Recession-Proof Your Portfolio With These Top 5 Bear Market Dividend Aristocrats

With the market overvalued by 60%, we will see a market correction as the price to earnings ratio of the market reverts to its historical level at some point. It may be 30 days from now or 5 years from now, but it will happen eventually. This article will help you find stocks that are likely to perform well in a recession by examining what stocks performed best over the 2007 to 2009 recession.

Dividend Aristocrats & Recessions

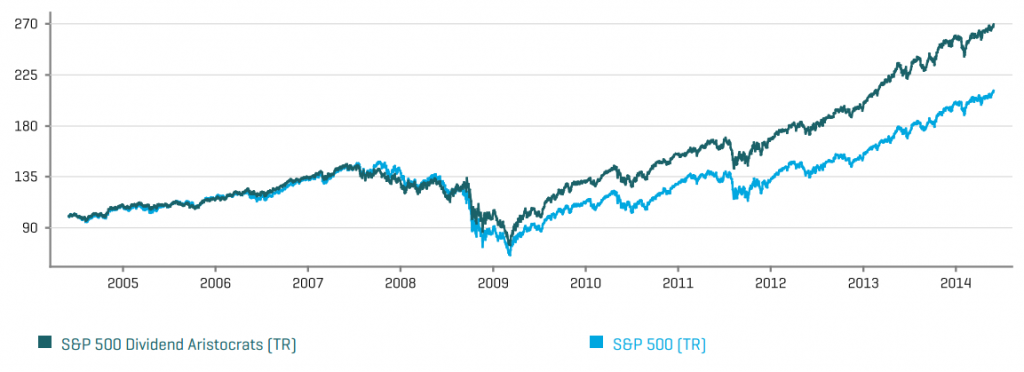

Dividend Aristocrats have historically performed well during recessions. The Dividend Aristocrats index was down -21.88% in 2008, versus -37.00% for the S&P500 index. Dividend Aristocrats tend to do better during recessions because they are sound businesses with stable cash flows. Amazingly, The Dividend Aristocrat index slightly outperformed the S&P500 in 2009 as well, during the recovery from the recession. In 2009, the Dividend Aristocrat Index was up 26.56% versus 26.46% for the S&P500 index. In fact, the Dividend Aristocrat index has soundly outperformed the S&P500 index over the last decade.  Source: S&P500 Dividend Aristocrats Fact Sheet

Source: S&P500 Dividend Aristocrats Fact Sheet

Dividend Aristocrats with Lowest Drawdown: 2007 through 2009

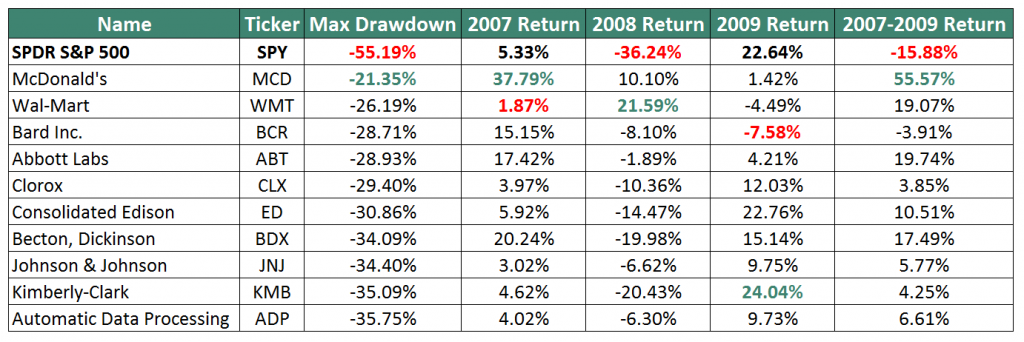

Investing in Dividend Aristocrats is a great way to lessen the impact of recessions while still participating in bull market runs. Some Dividend Aristocrats weathered the recession of 2007 to 2009 much better than others. The 10 Dividend Aristocrats from 2007 with the lowest maximum drawdown (biggest loss from highest price to lowest price) from the beginning of 2007 to 2009 are shown below. For reference, I have included the maximum drawdown and returns for SPY (S&P 500 ETF) as well for comparison.  McDonald’s had the lowest overall maximum drawdown, at -21.65%. McDonald’s was also the only Dividend Aristocrat to post positive returns in 2007, 2008, and 2009. The company had the highest return on the top 10 in 2007, as well. Wal-Mart had the second lowest maximum drawdown through the period at just -26.19%. The company narrowly missed posting positive returns in all 3 years, with a slight loss of -4.49% in 2009. Wal-Mart performed best when the economy was at its worst. The company gained 21.59% in 2008, as the S&P500 ETF, SPY, was down over -35%. The companies on the list represent a diverse mix of industries: Fast Food Restaurants 1. McDonald’s (MCD) Discount Retailers 1. Wal-Mart (WMT) Medical Insturments, Supplies, Appliances, & Equipment 1. C. R. Bard (BCR) 2. Abbott Labs (ABT) 3. Becton, Dickinson (BDX) Consumer Products 1. Clorox (CLX) 2. Johnson & Johnson (JNJ) 3. Kimberly-Clark (KMB) Utilities 1. Consolidated Edison (ED) Business Software 1. Automatic Data Processing (ADP) The businesses on this list are all world class businesses. They operate in industries that are resistant to recessions. People flock to cheap food (MCD) and products (WMT) during hard financial times. Some things cannot be cut back on, no matter the price. Utilities (ED) and medical supplies (BCR, ABT, BDX) are among these items. Consumer products (CLX, JNJ, KMB) are also purchased regardless of the economic climate. Finally, payrolls (ADP) still need to be processed when the economy is shrinking. These businesses all did very well from 2007 to 2009. What businesses today would be able to whether the storm in a similar fashion?

