Stock World Weekly - November 2, 2014

Here's an excerpt from Stock World Weekly -- the weekly newsletter of Phil's Stock World. This week, we discuss earnings, the end of QE, and the economy. Phil gives several trade ideas.

Excerpts:

The Week Ahead

Earnings season continues. 55% of S&P 500 companies have reported third quarter results (3Q). 72% beat earnings expectations and 54% beat revenue expectations. These figures are typical of any given quarter.

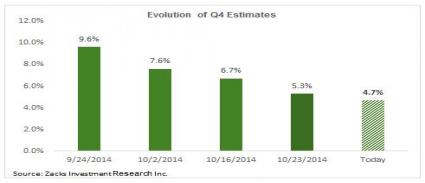

Guidance tells a different story. A majority of the S&P 500 companies have guided lower. Growth estimates for the current quarter, 4Q-14, compared to the same quarter last year, 4Q-13, have been decreasing from September 24 till today -- this is a common pattern (chart below)

Seraz Mian of Zack’s notes that the downward guidance is greater than usual: “In some aspects, the negative revisions trend for the current quarter is somewhat more pronounced than what we had seen at a comparable stage in the preceding reporting cycle.” (Q3 Earnings: The Halftime Report)

Notable earnings reports next week:

- Monday: AIG, GT Advanced Technologies, Herbalife, Hertz, LeapFrog, Marathon Oil and Sprint

- Tuesday: Activision, AK Steel, Alibaba, Burger King, International Paper, Jazz Pharmaceuticals, Priceline, SolarCity and TripAdvisor

- Wednesday: CBS, Noodles & Co, Qualcomm, Stratasys, Tesla, Tim Hortons, Whole Foods and Zillow

- Thursday: AOL, DIRECTV, El Pollo Loco, First Solar, Molson Coors, Orbitz, SouFun, Walt Disney, Wendy’s and Zynga

- Friday: Cooper Tire

Chipotle Mexican Grill (CMG $638.00)

Chipotle Mexican Grill is one of the fastest growing restaurant chains in America. Its popularity with young adults and teenagers is due to the high quality food ingredients and efficient production flow.

Chipotle released very strong third quarter earnings last week: revenue jumped 31.1% to $1.08 billion and earnings per share increased 56% year over year to $4.15 a share. While earnings were strong, shares sold off as the company reduced its outlook for 4Q. Investors are wondering whether Chipotle has the capacity to continue growing at the rate its been growing at over the past year.

As the company matures, analysts are looking to see how it responds to increased traffic flow in the restaurants, rising prices of ingredients such as beef and chicken, and whether it can keep the same brand popularity it has built up as it expands into new locations.

Based on the recent events, Phil likes the November $600 puts to establish a short position.

Weekend Reading

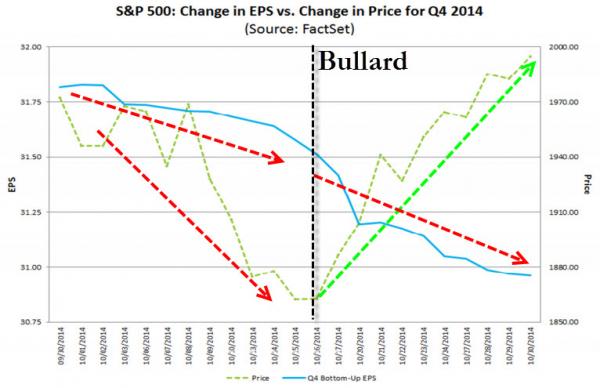

Zero Hedge reports that this quarter’s revision in analyst earnings estimates has been “more than double the average EPS downgrade of any quarter in the last 10 years.” Quoting Factset:

During the month of October, analysts lowered earnings estimates for companies in the S&P 500 for the fourth quarter. The Q4 bottom-up EPS estimate (which is an aggregation of the estimates for all the companies in the index) dropped by 2.7% (to $30.96 from $31.82) during the month....

During the past year (4 quarters), the average decline in the bottom-up EPS estimate during the first month of the quarter has been 1.3%. During the past five years (20 quarters), the average decline in the bottom-up EPS estimate during the first month of the quarter has been 0.6%. During the past ten years, (40 quarters), the average decline in the bottom-up EPS estimate during the first month of the quarter has been 1.8%. Thus, the decline in the bottom-up EPS estimate recorded during the course of the first month (October) of the fourth quarter was higher than the 1-year, 5-year, and 10-year averages.

However, most of the reductions to earnings estimates have occurred in the commodity-based sectors...

In terms of price, the value of the S&P 500 has increased by 1.1% (to 1994.65 from 1972.29) during the month of October. This marks the 7th time in the past 12 quarters that the bottom-up EPS estimate has decreased while the price of the index has increased during the first month of the quarter.

(Chart Of The Day: "It's Not About the Earnings" Edition)

As the US Central Bank, the Fed, decreases government spending on its monetary stimulus operations (QE), The Bank of Japan seeks to go all in. Toru Fujioka and Masahiro Hidaka of Bloomberg write that Japan seeks to boost stimulus as the Japanese economy struggles.

Bank of Japan Governor Haruhiko Kuroda led a divided board to expand what was already an unprecedentedly large monetary-stimulus program, boosting stocks and sending the yen tumbling.

Kuroda, 70, and four of his eight fellow board members voted to raise the BOJ’s annual target for enlarging the monetary base to 80 trillion yen ($724 billion), up from 60 to 70 trillion yen, the central bank said. An increase was foreseen by just three of 32 analysts surveyed by Bloomberg News. The BOJ also cut its forecasts for inflation and growth in Japan, the world’s third-biggest economy.

“It was great timing for Kuroda,” said Takeshi Minami, Tokyo-based chief economist at Norinchukin Research Institute, one of two who correctly forecast today’s easing. Minami noted that it follows the Federal Reserve’s ending of quantitative easing, helping highlight the differing paths for the U.S. and Japan, which has the heaviest debt burden of any country. (Kuroda Surprises With Stimulus Boost as Japan Struggles)

more