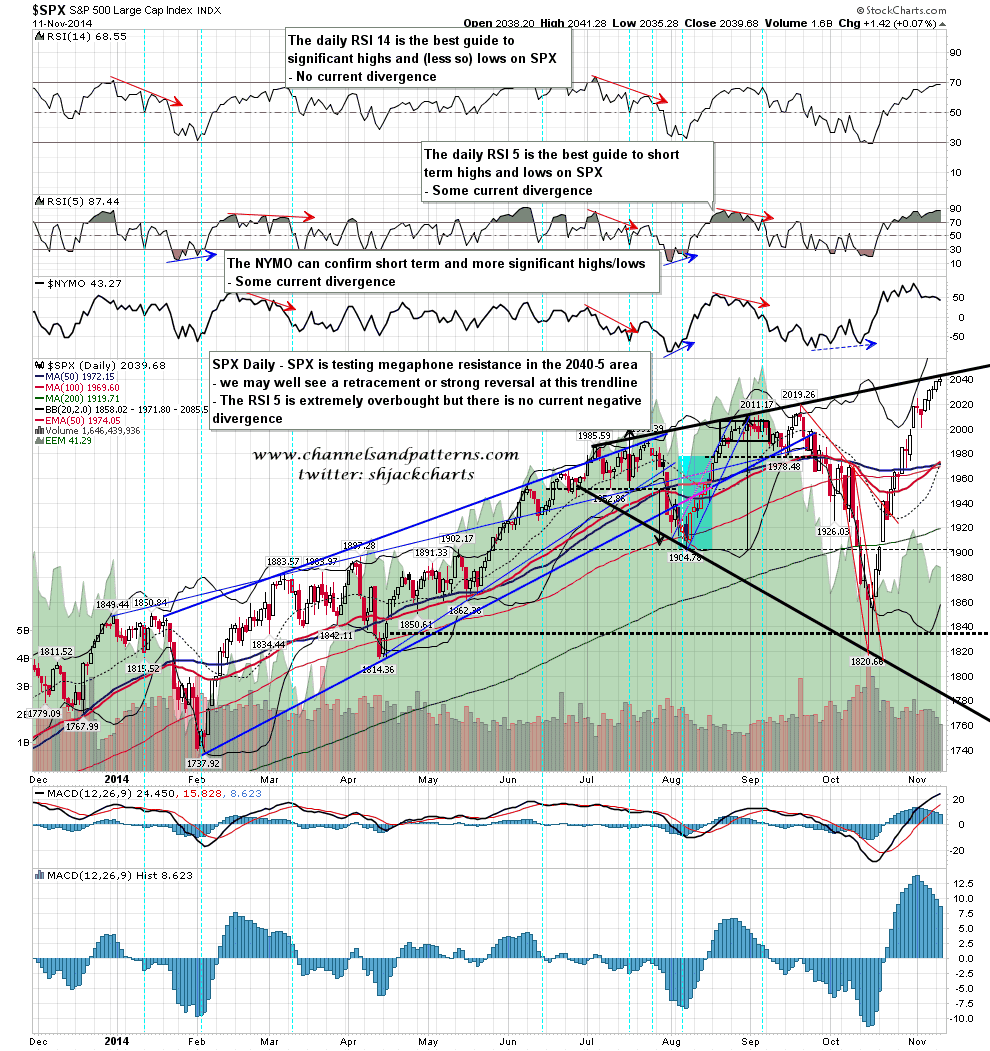

SPX Hits Megaphone Resistance

SPX hit my 1940-5 target range yesterday and at the moment seems to be failing there. That fail looks very bearish but I’ll be assuming that this is a retracement only unless we break through the MA support cluster in the 1970-80 area to open up a possible retest of the 200 DMA at 1920, and then break hard through that on that retest. Until then I will be assuming that we are looking for a retracement before a move to new highs. SPX daily chart:

