Profit By Connecting The Dots On The Next M&A Buyout

We could be on the verge of another major oil M&A boom like the historic one that brought Exxon and Mobil together. Mergers and acquisitions have the potential to shake up a market and send some stocks soaring, but the best industry plays aren’t all that obvious. That’s why we’ve dug deeper to find the best plays to profit from the M&A boom.

It has been a week since one of the biggest “Merger Mondays” in recent memory.

Halliburton Company (NYSE: HAL) is buying up Baker Hughes Incorporated (NYSE: BHI) for nearly $35 billion. Then there’s Actavis PLC (NYSE: ACT) buying Allergan Inc. (NYSE: AGN) for $66 billion.

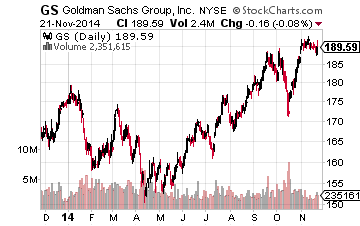

This brings the total M&A volume total for the year to over $3 trillion — more than any year since 2007. At the forefront is Goldman Sachs (NYSE: GS), which has led more deals than anyone else this year — advising on both the Halliburton-Baker Hughes and Actavis-Allergan deals.

Goldman has advised on a whopping $935 billion worth of M&A deals this year, pulling in a cool $1.7 billion for itself in the form of advisory fees. Goldman Sachs could be an underrated play on the continuation of the current M&A boom.

It trades at less than 11 times earnings and has the best return on equity all the major investment banks at 11.5%. With the stock up just 8% year-to-date, the market might be underestimating just how beneficial the M&A boom could be to its earnings.

However, I think there’s a bigger trend in M&A taking place that investors should be focusing on. And it’s in the oil and gas space.

With the Halliburton-Baker Hughes deal, this year’s oil and gas M&A volume is nearly $370 billion, which is the highest level since this type of data was first tracked in the 1970s.

With oil prices around $75 a barrel — the lowest we’ve seen in over four years — many a companies with weak balance sheets will be forced to either merge or sell themselves to stronger players. The marrying of oil and gas companies might be the only legitimate way to weather the storm, helping lower costs and ease overcapacity issues.

Meanwhile, there are a few companies at the top of the food chain that have been hoarding cash and keeping their balance sheets clean — perhaps in anticipation for one of the greatest buying opportunities for oil assets in the last decade.

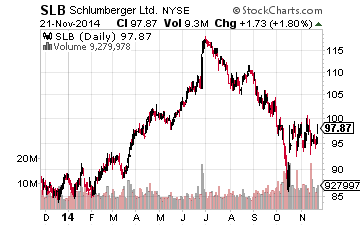

Naturally, the market will look to other players in the oil and gas products and servicing space given the Halliburton-Baker Hughes hype.Schlumberger (NYSE: SLB) will be losing its top spot as the largest oil products company by revenues. That means it could be on the prowl for acquisition targets to regain its title.

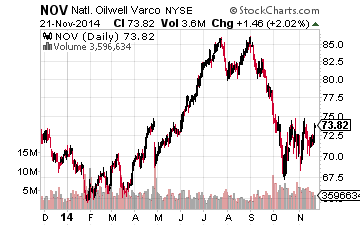

National Oilwell Varco (NYSE: NOV) is an underrated player in the oil products space, generating more free cash flow and has carrying less debt than either Halliburton or Baker Hughes. But with a $31 billion market cap, it could be a buyer rather than a buyout target. Then there’s Weatherford International (NYSE: WFT), with a $12 billion market cap, it is the smallest of the major oil and gas products companies.

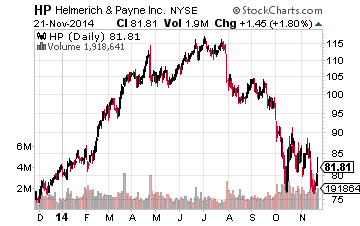

There’s also land drillers, which appear to in better shape than the offshore drillers. Land drillers, given the rise of unconventional drilling, aren’t faced with the oversupply of drilling rigs. There still appears to be plenty of work for onshore drilling rigs.

