar index (DXY00 unch) is unchanged. EUR/USD (^EURUSD) is down -0.06%. USD/JPY (^USDJPY) is down -0.20%. Dec T-note prices (ZNZ14 +0.09%) are up +3.5 ticks.

The Organization for Economic Cooperation and Development (OECD) said that "given the weak Eurozone economy and risk of deflation, the ECB should expand its monetary support, including through asset purchases," or "quantitative easing." The OECD kept its 2014 Eurozone GDP estimate at +0.8% and its 2015 estimate at +1.1%, and kept its 2014 Eurozone inflation forecast at +0.5% and 2015 estimate at +0.6%.

German Q3 GDP was left unrevised at +0.1% q/q and +1.2% y/y (nsa), although Q3 exports were revised upward to +1.9% q/q from +0.9% q/q, the most in 3-1/2 years, and Q3 imports were revised higher to +1.7% q/q from +1.6% q/q.

Japan Oct PPI services rose +3.6% y/y, right on expectations and the fastest pace of increase in 23-3/4 years.

U.S. STOCK PREVIEW

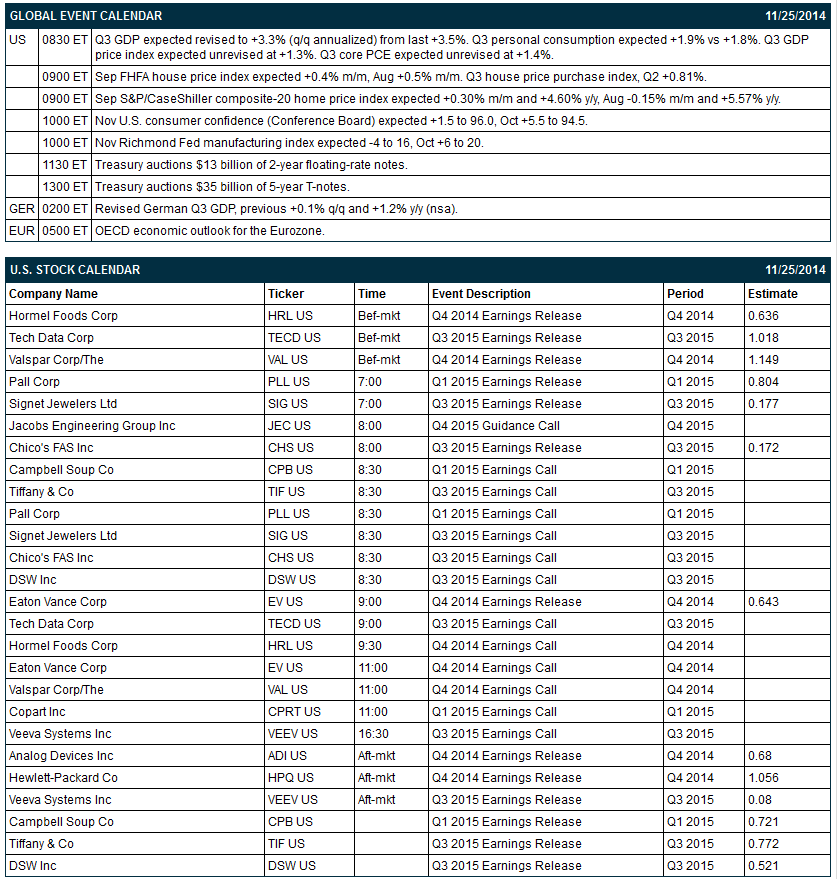

Today’s Q3 GDP report is expected to be revised lower to +3.3% (q/q annualized) from last estimate of +3.5%. The market is expecting U.S. home prices to show a moderate increase in September, thus giving a boost to household wealth and consumer confidence. The market consensus is for today’s Sep FHFA house price index to show an increase of +0.4% m/m and for the CaseShiller Composite 20 house price index to show an increase of +0.25% m/m. Today’s Nov U.S. consumer confidence index from the Conference Board is expected to show a +1.5 point increase to 96.0, adding to the +5.5 point increase to a new 7-year high of 94.5 seen in October. The Treasury today will sell $35 billion of 5-year T-notes and $13 billion of 2-year floating-rate notes.

There are 13 of the Russell 1000 companies that report earnings today with notable reports including: HP (consensus $1.06), Tiffany ($0.77), DSW (0.52), Campbell Soup (0.72), Eaton Vance (0.64), Pall Corp (0.80), Hormel Foods (0.64). There are no equity conferences during the remainder of this week.

