Q3 Earnings Season In The Spotlight

The 2014 Q3 earnings season takes center stage this week with Alcoa’s (AA- Analyst Report) release after the close on Wednesday Oct. 8. Alcoa isn’t the first to report quarterly results, though it is the first S&P 500 member with the calendar fiscal quarter to come out with results. Companies with fiscal quarters ending in August have been reporting since mid-September and the tally of such Q3 reports already totals 22 S&P 500 members. In fairness to Alcoa, however, investors start paying attention to the earnings season after their earnings announcement.

It is way too early to draw even preliminary conclusions from the results thus far. But the results thus far aren’t materially different from what we have seen from the same group of 22 companies in other recent quarters. The table below shows the scorecard for the 22 companies that have reported results already.

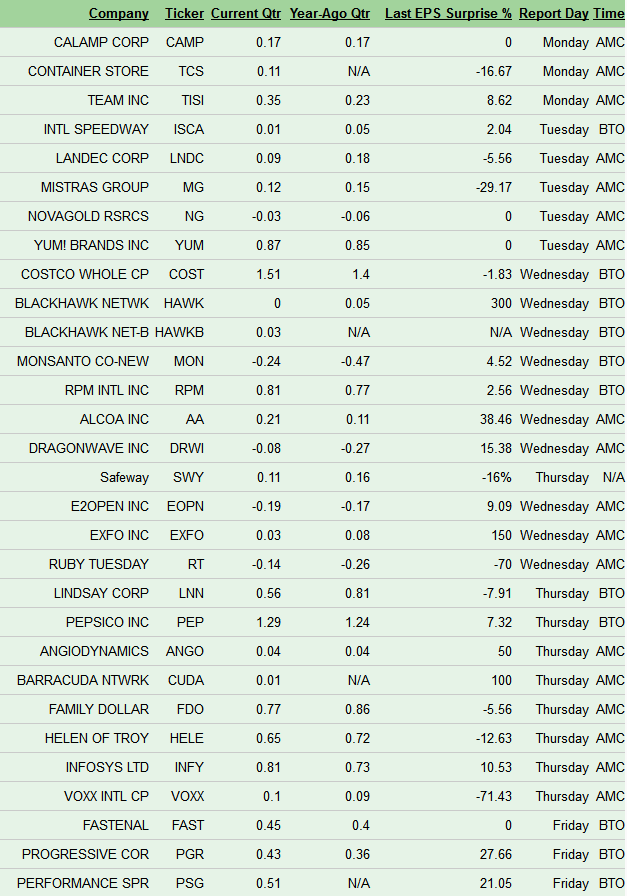

The earnings calendar is on the light side, with only about 30 companies reporting quarter results, including 9 S&P 500 members. But as you can see in the updated weekly earnings calendar below, the reporting cycle ramps up in a big way the following week.

This earnings season will give us a good sense of whether the profitability strength on display in the last reporting cycle was a one-off event or the start of something enduring. Please recall that part of the Q2 strength was a bounce back from the extremely low levels to which all activity levels had fallen in the weather-disrupted first quarter of the year. As such, one could argue that none of the last two earnings seasons represented truly normal conditions, which we will most likely see for the first time this year only in Q3.

The table below shows a summary picture of current Q3 expectations compared to what was actually achieved in Q2. As you can see, total earnings are expected to be up +1.5% from the same period last year on +1.8% higher revenues and modest margin gains. Finance remains a big drag this quarter, with total earnings for the sector expected to be down -3.9% from the same period last year. Excluding Finance, total earnings for the S&P 500 would be up +2.8%.

As has been the trend each quarter ahead of the start of the earnings season, estimates for Q3 have come down as well as the quarter unfolded. The recent leg down in estimates has mostly been due to Bank of America (BAC - Analyst Report), with the bank’s settlement with the government causing its Q3 EPS estimates to drop from positive 32 cents to the current 8 cents loss. In dollar terms, that’s a $4.2 billion negative swing in Bank of America’s Q3 earnings estimates.

The chart below shows estimates for 2014 Q3 have evolved over the last 10 or so weeks.

The negative revisions trend has been broad based, with most sectors suffering downward adjustments in estimates. But the trend has been most pronounced for Oil/Energy, Retail, and Conglomerates. The chart below shows the sectors with the biggest revisions. The Finance sector swing is primarily due to Bank of America.

Total earnings for the S&P 500 reached an all-time quarterly record in 2014 Q2 and current estimates for Q3 put the quarterly total as the second highest ever. But given the historical trend of roughly two-thirds of the companies beating earnings estimates, the final Q3 tally will likely be right in the preceding quarter’s record vicinity. The chart below shows that current consensus estimates reflect record tallies in the following quarters.

For these estimates to hold, we need an improvement on the guidance front, which has been persistently been weak for almost two years now. There was modest improvement in tone of management guidance on the Q2 earnings calls, but the majority of companies providing guidance still guided lower.

Given the global growth worries, it is likely that the quality and quantity of guidance will deteriorate even further this earnings season. Importantly, continued negative guidance will effectively guarantee that we will see a repeat of negative estimate revisions, with estimates for Q4 coming down as earnings season unfolds.

That said, continuation of even the modest improvement in guidance will be a net positive in the overall earnings picture.

Note: For a complete analysis of 2014 Q3 estimates, please check out weekly Earnings Trends report.

Monday-10/06

- Not much on the economic or earnings calendars today.

Tuesday -10/07

- Not much on the economic calendar, but Yum Brands (YUM) will be releasing quarterly results after the close.

- The estimate revisions trend has been consistently negative for YUM, with the current Q3 estimate of 87 cents down from $1.01 per share two months back. The negative revisions primarily reflect China worries, where weak same-store sales and margin pressures weighing on results.

Wednesday-10/08

- Minutes of the last Fed meeting will come out in the afternoon and Alcoa (AA - Analyst Report) will report quarterly results after the close.

- Earnings ESP or Expected Surprise Prediction, our proprietary leading indicator of positive earnings surprises is showing Alcoa coming out with an earnings beat.

- Our research shows that companies with Zacks Rank #1 (Strong Buy), Zacks Rank # 2 (Buy), and Zacks Rank #3 (Hold) coupled with positive Earnings ESP are highly likely to come out with positive earnings surprise. Alcoa has Zacks Rank #2 (Buy) and Earnings ESP of +9.5%.

- For more details on Zacks Earnings ESP, please click here.

Thursday -10/09

- Weekly jobless claims and the August Wholesale inventories are the key economic readings today.

- Pepsi (PEP - Analyst Report) will be the key earnings report in the morning while Family Dollar (FDO - Analyst Report) will report after the close.

Friday-10/10

- Not much on the economic calendar, but Fastenal (FAST - Analyst Report) and Progressive Corp (PGR - Analyst Report) will be the only notable reports today, both in the morning.

- Earnings ESP is showing Progressive beating EPS estimates. The Zacks Rank # 2 (Buy) stock has ESP of +2.3%.

Here is a list of the 30 companies reporting this week, including 9 S&P 500 members.