The big three in this space include Helmerich & Payne (NYSE: HP), Nabors Industries (NYSE: NBR) and Patterson-UTI Energy (NASDAQ: PTEN). Of these three, Nabors is the all-around cheapest. However, the issue is that land drillers are still reliant on oil prices and oil drilling activity.

Thus, it would appear that the best plays for the M&A boom in oil are the exploration and production companies. There are a larger number of potential buyers in the space and there are a number of companies that are just too cheap to ignore.

What’s more is that some of the more established oil and gas producers control their own destiny — more than other oil-related names anyway. If prices remain low, we should see more companies scaling back capital expenditure plans. Basically, oil companies can scale back production or choose not to produce oil at certain wells if it’s not economical.

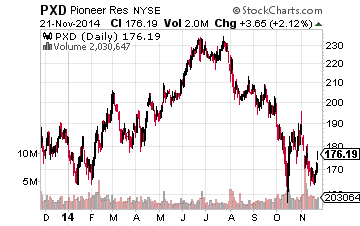

Regardless, their stock prices have still taken a beating over the last three months. And now some of the leading companies in the industry are in play when it comes to M&A.

Oil companies with market caps of around $25 billion are in the sweet spot. They are large enough to make major deals of their own, while also being just small enough to be swallowed up by one of the oil and gas Supermajors.

To start, there’s Pioneer Natural Resources Co. (NYSE: PXD) — the acreage leader in the Permian Basin — and Continental Resources, Inc (NYSE: CLR) — which is a major player in the Bakken Shale. Continental Resources is the cheapest of the two, but Pioneer Natural Resources has the best balance sheet.

Now, back to the top of the food chain. Some of the oil and gas Supermajors are flush with cash and likely chomping at the bit to take advantage of the buying opportunity that cheap oil has provided.

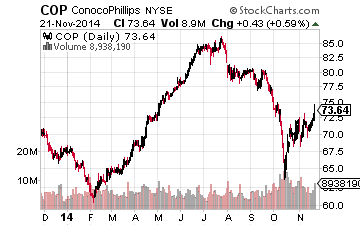

ConocoPhillips (NYSE: COP) has $5.8 billion in cash and a debt-to-equity of 35%. There’s also Chevron Corporation (NYSE: CVX), which is flush with over $14.5 billion in cash and a debt-to-equity ratio of just 15%. These guys are large enough to swallow up the likes of a Continental or Pioneer Natural.

Thinking about it another way: Halliburton is making a $35 billion deal for Baker Hughes with just $2.2 billion in cash on its balance sheet and a 50% debt-to-equity. Imagine what the likes of ConocoPhillips and Chevron could get done.

Although it sounds outlandish, we could be on the verge of another multi-year span of mega deals. The major oil M&A boom of 1998 to 2000 brought us the $45 billion buyout of Texaco by Chevron and the $80 billion merger of Exxon and Mobil.

BP PLC (NYSE: BP) tried to convince fellow U.K.-based oil Supermajor, Royal Dutch Shell PLC (NYSE: RDS.A), to merge back in 2004. BP said the yearly cost savings could be upwards of $10 billion. With oil so low, might these major companies turn to major mergers as a way to prop up profitability?

As mentioned, there is a derivative play for investors looking to gain exposure to the M&A boom without having to worry so much about oil prices — that’s the investment banks.

But the bottom line is that interest rates remain relatively low and the recent selloff of anything oil-related have made stock prices of oil and gas companies very enticing.

You could play the smaller companies that could see a buyout, such as Oasis Petroleum (NYSE: OAS) — the largest acreage owner in the Bakken Shale with a $2.8 billion market cap. I think there’s bigger fish to be fried. The most money will be made in the oil M&A of larger companies.

The recent deals are telling us that major companies are willing to make big bets again. And the tumble in oil prices over the last few months is offering buyers flush with cash great buying opportunities for expanding their portfolios and footprint.

Comments

No Thumbs up yet!

No Thumbs up yet!