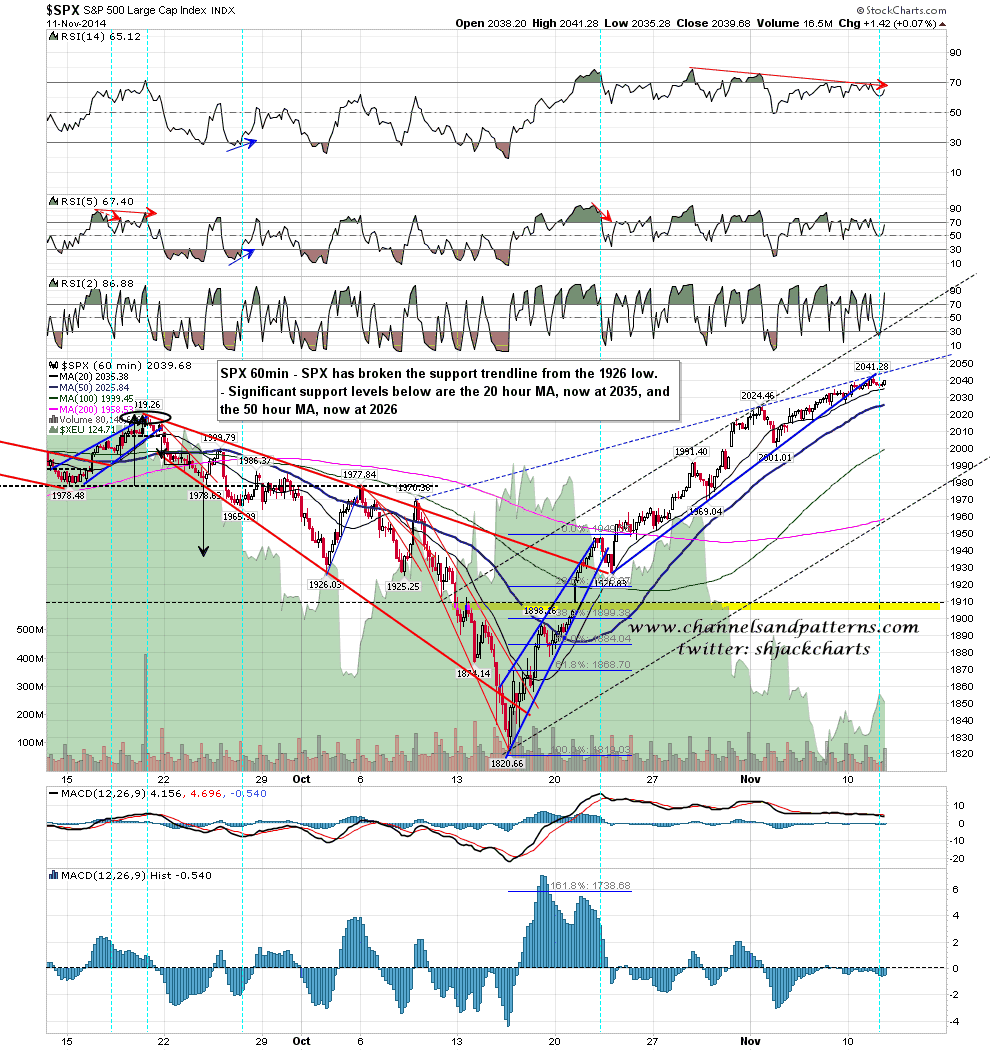

Immediate SPX support is at the 20 hour MA at 2035, and then the 50 hour MA at 2026. On a break below the 50 hour MA I’d be looking for a test of the 2001 low and the 2000 area. SPX 60min chart:

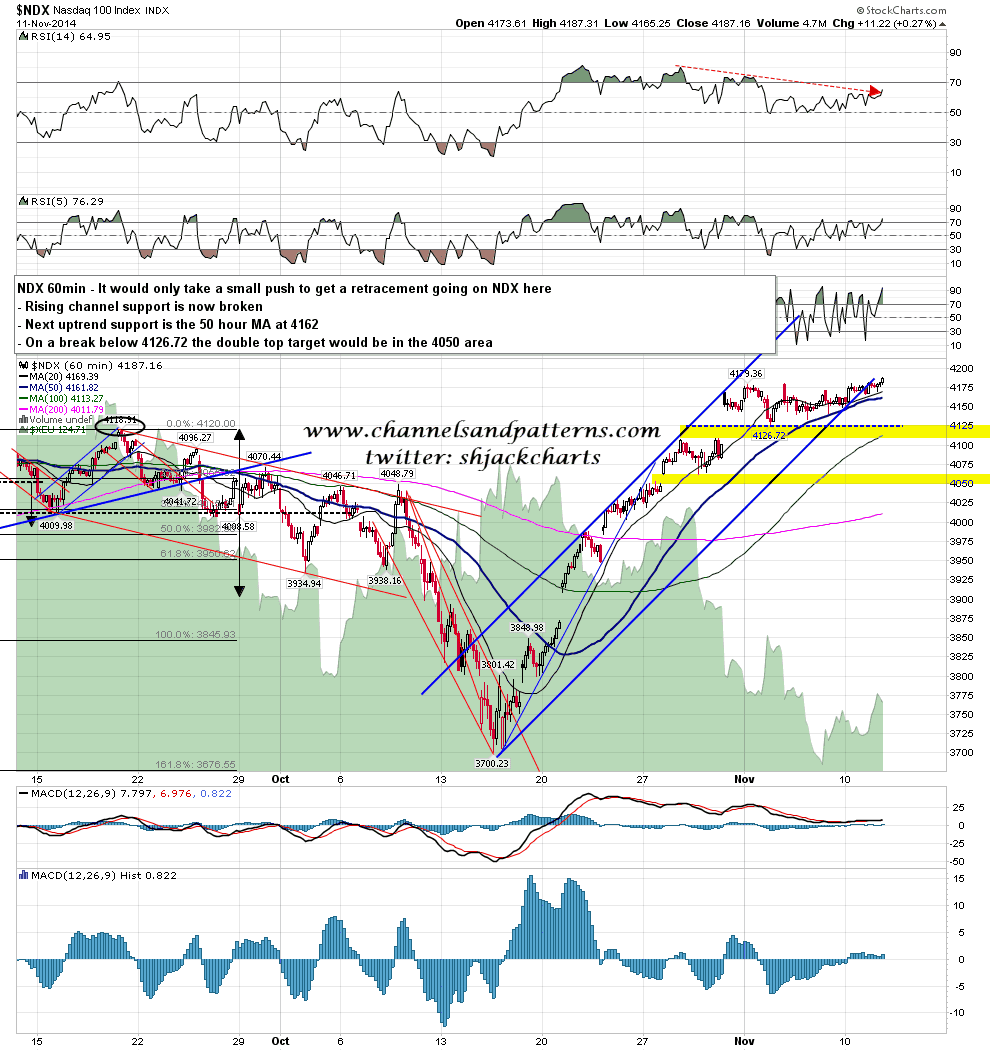

NDX broke the rising channel yesterday, which is encouraging, and I’m watching for a break below the 50 hour MA at 4162. On a sustained break below 4126 the double top target would be in the 4050 area filling the two open gaps that I have highlighted in yellow. NDX 60min chart:

