Morning Call For Oct. 14, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.12%) this morning are up +0.19% as the market awaits Q3 company earnings results, while European stocks are down -1.26% at an 8-month low after the German Oct ZEW investor confidence fell for a 10th month to a nearly 2-year low and UK Sep inflation slowed to a 5-year low. Asian stocks closed mostly lower: Japan -2.38%, Hong Kong -0.41%, China -0.34%, Taiwan +0.65%, Australia +1.01%, Singapore -0.24%, South Korea +0.12%, India -0.13%. Japan's Nikkei Stock Index slid to a 2-month low as a drop in exporters led the overall market lower after the yen strengthened to a 1-month high against the dollar, which undercuts exporters' earnings prospects. Commodity prices are mixed. Nov crude oil (CLX14-1.18%) is down -1.22%. Nov gasoline (RBX14 -1.32%) is down -1.33%. Dec gold (GCZ14 +0.50%) is up +0.26%. Dec copper (HGZ14 +0.33%) is up +0.67% at a 2-week high on speculation China will lower borrowing costs to spur economic growth after the PBOC cut the interest rate it pays lenders for 14-day repurchase agreements for the second time in a month. Agriculture and livestock prices are mostly lower. The dollar index (DXY00 +0.21%) is up +0.27%. EUR/USD (^EURUSD) is down -0.78%. USD/JPY (^USDJPY) is up +0.03%. Dec T-note prices (ZNZ14 +0.39%) are up +9.5 ticks at a fresh contract high as the 10-year T-note yield tumbled to a 1-1/4 year low of 2.194% on carry-over support from a rally in German bunds which rallied to an all-time high as the 10-year German bund yield fell to a record low 0.846%.

The German Oct ZEW expectations of economic growth survey fell -10.5 to -3.6, a bigger decline than expectations of -6.9 to 0 and the lowest in 23 months. The Oct ZEW current situation survey slumped -22.2 to 3.2, a much bigger decline than expectations of -10.4 to 15.0 and the lowest in 4-1/3 years.

Eurozone Aug industrial production fell -1.8% m/m and -1.9% y/y, more than expectations of -1.6% m/m and -0.9% y/y, with the -1.8% m/m decline the largest monthly drop in 2 years.

UK Sep CPI was unch m/m and rose +1.2% y/y, less than expectations of +0.2% m/m and +1.4% y/y, with the +1.2% y/y gain the slowest pace of increase in 5 years. Sep core CPI rose +1.5% y/y, less than expectations of +1.8% y/y and the slowest pace of increase in 5-1/2 years.

Japan Sep PPI fell -0.1% m/m and rose +3.5% y/y, slightly less than expectations of -0.1% m/m and +3.6% y/y.

U.S. STOCK PREVIEW

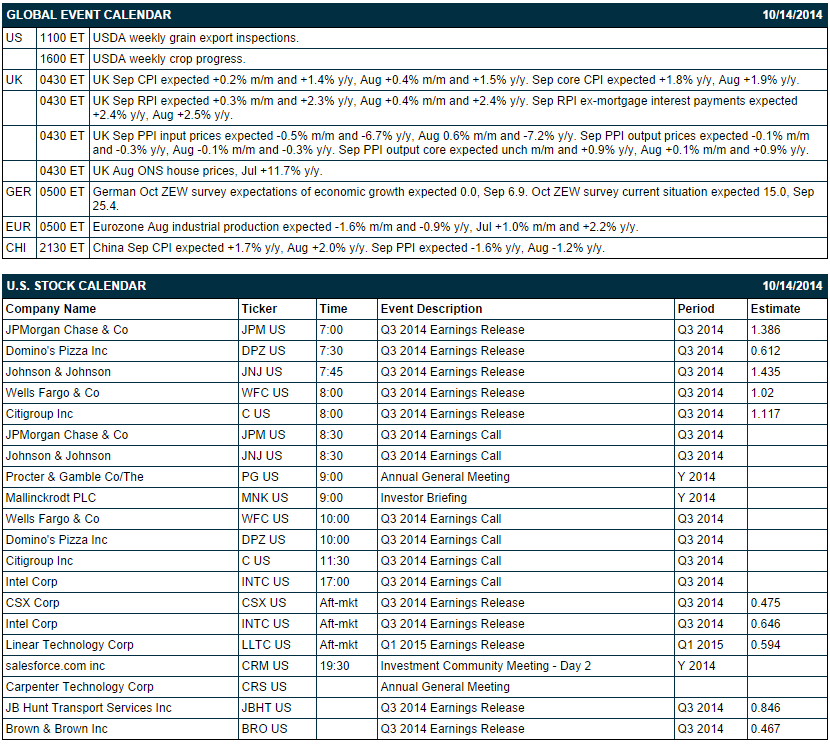

There are no U.S. economic reports today. There are 7 of the S&P 500 companies that report earnings today: JPMorgan Chase (consensus $1.39), Citigroup (1.12), Wells Fargo (1.02), Intel (0.65), Johnson & Johnson (1.44), CSX (0.48), Linear Technology (0.58). Equity conferences during the remainder of this week include: Bio Japan 2014 on Wed, Bloomberg Next Big Thing Summit: East on Thu, and 5th Annual Global Automotive Forum on Thu.

