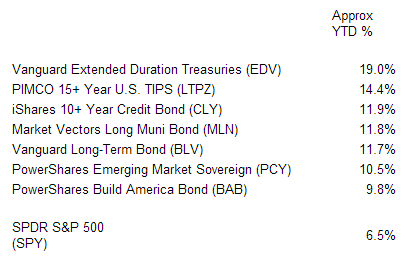

Seven Investments That Are Beating The SPDR S&P 500 ETF (SPY)

Imagine for a moment that you are not familiar with ticker symbols. Now, let me name seven contenders for your investment dollars — assets that simultaneously diversify your portfolio as well as increase your risk-adjusted performance.

| Ticker Symbols (Imagine That You Are Unfamiliar With Them) |

Cut to the chase, right? What are these magical companies or stock funds that will enhance one’s risk-adjusted results?

|

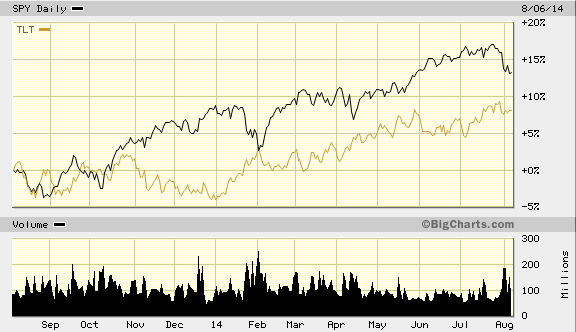

Longer-Term Bonds Of All Stripes Rallying Better Than Stocks

|

As Alan Roth pointed out at ETF.com this week, “In the beginning of this year, economists uniformly forecasted rising rates due to Fed tapering. Rates have so far declined making it a good year for bonds and fooling investors.” Yet not all investors decided to follow the herd. In fact, interest rates had already risen dramatically in 2013 and that the tapering effect discussed by the economic punditry had already been priced in. It followed that contrarians believed that bond yields were more likely to fall than rise. (See my January commentary, “Against The Herd: Lower Rates, Not Higher Rates, In 2014.“)

Of course, yesterday’s news may not mean much to those who are looking to put money to work at the current moment. On the other hand, understanding one’s missteps can help one avoid similar errors in the future. When there’s 100% agreement on a particular outcome, that’s typically a red flag. Investors should also consider just how little they hear about the monumental performance of longer-term bonds relative to stocks. Does CNBC do you a service or disservice with its endless chatter about Dow 17000 or the daily all-time records set by the S&P 500?

A great many naysayers believe that a correction is long overdue. After all, the S&P 500 has traded above its 200-day moving average for a record 398 sessions. Nevertheless, a record does not necessarily end the second it is achieved. Cal Ripken, Jr. did not just break Lou Gehrig’s record of 2,130 consecutive baseball games played — a record that had not been approached in 56 years — Mr. Ripken obliterated the achievement with 2,632 consecutive outings.

That said, the bond market’s resilience coupled with mixed economic data favor a “barbell approach.” I recommend rebalancing efforts that reduce assets in the middle of a risk spectrum — the handle of a barbell — as well as acquiring assets at the “least risky” and “most risky” ends of that spectrum.

Since the year began, I have been systematically reducing exposure to shorter-term investment grade in favor of Vanguard Long-Term Bond (BLV) or Vanguard Extended Duration (EDV). Do they have a whole lot of room to run? Maybe not. Yet the combination of yield and “risk-free” safety offer a compelling alternative to an aging rally for U.S. equities. And while the muni bond segment may be overvalued relative to treasuries, swapping out some of the intermediate-term high yielding junk bonds for ETFs like Market Vectors Long-Term Muni (MLN) is a worthy shift in taxable accounts.

What about the far right side of the barbell? If the U.S. stock market is in jeopardy of pulling back sharply, wouldn’t that imply trouble for foreign equities and emerging markets? Not necessarily. Emerging equities have been out of favor for so long, their price-to-earnings ratios offer compelling relative value. For instance, SPDR S&P Emerging Market Small Cap (EWX) trades near the same price that it traded at three years ago. With an earnings growth rate estimate of 17%, that alone may be compelling. This exchange-traded tracker also lists a Forward P/E of 13.4 that compares favorably with SPDR Russell 2000 Small Cap (TWOK) at a Forward P/E of 20. Moreover, EWX is well above its long-term 200-day moving average.

ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser ...

more