OVERNIGHT U.S. STOCK MOVERS

Valspar (VAL -0.11%) reported Q4 EPS of $1.38, well above consensus of $1.15.

Campbell Soup (CPB -0.54%) reported Q1 EPS of 74 cents, stronger than consensus of 72 cents.

Pall Corp. (PLL -0.40%) reported Q1 EPS of 89 cents, higher than consensus of 80 cents.

Netflix (NFLX -1.06%) was downgraded to 'Hold' from 'Buy' at Stifel.

Tiffany & Co. (TIF +1.06%) reported Q3 EPS of 76 cents, weaker than consensus of 77 cents.

Hormel Foods (HRL -0.37%) reported Q4 EPS of 63 cents, below consensus of 64 cents.

According to the Wall Street Journal, Honda (HMC -0.19%) said that over an an 11-year period beginning in 2003, it did not report 1,729 death and injury incidents to U.S. regulators.

Post Holdings (POST +0.87%) reported Q4 adjusted EPS of 13 cents, nearly double consensus of 7 cents.

Dycom (DY +0.92%) jumped over 5% in after-hours trading after it reported Q1 EPS of 59 cents, well above consensus of 50 cents.

Ceridian reported an 8.3% stake in FleetCor (FLT +0.04%) .

Aegean Marine (ANW -0.43%) reported Q3 EPS of 20 cents, less than consensus of 21 cents.

Casey's General Stores (CASY +0.75%) announced that it will revise its financial statements for fiscal years 2012, 2013 and 2014 and Q1 of fiscal 2015 for an accounting error and pay the I.R.S. $30.4 million in taxes due as well as $1.1 million in interest to resolve this matter.

Brocade (BRCD +1.65%) reported Q4 EPS of 24 cents, higher than consensus of 23 cents.

Nuance (NUAN +0.53%) rose over 4% in pre-market trading after it reported Q4 EPS of 33 cents, better than consensus of 27 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.08%) this morning are up +1.75 points (+0.08%). The S&P 500 index on Monday closed higher: S&P 500 +0.29%, Dow Jones +0.04%, Nasdaq +0.78%. Bullish factors included (1) carry-over support from a rally in European stocks after the German Nov IFO business climate index unexpectedly rose +1.5 to 104.7, the first increase in the last 7 months, and (2) a rally in retailers and consumer discretionary stocks on optimism for a robust holiday-shopping season after the national Retail Federation predicted that U.S. retail sales will rise +4.1% y/y this holiday season, stronger than the +2.9% average of the past 10 years.

Dec 10-year T-notes (ZNZ14 +0.09%) this morning are up +3.5 ticks. Dec 10-year T-note futures prices on Monday erased early losses and closed higher: TYZ4 +3.00, FVZ4 +2.00. The main bullish factor Monday was exceptional demand for the Treasury’s $28 billion auction of 2-year T-notes that produced a bid-to-cover ratio of 3.71, higher than the 12-auction average of 3.41. Bearish factors included (1) supply pressures as the Treasury auctions $105 billion of T-notes during this holiday-shortened week, and (2) reduced safe-haven demand for T-notes as global stock markets rallied.

The dollar index (DXY00 unch) this morning is unchanged. EUR/USD (^EURUSD) is down -0.0007 (-0.06%). USD/JPY (^USDJPY) is down -0.24 (-0.20%). The dollar index on Monday retreated from a 4-1/3 year high and closed lower. Closes: Dollar index -0.159 (-0.18%), EUR/USD +0.00528 (+0.43%), USD/JPY +0.44 (+0.37%). Negative factors included (1) a rebound in EUR/USD which recovered from a 2-week low after the German Nov IFO business climate index unexpectedly rose for the first time in 7 months, and (2) a rally in global equity markets, which curbed the safe-haven demand for the dollar.

Jan WTI crude oil (CLF15 +0.59%) this morning is up +27 cents (+0.36%) and Jan gasoline (RBF15 +0.93%) is up +0.0156 (+0.77%). Jan crude and Dec gasoline on Monday closed lower. Closes: CLF5 -0.73 (-0.95%), RBF5 -0.0258 (-1.26%). Bearish factors included (1) speculation that OPEC will fail to agree on production cuts at Thursday’s cartel meeting in Vienna, and (2) a forecasted snowstorm for the U.S. northeast later this week that may reduce travel and fuel demand. Losses were muted due to a weak dollar and a rally in stocks.

Disclosure: None

Comments

No Thumbs up yet!

No Thumbs up yet!