Small Cap Best And Worst Report

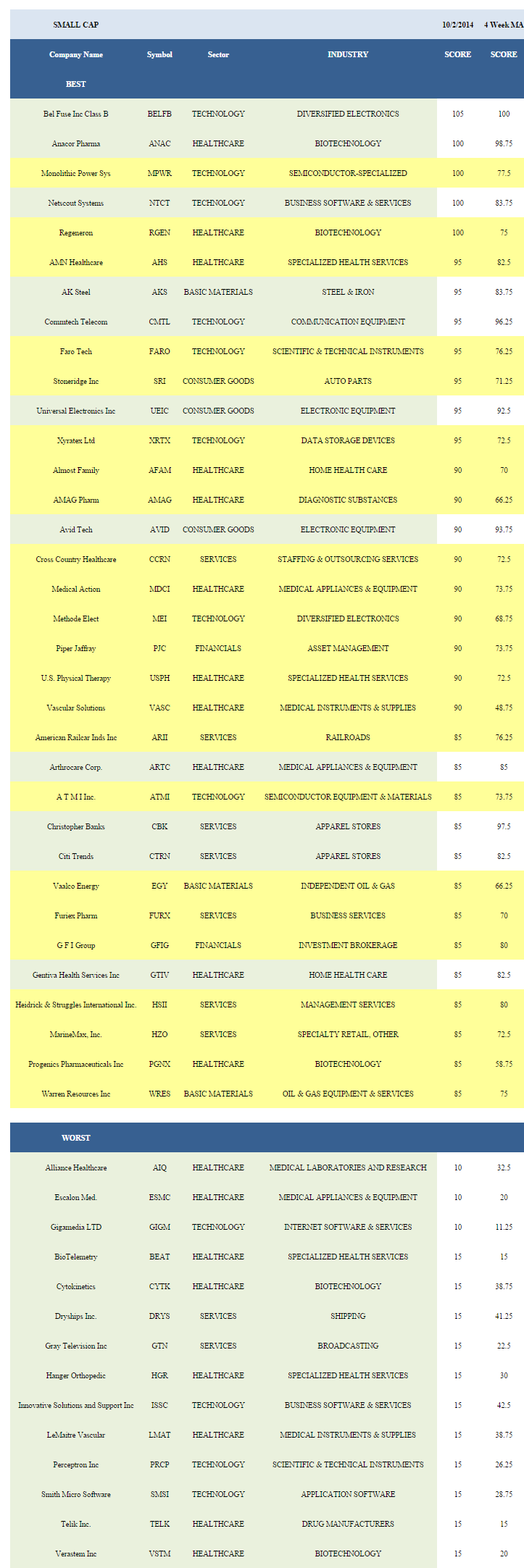

Since 2010, the average return for our weekly best scoring small caps has outpaced the R2K by an average 716 bps over the following year. The best performers from one year ago are ARII up 98%, SYNA up 64%, and ODFL up 51%.

hyhytre.png)

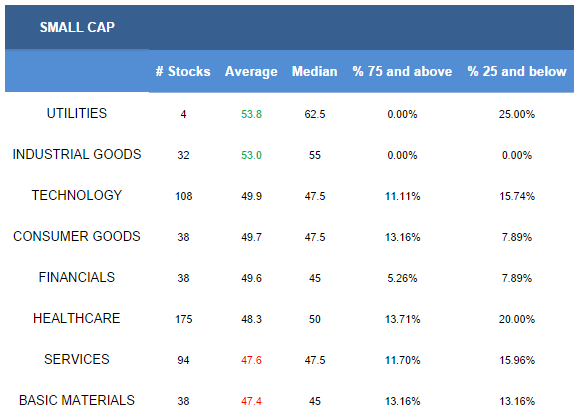

· The best scoring small cap sector is utilities.

· The top scoring small cap industry is railroads

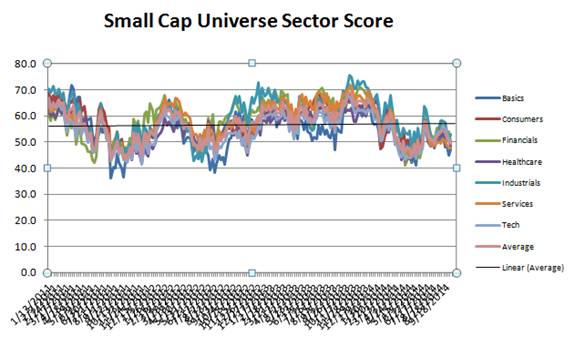

The average small cap score is 48.96 this week, below the four week moving average score of 50.94. The average small cap stock is trading -29.04% below its 52 week high, -5.51% below its 200 dma, and has 9.54 days to cover held short. Short interest is approaching levels that have historically suggested buying.

Utilities and industrial goods score best in small cap after rolling scores to reflect Q4 seasonality. Technology, consumer goods, financials, and healthcare score in line with the average small cap universe score. Services and basics score below average.

.png)

The top small cap industry is railroads (ARII, GBX, RAIL). Rising rail volume continues to support demand for railcars. The biggest year-over-year growth in carloads has occurred in grain, up 18%, and petroleum products, up 12.2%. 10,000 baby boomers are turning 65 daily through 2029, supporting home healthcare (AFAM, GTIV, AMED) demand and industry consolidation Diversified electronics (BELFB, MEI), management services (HSII, CRAI), and P&C insurers (STFC, GLRE) round out this week's top scoring industry list. According to MarketScout, commercial P&C insurance premiums improved 3% in August.

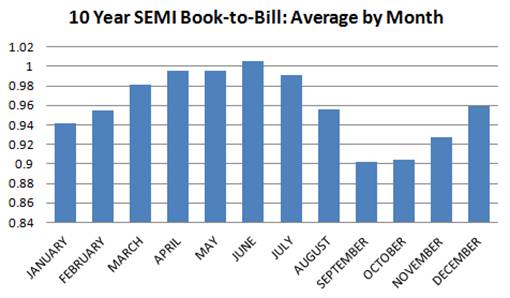

Steel & iron AKS is the only small cap basics industry to score above average. Auto parts (SRI, SMP) and processed & packaged goods (KTEC, DMND) score best across consumer goods. Year-over-year growth in EU auto sales has slowed, but remains positive with EU passenger vehicle registrations growing 2.1% in August. Year-to-date, the measure is up 6% from 2013. Buy P&C insurers, investment brokers GFIG, and regional banks (CFNL, TCBK) in small cap financials. Commercial and Industrial loans at U.S. banks continued higher in August with total C&I loans reaching $1,748 billion, up from $1,682 billion in April. Home healthcare and medical instruments (VASC, ICUI) score above average in healthcare. In industrial goods, focus on industrial electrical equipment (BGC, DAKT) and aerospace/defense (ORB, AVAV). The top services baskets include rails, staffing (CCRN, BBSI), and truckers SAIA. In technology, focus on diversified electronics, semi ICs (TQNT, RFMD), and specialized semiconductors MPWR. The SEMI book-to-bill was 1.04 in August. The measure historically puts in a low exiting Q3 and then builds through Q4.

Disclosure: None.