Recent Reference Points - Before And After

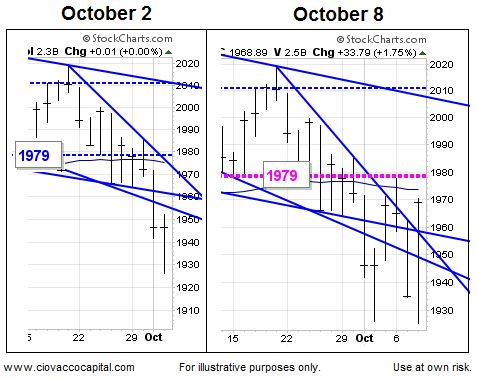

On October 2, we noted the levels below, including 1979, could be used as bull/bear guideposts. The S&P 500 closed at 1968 after Wednesday’s big rally, meaning it remains below 1979. Our purpose is not to predict whether or not 1979 will be exceeded, but to note that some patience remains in order until 1979 is cleared.

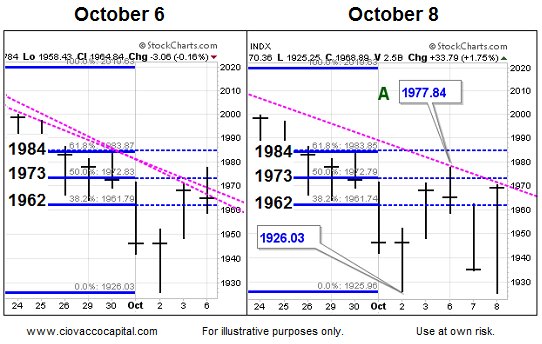

On October 6, we noted the levels below, including 1973 and 1984, could be used as bull/bear guideposts. The S&P 500 closed at 1968 after Wednesday’s big rally, meaning it remains below both 1973 and 1984. Our purpose is not to predict whether or not these levels will be exceeded, but to note that some patience remains in order until we can “see it”.

On October 7, we noted the levels below, including the October 6 high of 1978 (see blue arrow), could be used as bull/bear guideposts. The S&P 500 closed at 1968 after Wednesday’s big rally, meaning it remains below 1978. Our purpose is not to predict whether or not 1978 will be exceeded, but to note that some patience remains in order until the downward-sloping trendlines are cleared.

If stocks can continue to rally (and they may), the evidence/model will most likely allow us to add to our stock positions over the next few days. Keep in mind, the S&P made a new intraday low Wednesday, meaning we remain in “one day wonder” territory for now. We are happy to reinvest our cash when our disciplined system, based on facts, allows.

Disclosure: None.