This Week’s Sizemore Insights: Hunting For Global Value

Here is a statement of the obvious if there ever was one: The market doesn’t always do what it’s supposed to. Expensive markets are supposed to correct, and cheap markets are supposed to rally as both revert to their long-term averages. But there are long stretches of time where expensive markets get even more expensive and cheap markets get even cheaper.

In the short term, valuations really don’t matter because, as Benjamin Graham noted, the market is a voting machine ruled by emotions. But Graham also believed that over longer stretches, the market is a weighing machine that assigns the “correct” value. This is the rationale for value investing, and it’s something I firmly believe in.

We can’t know ahead of time what the market will return over the next five years, but we certainly can look at some hypotheticals based on history. In The Next Ten Years, I shared estimates compiled by Rob Arnott at Research Affiliates that used today’s cyclically-adjusted price/earnings ratios (“CAPE”) and forecasted returns based on earnings and a regression to the long-term average valuation. Today, I’m going to share estimates by Wellershoff & Partners Ltd that add an additional wrinkle. Wellershoff adds a “macroeconomically fair CAPE” to the mix, which takes into account interest rates, inflation rates and economic growth.

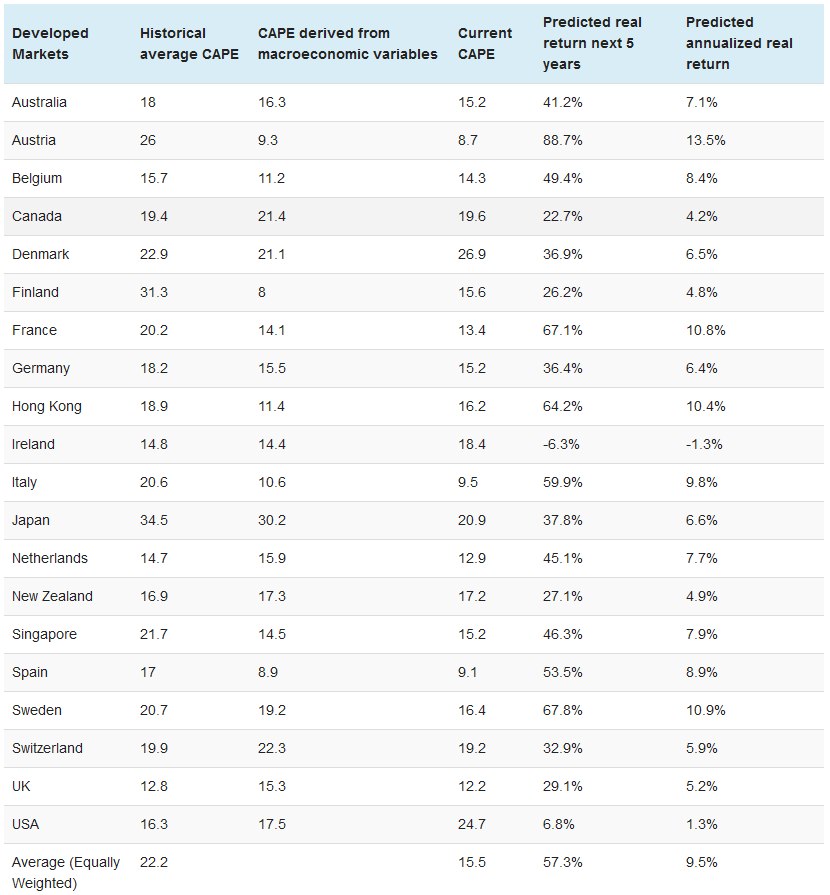

Let’s start by digging into the developed world markets:

With the exception of tiny Denmark, the United States is the most expensive developed market in the world with a CAPE of 24.7. The long-term average is just 16.1…and a “fair” CAPE that would adjust that long-term rate for today’s interest, inflation, and growth rates would be 17.5. Starting at these levels, the U.S. market is priced to deliver returns of about 1.3% over the next five years.

