Morning Call For Sept. 25, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 -0.05%) this morning are down -0.01% and European stocks are up +0.41%. European stocks are higher on optimism that a slump in the euro to a 1-3/4 year low against the dollar will increase the competitiveness of European companies in the global market and boost profits of European exporters. Asian stocks closed mixed: Japan +1.26%, Hong Kong -0.64%, China -0.20%, Taiwan -0.96%, Australia +0.12%, Singapore -0.06%, South Korea -0.16%, India -1.03%. Japan's Nikkei Stock Index surged to a 6-3/4 year high as exporters rallied on a weaker yen and after investors bought dividend paying stocks as more than 1,000 companies go ex-dividend tomorrow. Commodity prices are mostly lower. Nov crude oil (CLX14 +0.26%) is down -0.11%. Nov gasoline (RBX14 +1.29%) is up +0.72%. Dec gold (GCZ14 -0.72%) is down -0.83% at an 8-3/4 month low as the dollar index soars to a 4-year high. Dec copper (HGZ14 -0.39%) is down -0.72% amid speculation supplies might increase as stockpiles tied up in so-called commodity financing deals in China come onto the market after Chinese investigators uncovered almost $10 billion in fraudulent trades. Agriculture and livestock prices are mixed. The dollar index (DXY00 +0.46%) is up +0.41% at a 4-year high. EUR/USD (^EURUSD) is down -0.45% at a 1-3/4 year low after ECB President Draghi told a Lithuanian newspaper that the ECB stands ready to use "additional unconventional instruments" to revive growth in the Eurozone. USD/JPY (^USDJPY) is up +0.19%. Dec T-note prices (ZNZ14 +0.11%) are up +3.5 ticks.

ECB President Draghi told the Lithuanian business newspaper Verslo Zinios that the Eurozone recovery "seems to have lost momentum recently" and that "clear risks" to growth include heightened geopolitical tensions and insufficient structural reforms. He added the ECB stands ready to use "additional unconventional instruments" to further address the risk of a prolonged period of low inflation.

The Eurozone Aug M3 money supply rose +2.0% y/y, higher than expectations of +1.9% y/y and the fastest pace of increase in a year. The Aug M3 money supply 3-month average was +1.8%, right on expectations.

UK Sep CBI reported sales fell -6 from Aug to 31, a larger decline than expectations of -4 to 33.

The Japan Aug PPI services rose +3.5% y/y, less than expectations of +3.7% y/y, but still matched May's and June's increase as the most in 23 years.

U.S. STOCK PREVIEW

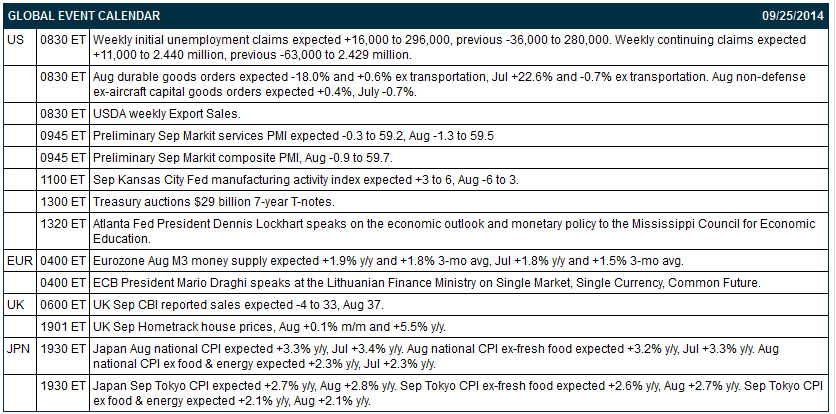

The market is expecting today’s weekly initial unemployment claims report to show an increase of +16,000 to 296,000, regaining some ground after last week’s plunge of -36,000 to 280,000. Meanwhile, the market is expecting today’s continuing claims report to show an increase of +11,000 to 2.440 million, reversing part of last week’s sharp decline of -63,000 to 2.429 million. The market is expecting today’s Aug durable goods orders report to show a decline of -18.0%, reversing most of July’s surge of +22.6% that was tied to a big jump in aircraft orders. Excluding transportation and the aircraft order spike, the market is expecting today’s Aug durable goods orders report to show an increase of +0.6%, reversing nearly all of July’s -0.7% decline. The Treasury today will conclude this week’s $106 billion T-note auction package by selling $29 billion of 7-year T-notes.

