Stocks: Bigger Picture Showing Cracks

Global Growth And Earnings

Experienced investors know when the market swings wildly from day to day, that looks more like a corrective period than a stable attempt to stage a sustainable rally. Concerns include more than just the Fed. From Reuters:

The S&P 500 on Thursday posted its largest percentage decline in six months on concerns about the strength of the global economy and its effect on corporate earnings. The slide dragged the benchmark to below its 150-day moving average for the first time since November 2012. The selloff, which put the S&P 500 at its lowest since Aug. 7, followed weak data from Germany, Europe’s largest economy, and comments from a Fed official who suggested investors had unrealistic expectations about the Fed’s eventual rate increase.

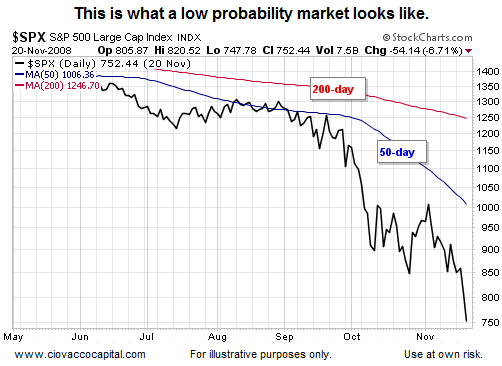

2008: Low Confidence Period

Using 2008 as a reference point, the slopes of the S&P 500’s 50-day (blue) and 200-day (red) were indicative of concerns about the economy and financial system.

Fast forward to October 2014 and we see small caps are showing a discernible shift in economic and systemic confidence. The profile of small caps is starting to deteriorate in a way not seen in 2013.

The broad NYSE Composite Index has dropped below its 50-day and 200-day moving averages. The NYSE Composite is also testing important support.

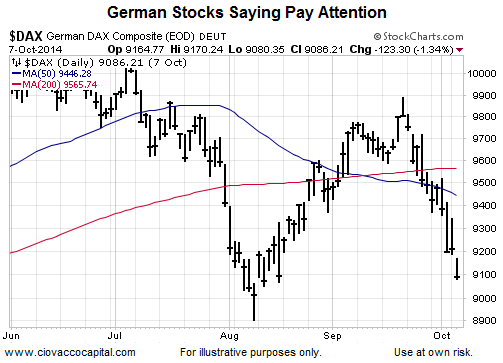

European Stocks Look More Vulnerable

Many investors believe the market’s recent bout of weakness is no different than any of the other shallow pullbacks in recent memory. The chart of the German stock market below does not agree with that characterization. The German DAX, which tends to zig and zag with the U.S. stock market, shows waning confidence in the European and global growth stories.

The German Horror Story

The chart above is a way to monitor the market’s perception of the German economy. The weakness in the chart aligns with recent data. From The Guardian:

German exports suffered the biggest monthly fall in more than five and a half years in August, leaving Europe’s largest economy in need of “a small miracle” to avoid recession in the third quarter…Germany’s economy shrank by 0.2% in the second quarter, so a second consecutive contraction in GDP in the third quarter would tip it into a technical recession. Carsten Brzeski, economist at ING, described the current situation in Germany as a “horror story”. He said: “The magnitude of the fall brings back memories of the peak of the financial crisis in early 2009. The economy seems to need a small miracle in September to avoid a recession in the third quarter.”

Investment Implications - The Weight Of The Evidence

The big picture may seem to have an “easy bearish bias” to it. It is not that easy. On one hand, this type of market is vulnerable; thus, the large cash positions we currently are holding. On the other hand, a market with this profile can also rally back toward the recent highs, even under a longer-term bearish scenario, which is why (a) we still have some equity exposure, and (b) have not made large bearish bets of any kind. The tweet below still applies heading into Friday’s session.

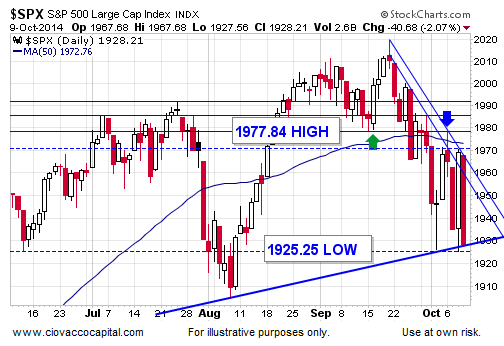

If the S&P closes below the recent intraday low of 1925, then our model will most likely call for additional defensive chess moves. From a neutral perspective, if 1925 holds, some patience remains in order. From a bullish perspective, if the S&P can reclaim 1978, and the key Fibonacci level of 1984, the odds of good things happening will improve.

Disclosure: None.