Do I expect the S&P 500 to deliver exactly 1.3% per year over the next five years? Absolutely not. It could be much higher…or much lower. But that 1.3% figure gives us a rough gauge of what to expect as a “reasonable” return at today’s prices. (Arnott, by the way, came up with a figure of 0.7%.)

Austria, France, Hong Kong and Sweden are all priced to deliver double-digit annual returns, and Italy and Spain are not far behind. But most of the developed world is priced to deliver returns in the mid single digits. That’s not particularly great, but it’s not terrible.

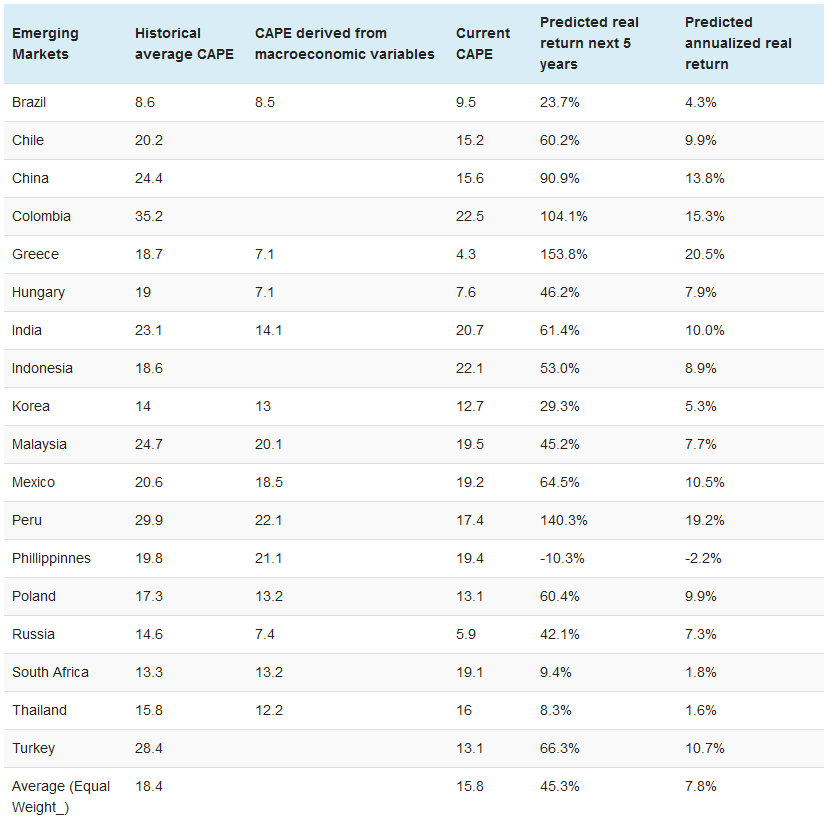

Now, let’s take a look at emerging markets:

Here we see a very mixed bag. China, Colombia, Greece, India, Mexico, Peru and Turkey are all priced to deliver double-digit annual returns. And the implied returns in Greece and Peru are a jaw-dropping 19% and 20%, respectively. But many emerging markets are priced to deliver returns in the mid-to-low single digits, which isn’t enough enticement to justify taking the risk that comes with emerging markets.

There are several major caveats here. Data for China, Colombia, Hungary, Peru and Russia goes back only to the mid 2000s, making historical comparisons weak. And Wellershoff’s macroeconomically “fair” adjustments have a huge impact on the expected returns calculations for Greece, Hungary, India, Peru and Russia. We have to take these with a healthy grain of salt and look at each country on a case by case basis.

We also have to consider the impact that currency moves will have on American investors. For example, Brazil and South Africa look pretty expensive by Wellershoff’s estimates, but U.S. investors could still profit very handsomely if the Brazilian real and South African rand recoup some of their losses of the past four years. I consider that not only possible but very likely, in fact.

Still on balance, this gives us a nice starting point for a top-down valuation analysis.

My portfolios currently have a strong international bias. Given the valuations we see here, I don’t expect that to change any time soon.

more

Comments

No Thumbs up yet!

No Thumbs up yet!