OVERNIGHT U.S. STOCK MOVERS

JPMorgan Chase (JPM -0.62%) reported Q3 EPS of $1.62, well ahead of consensus of $1.39.

Netflix (NFLX -2.99%) was upgraded to 'Buy' from 'Hold' with a $600 price target at target at BTIG.

BorgWarner (BWA -3.12%) and Delphi Automotive (DLPH -3.40%) were both upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

Ford (F -1.81%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

Wynn Resorts (WYNN -1.85%) was downgraded to 'Neutral' from 'Buy' at BofA/Merrill Lynch.

Corning (GLW -2.92%) was downgraded to 'Neutral' from 'Buy' at BofA/Merrill Lynch.

EOG Resources (EOG -6.76%) was upgraded to 'Outperform' from 'Market Perform' at Bernstein.

Cigna (CI -1.00%) was downgraded to 'Neutral' from 'Buy' at Sterne Agee.

Barclays downgraded both Tyco (TYC -1.17%) and Eaton (ETN -1.10%) to Equal Weight from Overweight.

S&P late yesterday announced changes to the S&P MidCap 400 and S&P SmallCap 600 indexes. In the S&P MidCap 400 index, Tanger Factory Outlet Centers (SKT +1.42%) will replace URS Corp. (URS -1.11%). In the S&P SmallCap 600 index, American Equity Investment Life Holding Co. (AEL+4.30%) will replace Tanger Factory Outlet Centers (SKT +1.42%) and AngioDynamics (ANGO +5.57%) will replace Annie's (BNNY unch).

Lululemon's (LULU -3.15%) Q3 sales are tracking below consensus, according to ITG Research.

Iliad announced that it has ended its plan to acquire T-Mobile (TMUS -2.50%).

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.12%) this morning are up +3.50 points (+0.19%). The S&P 500 index on Monday extended the month-long sell-off and closed sharply lower, with the S&P 500 index posting a new 5-month low. S&P 500 -1.65%, Dow Jones -1.35%, Nasdaq -1.62%. Bearish factors include (1) ongoing concern about weaker European and Asian economic growth, (2) the Ebola scare after the first case of transmission within American borders occurred over the weekend, (3) heavy technical selling as the S&P 500 index fell to a new 5-month low and crossed below its 200-day moving average, and (4) ideas that the stock market had previously been overvalued.

Dec 10-year T-notes (ZNZ14 +0.39%) this morning are up +9.5 ticks at a fresh contact high. Dec 10-year T-note futures prices on Monday rallied sharply and posted a new contract high. Closes: TYZ4 +23, FVZ4 +16.5. Bullish factors include (1) expectations for delayed Fed tightening due to slower global economic growth, and (2) increased safe-haven demand with the plunge in global stocks.

The dollar index (DXY00 +0.21%) this morning is up +0.228 (+0.27%). EUR/USD (^EURUSD) is down -0.0099 (-0.78%). USD/JPY (^USDJPY) is up +0.03 (+0.03%). The dollar index on Monday continued lower as the market pushed back expectations for Fed tightening due to the weakness in global economic growth and the sharp sell-off in the stock market. Closes: Dollar index -0.38 (-0.44%), EUR/USD +0.0124 (+0.98%), USD/JPY -0.80 (-0.74%). Meanwhile, the yen saw some strength on safe-haven demand.

Nov WTI crude oil (CLX14 -1.18%) this morning is down -$1.05 a barrel (-1.22%). and Nov gasoline (RBX14 -1.32%) is down -0.0300 (-1.33%). Nov crude and Nov gasoline prices on Monday extended the recent plunge and closed lower. Closes: CLX4 -0.62 (-0.72%), RBXX4 -0.0137 (-0.61%). Crude oil and gasoline prices continued to see downward pressure from worries about weaker global economic growth, and from the price war among OPEC members. OPEC leaders over the weekend rejected Venezuela’s call for an emergency meeting to discuss production cuts, illustrating that Saudi Arabia is not interested in cutting production at present.

Disclosure: None