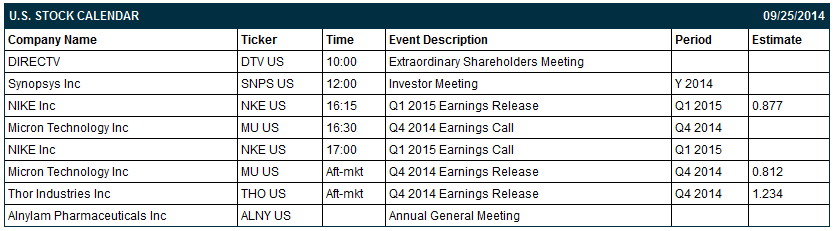

There are three of the Russell 1000 companies that report earnings today: Nike (consensus $0.88), Micron Technology (0.81), Thor Industries (1.23). Equity conferences during the remainder of this week include: World LNG Series:Asia Pacific Summit on Tue-Thu, and 8th Rocky Mountain Utility Efficiency Exchange on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

Northrop Grumman (NOC +0.89%) was upgraded to 'Buy' from 'Hold' at Argus with a $145 price target.

AutoZone (AZO +0.17%) was downgraded to 'Hold' from 'Buy' at Argus.

Yahoo (YHOO +2.13%) was downgraded to 'Sector Perform' from 'Outperform' at RBC Capital.

Comerica (CMA -0.59%) was upgraded to 'Buy' from 'Hold' at Wunderlich.

Barrick Gold (ABX -1.35%) was upgraded to 'Overweight' from 'Neutral' at HSBC.

KB Home (KBH -5.30%) was downgraded to 'Sector Perform' from 'Outperform' at RBC Capital.

Rexahn Pharmaceuticals (RNN unch) jumped over 10% in after-hours trading after it announced that the FDA has granted Orphan Drug Designation for its drug RX-3117 for the treatment of patients with pancreatic cancer.

Worthington (WOR unch) reported Q1 EPS of 63 cents, right on consensus, although Q1 revenue of $862.4 million was higher than consensus of $857.67 million.

H.B. Fuller (FUL +0.37%) slumped over 10% in after-hours trading after it reported Q3 adjusted EPS of 42 cents, well below consensus of 76 cents as Q3 revenue of $526.8 million was below consensus of $539.54 million.

Boeing (BA +0.94%) was awarded a $102 million government contract for full rate production of the Next Generation Automatic Test System.

Raytheon (RTN +0.47%) was awarded a $251.13 million government contract for the procurement of 231 Tomahawk Block IV All-Up-Round missiles for the U.S. Navy and the United Kingdom.

Jabil Circuit (JBL -0.10%) rose over 3% in after-hours trading after it reported Q4 core EPS of 5 cents, well above consensus of no gain, and then raised its 2015 revenue estimate to $16.5 billion-$18.0 billion, above consensus of $16.35 billion.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.05%) this morning are down -0.25 of a point (-0.01%). The S&P 500 index on Wednesday closed higher: S&P 500 +0.78%, Dow Jones +0.90%, Nasdaq +1.05%. Bullish factors included (1) the +18.0% surge in U.S. Aug new home sales to 504,000, much stronger than market expectations of +4.4% to 430,000 and the most in 6-1/4 years, and (2) reduced geopolitical concerns in Ukraine after NATO said that Russia has embarked on a “significant” withdrawal of forces from Ukraine, which adds to signs that the truce between Ukraine forces and separatists is holding.

Dec 10-year T-notes (ZNZ14 +0.11%) this morning are up +3.5 ticks. Dec 10-year T-note futures prices on Wednesday closed lower. Bearish factors included (1) the larger-than-expected increase in U.S. Aug new home sales to the highest level in 6-1/4 years, and (2) reduced safe-haven demand for Treasuries after stocks rallied. Closes: TYZ4 -8.00, FVZ4 -5.25.

The dollar index (DXY00 +0.46%) this morning is up +0.351 (+0.41%) at a fresh 4-year high. EUR/USD (^EURUSD) is down -0.0058 (-0.45%) at a 1-3/4 year low and USD/JPY (^USDJPY) is up +0.21 (+0.19%). The dollar index on Wednesday climbed to a 4-year high and closed higher. Bullish factors included (1) signs of strength in the U.S. economy after Aug new home sales surged +18.0% to a 6-1/4 year high of 504,000, (2) hawkish comments from Cleveland Fed President Mester who said the U.S. economy is making “significant” progress and a faster pace of improvement would argue for earlier liftoff and more rapid interest rate increases, and (3) weakness in EUR/USD which fell to a 14-1/2 month low after German Sep IFO business climate fell more than expected to a 17-month low. Closes: Dollar index +0.379 (+0.45%), EUR/USD -0.00667 (-0.52%), USD/JPY +0.155 (+0.14%).

Nov WTI crude oil (CLX14 +0.26%) this morning is down -10 cents (-0.11%) and Nov gasoline (RBX14 +1.29%) is up +0.0180 (+0.72%). Nov crude and gasoline prices on Wednesday closed higher: CLX4 +1.24 (+1.35%), RBXX4 +0.0083 (+0.33%). Bullish factors included (1) signs of economic strength that may boost energy demand after U.S. Aug new home sales rose to a 6-1/4 year high, and (2) the unexpected -4.27 million bbl decline in U.S. crude oil inventories to an 8-month low of 358 million bbl vs expectations for a +750,000 bbl increase.

Disclosure: None