Morning Call For Oct. 17, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +1.43%) this morning are up +1.30% and European stocks are up +1.53% as Italian and Spanish government bonds gained on the prospects of additional ECB stimulus. ECB Executive Board member Coeure said the central bank will start "within the next days" to purchase assets in the new program to support the economy. A rally in European automakers also supported stock gains after Eurozone car sales last month rose by the most in 6 months. Asian stocks closed mixed: Japan -1.40%, Hong Kong +0.53%, China -0.11%, Taiwan -1.40%, Australia +0.32%, Singapore +0.43%, South Korea -1.22%, India +0.42%. China's Shanghai Stock Index fell to a 3-week low on speculation that a trading link that would allow the equivalent of $1.7 billion in daily net purchases of Hong Kong shares and $2.1 billion for Shanghai stocks will be delayed. Japan's Nikkei Stock Index fell to a 4-1/2 month low as exporters weakened on concern a global economic slowdown will reduce exporters' profits. Commodity prices are mixed. Nov crude oil (CLX14 +1.54%) is up +1.75%. Nov gasoline (RBX14 +1.02%) is up +1.09%. Dec gold (GCZ14 -0.31%) is down -0.34%. Dec copper (HGZ14 +0.13%) is down -0.27% at a fresh 7-month low on signs of increased supplies after weekly Shanghai copper inventories surged +14,465 MT to a 2-1/4 month high of 97,235 MT. Agriculture and livestock prices are mixed with Dec hogs down -1.02% at an 8-month nearest-futures low on demand concerns. The dollar index (DXY00 -0.12%) is down -0.07%. EUR/USD (^EURUSD) is up +0.05%. USD/JPY (^USDJPY) is up +0.20%. Dec T-note prices (ZNZ14 -0.24%) are down -13.5 ticks as a rally in U.S. and European stocks reduces the safe-haven demand for T-notes.

Eurozone Aug construction output rose +1.5% m/m, the biggest increase in 8 months. On an annual basis, Aug construction output fell -0.3% y/y.

Eurozone Sep new car registrations rose +6.4% y/y to 1.236 million units, the largest increase in 6 months.

U.S. STOCK PREVIEW

Today’s Sep housing starts report is expected to show an increase of +5.1% to 1.005 million, reversing part of the sharp -14.4% drop to 956,000 seen in August from the 6-1/2 year high of 1.117 million units posted in July. Today’s early-Oct U.S. consumer confidence index from the University of Michigan is expected to fall mildly by -0.6 points to 84.0, reversing part of the +2.1 gain to the 1-1/4 year high of 84.6 seen in September.

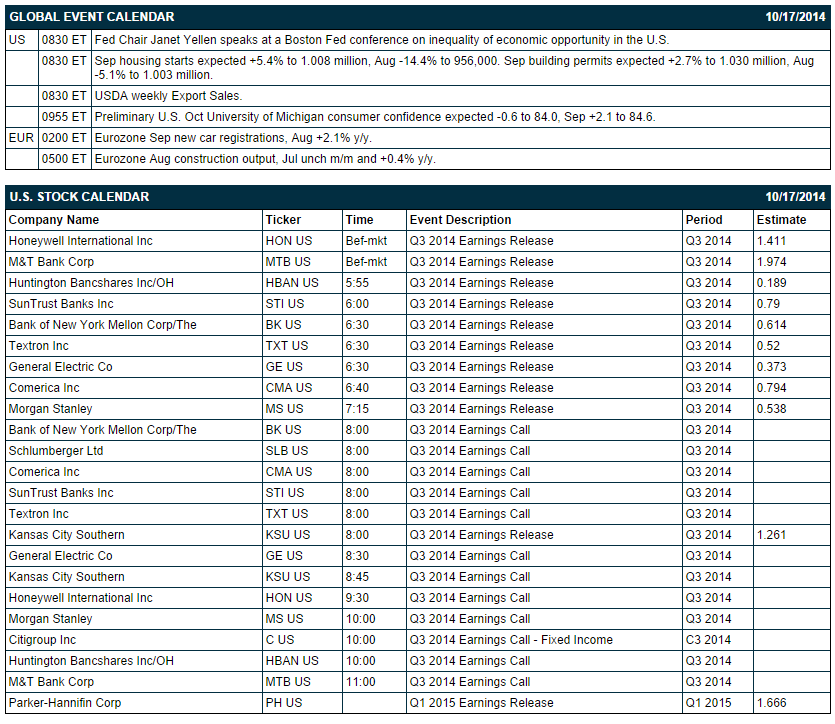

There are 11 of the S&P 500 companies that report earnings today with notable reports including: Morgan Stanley (consensus $0.54), GE (0.37), Honeywell (1.41), M&T Bank (1.97), Huntington Bancshares (0.19), SunTrust Banks (0.79), Bank of New York Mellon (0.61), Textron (0.52), Comerica (0.79), Kansas City Southern (1.26), Parker-Hannifin (1.67). There are no equity conferences today.

