The Lie Of Lehman Revisionism: A Bailout Shouldn’t Have Happened And Didn’t Matter

Here come the revisionists with new malarkey about the 2008 financial crisis. No less august a forum than the New York Times today carries a front page piece by journeyman financial reporter James Stewart suggesting that Lehman Brothers was solvent; could and should have been bailed out; and that the entire trauma of the financial crisis and Great Recession might have been avoided or substantially mitigatged:

What happened that September was the culmination of circumstances reaching back years — of ordinary people too eager to borrow, of banks too eager to lend and of Wall Street financial engineers reaping multimillion-dollar bonuses. Even so, saving Lehman from complete collapse might have shielded the economy from what turned out to be a crippling blow.

That is not just meretricious nonsense; it's a measure of how thoroughly corrupted by the cult of central banking has become the public discourse about the fundamental financial and economic realities of the present era. For crying out loud, yes, there would have been a Great Recession—even had Lehman been pawned off to Barclays with a taxpayer guarantee or if it had been bailed-out in some other manner.

In fact, the Barclay’s logo did end up on Lehman’s glass tower on 7th Avenue shortly after the September 15th screen shot below. Yet the decision to allow Lehman’s stock and bondholders to take a severe haircut first did not cause the thundering collapse of the housing and credit markets, nor the loss of the artificially bloated level of consumption spending, jobs and income that had accompanied the giant financial bubble that finally burst in September 2008.

The villain is the Greenspan Fed and the rampage of debt and speculation its cheap money and “wealth effects” coddling of Wall Street had engendered over the previous two decades. When Greenspan took office in 1987, total credit market debt outstanding was $12 trillion, but by the time of the Lehman event it was $52 trillion, meaning that the debt burden on the US economy had soared by 5X during a period when nominal GDP grew by only 2X.

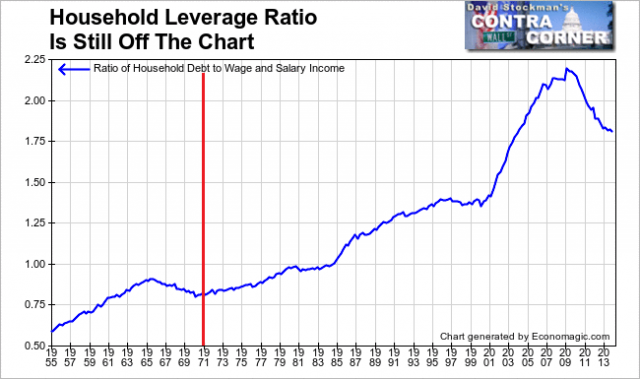

Moreover, within the household sector the explosion of debt was even more stunning owing to the Greenspan policies of cheap mortgage rates and the overt encouragement of American families to raid their home ATM machines. As shown below, household debt ballooned from just $2.7 trillion when Greenspan took charge of the Eccles Building in August 1987 to nearly $14 trillion on the eve of the crisis.

And there can be little doubt as to what explains the above mountain of household debt. American households were raiding their home ATM machines—-that is, cashing out the equity in their homes—-in order to indulge in a massive orgy of consumption spending that they had not earned. In fact, at the peak in 2005-2007, households were extracting cash from their ATM at nearly a $1 trillion annual rate, ballooning their disposable incomes by upwards of 8%. That is, they were buying flat screen TVs, granite kitchen counters, restaurant dinners and trips to the mall with money they hadn’t earned, and based on rapidly rising leverage ratios that couldn’t be sustained.

What caused the Great Recession, therefore, was the day of reckoning when the household borrowing mania reached its limit. As shown below, the swing in household spending from home ATM machines was massive and violent—–and at its peak extent between 2006 and 2010 amounted to a reversal of nearly $1.4 trillion. Yes, when an gigantic, artificial spending bubble of this magnitude is pricked, the repercussions do cascade through the Main Street economy taking down sales, jobs and incomes as they go.

Accordingly, the chart below explains the Great Recession, not some revisionist gumming up the bowels of the New York Fed as to how the economy could have been “saved” if only Tiny Tim Geithner had gotten the word on Sunday evening September 14th that Lehman was “solvent” after all. In fact, the name on the single glass tower above had nothing to do with crash of household borrowing from upwards of 40 million home ATMs pictured in the graph below.

Moreover, what caused the recession to be so painful and deep is that the phony prosperity of the Greenspan era could no longer be fueled by pushing households deeper into debt. By the fall of 2008, “peak debt” had been reached in the household sector, and a modest deleveraging was begun owing to upwards of $1 trillion in mortgage defaults. But this wasn’t a recoverable loss of “aggregate demand” per the Keynesian mantra at the Bernanke Fed. The American economy was drastically squeezed by the Great Recession because mortgage-fueled spending was being liquidated all across America, not because punters in Lehman stock and bonds lost their shirts, and deservedly so.

In short, the Great Recession was about the abrupt end of the great financial party conducted by the Maestro during which the nation underwent a collective LBO, raising its leverage ratio from a historically sound and sustainable 1.5X national income to 3.5X on the eve of the Lehman collapse. Those two extra turns of debt amounted to $30 trillion at the time the US economy buckled in 2008 and were a measure of both the folly of the Greenspan/Bernanke spending party that had been previously financed by the Fed’s cheap money policies, and the enormity of the adjustment that was brought to bear on the US economy when the bubble finally collapsed.

Not surprisingly, upwards of $10 trillion in household wealth was destroyed by the financial crisis and recession which followed. But given the enormous inflation of housing prices and risk asset values which had been driven by the debt bubble, it is ludicrous to suggest that save for not saving Lehman, the housing crash pictured below would not have happened. In fact, between late 1994 and early 2006 home prices in America rose each and every months for about 125 straight months, rising by nearly 140% over the period.

Needless to say, the above wasn’t sustainable and didn’t reflect either the free market at work or greed running rampant in the towns and cities of America. It was the cheap money and Wall Street coddling policies of the Fed which generated the housing binge, and the gambling hall known as Lehman Brothers that had gone along for the ride.

Disclosure: None.