McDonald’s had the lowest overall maximum drawdown, at -21.65%. McDonald’s was also the only Dividend Aristocrat to post positive returns in 2007, 2008, and 2009. The company had the highest return on the top 10 in 2007, as well. Wal-Mart had the second lowest maximum drawdown through the period at just -26.19%. The company narrowly missed posting positive returns in all 3 years, with a slight loss of -4.49% in 2009. Wal-Mart performed best when the economy was at its worst. The company gained 21.59% in 2008, as the S&P500 ETF, SPY, was down over -35%. The companies on the list represent a diverse mix of industries: Fast Food Restaurants 1. McDonald’s (MCD) Discount Retailers 1. Wal-Mart (WMT) Medical Insturments, Supplies, Appliances, & Equipment 1. C. R. Bard (BCR) 2. Abbott Labs (ABT) 3. Becton, Dickinson (BDX) Consumer Products 1. Clorox (CLX) 2. Johnson & Johnson (JNJ) 3. Kimberly-Clark (KMB) Utilities 1. Consolidated Edison (ED) Business Software 1. Automatic Data Processing (ADP) The businesses on this list are all world class businesses. They operate in industries that are resistant to recessions. People flock to cheap food (MCD) and products (WMT) during hard financial times. Some things cannot be cut back on, no matter the price. Utilities (ED) and medical supplies (BCR, ABT, BDX) are among these items. Consumer products (CLX, JNJ, KMB) are also purchased regardless of the economic climate. Finally, payrolls (ADP) still need to be processed when the economy is shrinking. These businesses all did very well from 2007 to 2009. What businesses today would be able to whether the storm in a similar fashion?

Top 5 Recession Proof Dividend Aristocrats

- Wal-Mart (WMT)

- McDonald’s (MCD)

- ExxonMobil (XOM)

- Becton, Dickinson (BDX)

- Kimberly-Clark (KMB)

Wal-Mart

PE ratio 2007: 17.18 PE ratio now: 15.93 Wal-Mart is positioned just as well to handle a recession today as it was in 2007. The company has increased its store count and selling space since 2007. When a recession comes, people will continue to shop at Wal-Mart to take advantage of the discount retailers low prices. Wal-Mart is a Top 10 stock based on the 8 Rules of Dividend Investing.

McDonald’s

PE ratio 2007: 14.39 PE ratio now: 18.41 McDonald’s experienced something of a renaissance over the 2000’s. Same store sales increased steadily, and the company modernized its restaurants. McDonald’s continues to expand internationally. The company is the global leader in fast food, with a market cap of $100 billion. Earnings per share increased each year from 2007 to 2009. McDonald’s sales increase during recessions as consumers switch to lower priced restaurant options. McDonald’s is among the cheapest restaurants, and benefits from the shift to cheap food during recessions. McDonald's is a Top 10 stock based on the 8 Rules of Dividend Investing

ExxonMobil

PE ratio 2007: 10.24 PE ratio now: 13.60 ExxonMobil was not a Dividend Aristocrat in 2007, so it was not included in the original study. Exxon is a Dividend Aristocrat today. The company performed well (comparatively) during the recession, with a maximum drawdown of -33.73%. As long as the world demands energy, ExxonMobil stands to profit. The company has historically been very profitable during recessions (and during economically prosperous times as well). ExxonMobil is a Top 10 stock based on the 8 rules of Dividend Investing.

Becton, Dickinson

PE ratio 2007: 24.02 PE ratio now: 24.78 Becton, Dickinson manufacturers and markets medical, diagnostic, and bioscience products. The company generates about 2/3 of its revenue overseas. The company performs well during recessions because medical products are in demand even during economic downturns. The company is growing rapidly in emerging markets, and China in particular. Chinese revenues grew about 17% year over year for the company.

Kimberly-Clark

PE ratio 2007: 18.67 PE ratio now: 20.13 Kimberly-Clark manufactures and markets branded consumer goods products. The companies top brands include Huggies, Kleenex, & Kotex. The business performed well during the last recession. Earnings dipped slightly from a high of $4.25 per share in 2007 to $4.06 per share in 2008. Recessions do not significantly impact the operating performance of Kimberly-Clark because the company sells staple consumer products that are used at the same speed regardless of the economic climate.

Long: MCD, WMT