OVERNIGHT U.S. STOCK MOVERS

Morgan Stanley (MS -0.25%) reported Q3 EPS of 65 cents, much better than consensus of 54 cents.

Comerica (CMA +1.23%) reported Q3 EPS of 74 cents, less than consensus of 79 cents.

Honeywell International (HON +1.50%) reported Q3 EPS of $1.47, higher than consensus of $1.41.

General Electric (GE -0.12%) reported Q3 EPS of 38 cents, better than consensus of 37 cents.

Kindred Healthcare (KND +0.73%) reported a 14.6% stake in Gentiva Health (GTIV +0.36%) .

Crown Holdings (CCK +2.33%) reported Q3 ex-items EPS of $1.36, stronger than consensus of $1.21.

Urban Outfitters (URBN -0.37%) tumbled over 10% in after-hours trading after it said that its Q3 gross profit margin may weaken due to lower than expected sales.

Xilinx (XLNX +2.42%) gained 4% in European trading after it reported Q2 EPS of 62 cents, better than consensus of 55 cents.

Advanced Micro Devices (AMD +1.15%) fell over 6% in after-hours tradig after it reported Q3 adjusted EPS of 3 cents, less than consensus of 4 cents.

Point72 Asset reported a 5.2% passive stake in Lumber Liquidators (LL +0.93%) .

Capital One (COF -0.86%) reported Q3 EPS of $1.86, weaker than consensus of $1.94.

SanDisk (SNDK +1.14%) declined nearly 5% in after-hours trading after it reported Q3 EPS of $1.45, higher than consensus of $1.33, but reported Q3 revenue of $1.75 billion, below consensus of $1.77 billion.

Google (GOOG -1.04%) fell almost 2% in after-hours trading after it reported Q3 EPS of $6.35, below consensus of $6.53.

Stryker (SYK -0.35%) reported Q3 adjusted EPS of $1.15, better than consensus of $1.14.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +1.43%) this morning are up sharply by +24.00 points (+1.30%). The S&P 500 index on Thursday closed little changed: S&P 500 +0.01%, Dow Jones -0.15%, Nasdaq -0.55%. Bullish factors included (1) the unexpected -23,000 decline in weekly unemployment claims to a 14-1/2 year low of 264,000, (2) the +1.0% increase in Sep industrial production, more than twice expectations of +0.4% and the largest gain in 1-3/4 years, and (3) comments from St. Louis Fed President Bullard that the Fed should consider delaying the end of its bond purchases to halt a decline in inflation expectations.

Dec 10-year T-notes (ZNZ14 -0.24%) this morning are down -13.5 ticks. Dec 10-year T-note futures prices on Thursday closed lower. Closes: TYZ4-16.50, FVZ4 -9.25. Bearish factors included (1) the unexpected decline in U.S. weekly unemployment claims to their lowest in 14-1/2 years, and (2) reduced safe-haven demand for T-notes after stocks recovered from sharp losses and closed higher.

The dollar index (DXY00 -0.12%) this morning is down -0.057 (-0.07%). EUR/USD (^EURUSD) is up +0.0006 (+0.05%). USD/JPY (^USDJPY) is up +0.21 (+0.20%). The dollar index on Thursday closed lower after St. Louis Fed President Bullard said that the Fed should consider delaying the end of its bond purchases to halt a decline in inflation expectations. Closes: Dollar index -0.192 (-0.23%), EUR/USD -0.00282 (-0.22%), USD/JPY +0.418 (+0.39%). EUR/USD closed lower on European sovereign debt concerns after the 10-year Greek bond yield roses to a 10-month high of 8.69% on concern the government won’t be able to fund itself if it sticks to plans to leave an international bailout program early.

Nov WTI crude oil (CLX14 +1.54%) this morning is up +$1.45 a barrel (+1.75%) and Nov gasoline (RBX14 +1.02%) is up +0.0241 (+1.09%). Nov crude rebounded from a 2-1/3 year low and Nov gasoline recovered from a 3-3/4 year low and closed higher. Closes: CLX4 +0.92 (+1.12%), RBXX4 +0.0660 (+3.07%). Bullish factors included (1) the -3.99 million bbl drop in weekly EIA gasoline supplies to 205.67 million bbl, a 1-3/4 year low, and (2) short-covering after crude prices fell more than $15 a barrel (-16%) over the past 2 weeks. Bearish factors included (1) the +8.92 million bbl increase in weekly EIA crude inventories, more than expectations of +2.5 million bbl, and (2) the +0.9% increase in U.S. crude production in the week ended Oct 10 to 8.95 million bpd, a new 29-1/4 yr high.

Disclosure: None