One Of My Favorite Option Trade Strategies

Strategy #1

Directional Swings

Trades That Last a Few Weeks

Buying Options

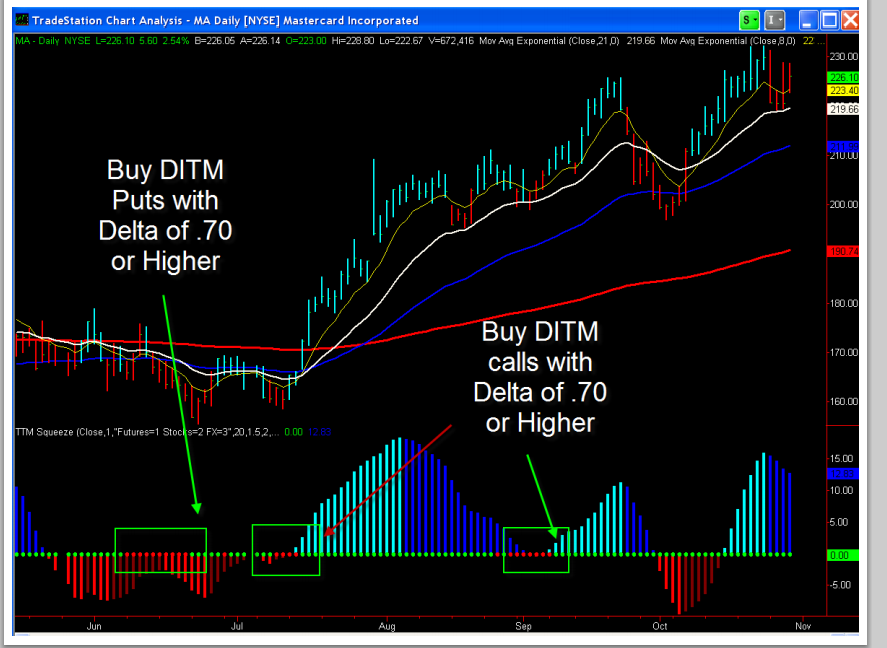

• Main thing is to have a setup on the underlying stock.

• Squeeze on the daily chart works really well.

• Think of it this way – you are just using the option as a CHEAPER WAY to buy the stock.

• $16 for an option is a lot cheaper than $160 for the stock.

• 1 option = 100 shares of stock. $16 option = $1600 out of pocket cost.

• Key is buying IN THE MONEY strike prices

• Squeeze fires off long on MA at $170

• July options at this point only have 1 week left.

• TWO OPTIONS:

• Buy DITM July Options – like $155

• And if trade is still valid at expiration sell these options and then buy the Aug 155s.

• Or just start off with the Aug 155s.

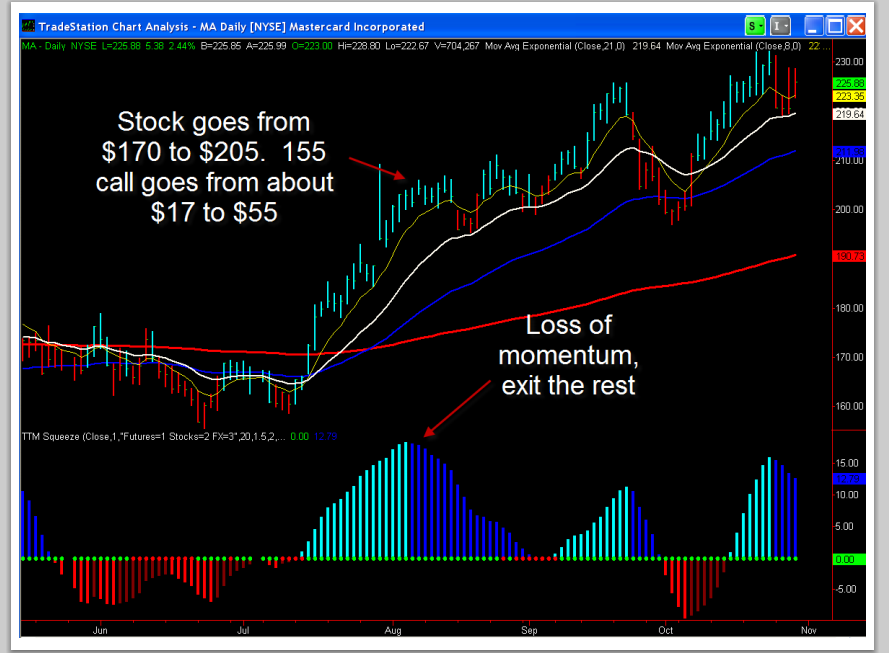

Exit strategy same as stock – I’m looking to scale out.

• Stop on option is 50% of the value.

• $16 option, then $8 stop.

• First target is 50%, for 1/3. So $24.

• Second target is 100% for 1/3, $32.

• Last hold on for squeeze loss of momentum, TTM Trend change etc.

• 1 option at $17 = $1700 cost

• 1 option at $55 = $5500 in proceeds

• Proceeds $3800 per contract.

For more, Visit John for a free webinar here.