October 2014 Coincident Indicator Review: Economy's Rate Of Growth Remains Nearly Constant

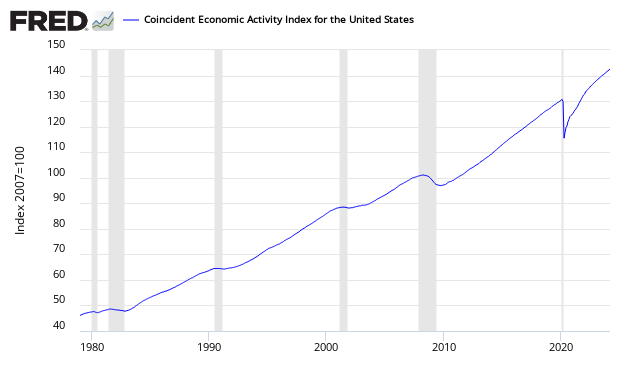

The above graph shows the index value for the US Coincident Index. A comparison of US Coincident Index, Aruoba-Diebold-Scotti business conditions index, Conference Board's Coincident Index, ECRI's USCI (U.S. Coincident Index), and Chicago Fed National Activity Index (CFNAI) coincident indicators follows.

Economic indicators that coincide with economic movements are coincident indicators. Coincident indicators by definition do not provide a forward economic view. However, trends are valid until they are no longer valid, making the trend lines on the coincident indicators a forward forecasting tool.

Econintersect's analysis of the coincident indices is that:

- There is general agreement that the economy is expanding - all show the rate of growth is nearly flat (not increasing or decreasing to any significant degree) - and the growth is remaining fairly stable.

- You cannot take most of these coincident indices to the bank - as they are subject to backward revision.

- The economy is expanding at main street level - but the growth rate remains slow.

Excerpt from Philly Fed Report for the United States Coincident Index

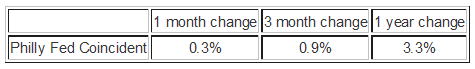

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2014. In the past month, the indexes increased in 47 states, decreased in one, and remained stable in two, for a one-month diffusion index of 92. Over the past three months, the indexes increased in 48 states, decreased in one, and remained stable in one, for a three-month diffusion index of 94. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.3 percent in October and 0.9 percent over the past three months.

The changes shown in the table below are unchanged from the previous month.

The Philly Fed produces this real time coincident indictor report based on six underlying indicators:

- Weekly initial jobless claims

- Monthly payroll employment

- Industrial production

- Personal income less transfer payments

- Manufacturing and trade sales

- Quarterly real GDP

Aruoba-Diebold-Scotti Business Conditions Index

However, the vertical lines on the chart above indicate the amount of indicators used to develop this forecast.

- For dates to the left of the left line, the ADS index is based on observed data for all six underlying indicators.

- For dates between the left and right lines, the ADS index is based on at least two monthly indicators (typically employment and industrial production) and initial jobless claims.

- For dates to the right of the right line, the ADS index is based on initial jobless claims and possibly one monthly indicator.

This means the accuracy of this index is reduced in real time. Per the Philly Fed:

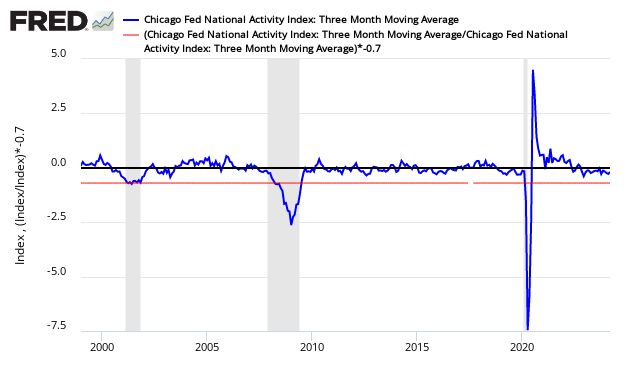

The Aruoba-Diebold-Scotti business conditions index is designed to track real business conditions at high frequency. Its underlying (seasonally adjusted) economic indicators (weekly initial jobless claims; monthly payroll employment, industrial production, personal income less transfer payments, manufacturing and trade sales; and quarterly real GDP) blend high- and low-frequency information and stock and flow data. Both the ADS index and this web page are updated as data on the index's underlying components are released.

The average value of the ADS index is zero. Progressively bigger positive values indicate progressively better-than-average conditions, whereas progressively more negative values indicate progressively worse-than-average conditions. The ADS index may be used to compare business conditions at different times. A value of -3.0, for example, would indicate business conditions significantly worse than at any time in either the 1990-91 or the 2001 recession, during which the ADS index never dropped below -2.0.

Conference Board's Coincident Index - hyperlink takes you to Econintersect's analysis (red line):

ECRI's USCI (U.S. Coincident Index)

Chicago Fed National Activity Index (CFNAI) - hyperlink takes you to Econintersect's analysis

Disclosure: None.