Swing Trade Tuesday's Narrow Range

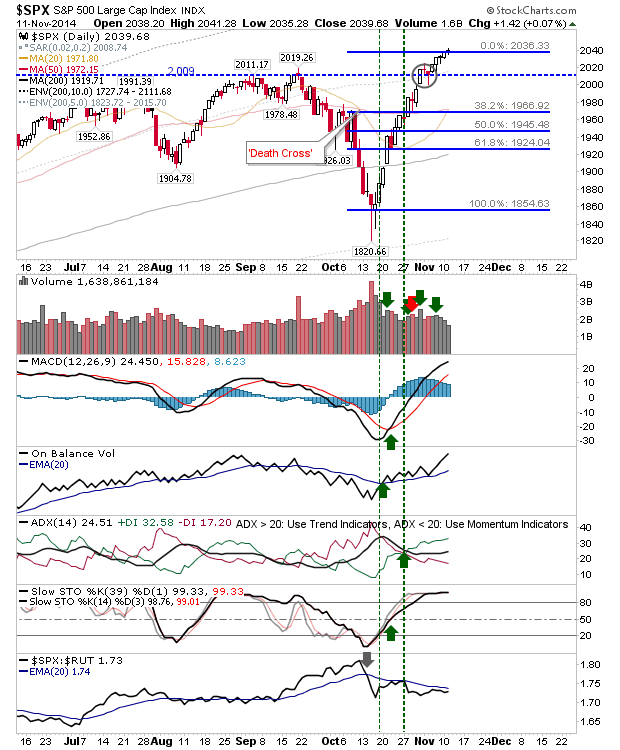

All indices traded themselves into very narrow ranges - offering the potential for a big move once today's high/low are breached. It's the kind of market where everyone is expecting the rally to collapse, but no one wants to make the first move. Which is why this rally will probably keep moving higher; even if all buyers are in, shorts will have to cover if there is another surge - which will bring more buyers in. One thing which is happening is the reduction in buying volume.

The S&P is unchanged.

The Nasdaq is indicating the slightest of breakouts from its handle. However, I wouldn't be shouting this from the top of the hill - it barely registers on a daily chart.

The Russell 2000 keeps its (tiny) breakout. Remains on course to test overhead resistance, and perhaps the index best placed for bulls looking for longs.

Tomorrow is another day. If the S&P breaks today's high/low in the first hour of trading, then the tone will likely be set for the day; trade in the direction of this break and watch for the counter move.

Disclosure: None.