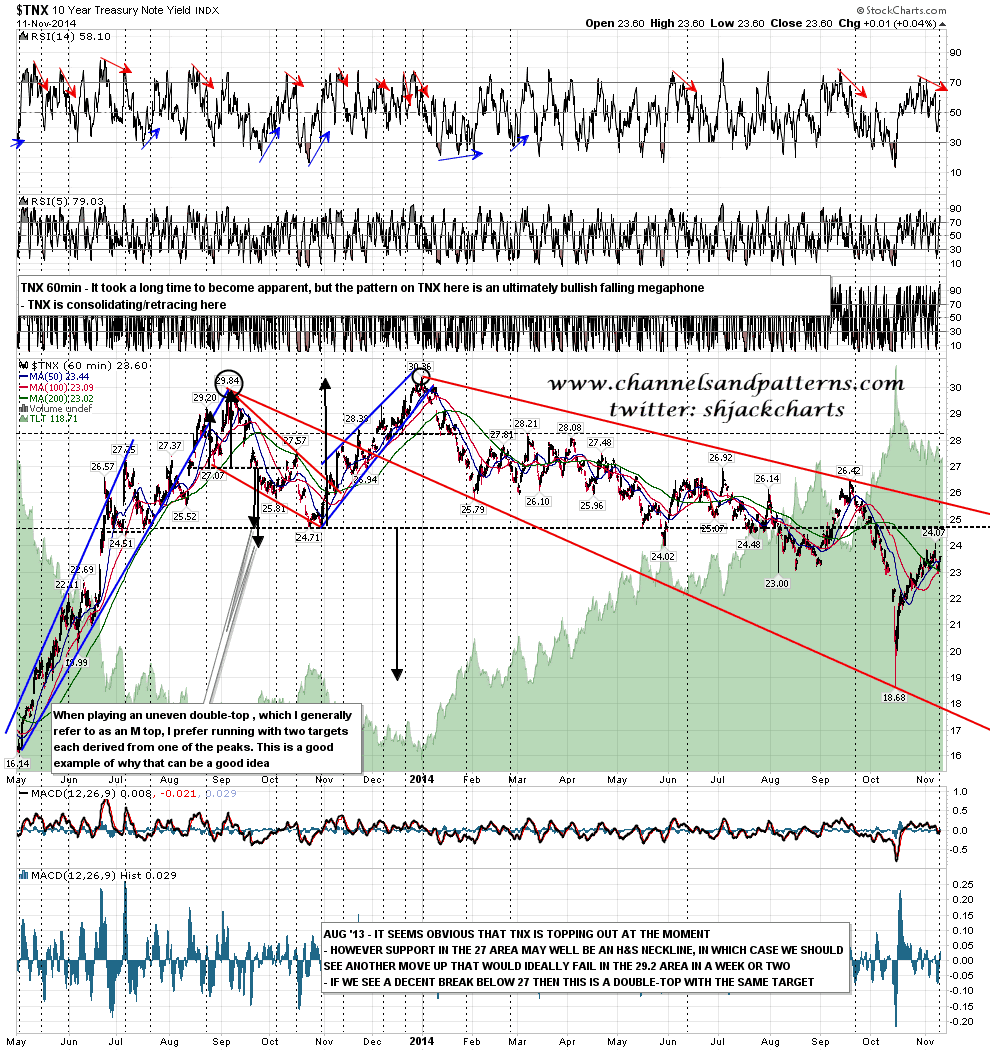

I’ve been giving some thought to the setup on bonds here and I think I have the overall pattern on TNX now. That should be a falling megaphone. Short term TNX is consolidating/retracing and then I’d expect a move to megaphone resistance in the 25.5 to 26 area. TNX might reverse and swing down again there, but probably more likely that it breaks up towards a full retrace of the move in 2014. That might of course require a retest of the lows first so a break over megaphone resistance might not be immediately bullish. TNX 60min chart:

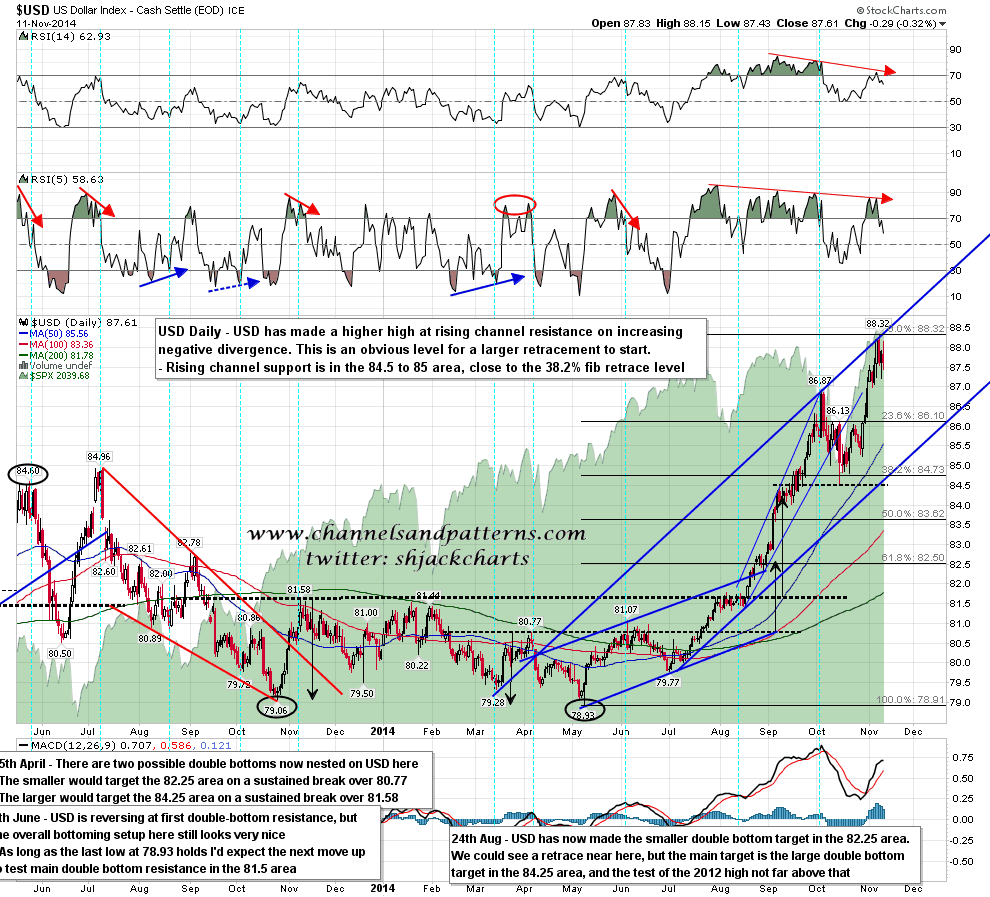

USD has rallied to a level which has retested rising channel resistance. This is the obvious level to start a retracement towards rising channel support in the 84.5 to 85 area, and lower if that should break. Negative divergence on RSI is very supportive of a retracement here and that is what I am looking for. USD daily chart:

I’m looking for retracement on equities here and given the strength of the uptrend into yesterday’s high, that could be fast and hard. I’ll be looking for support on SPX at the 50 hour MA at 2026 and if that breaks down hard then I’ll be looking for a move to the 2000 area.

This blog is not, and have never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more