Thrilling Thursday - New Highs Posted, Yellen Promises More QE

Before the US markets opened yesterday, things looked pretty grim and our morning Futures shorts (see yesterday's post) did well but rumors of even more QE and surprisingly good earnings from Macy's (M) turned things very quickly around, as you can see from this short Dave Fry video on XRT. This morning we have disappointing earnings from WMT and a big guide-down by CSCO and, once again, we went with shorts on the Futures (see morning tweet) - but from higher ground.

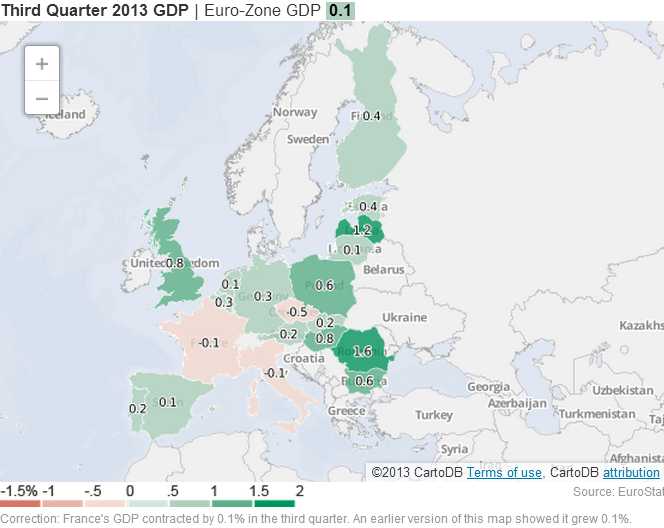

Now that Yellen's opening statement is pre-released, we can focus on what will happen next, which is the GOP Senators will attempt to tear her to shreds and try to tear down the administration by criticizing Government policy through the Fed. If that fails to spook the markets off their new highs, we have oil inventories at 10:30 after 9:45's Consumer Comfort Index and we've already seen poor GDP numbers in Europe (20% of the Global Economy) as well as turmoil in Japan while China's swap rates are rising again as Local Governments pile on $1.7Tn of debt in their "expansion."

Nomura sees the Nikkei falling back to 12,000 (down 20%) if the Government doesn't do MORE to persuade investors that it's economic stimulus efforts will succeed. Japanese equities are still the best performers among developed markets this year, with the Nikkei 225 and broader Topix index rising 40 percent through yesterday. Overseas institutional investors have poured $108.5 billion into Japanese stocks this year, the most among 10 Asian markets tracked by Bloomberg. (Charts from Zero Hedge)

Japanese companies eased off on capital spending in the July-September period and failed to step up exports even amid weakness in the yen, Government data showed today. Economic growth slowed to an annualized 1.9% from 3.8% the previous quarter, with the gain relying on government spending and an accumulation of inventories.

Twenty-five of 34 economists including those at Goldman Sachs Group Inc. and UBS AG expect the BOJ to add to easing in the first half of next year, according to a Bloomberg survey carried out Oct. 23-28. The average target for the Nikkei is 18,000 next year!

Like all the great industrialized nations these days, Japanese Corporate Profits are being sucked out of the wallets of their workers with Labor Compensation Growth turning NEGATIVE in Q3. Like the US, if Corporate Citizens get richer while flesh and blood Citizens get poorer - it all evens out, right?

Not surprisingly, with the bottom 90% getting poorer and poorer while an endless supply of free money is being pumped into the top 10%, we have a slumping base of consumer demand that is spreading across the planet. Sales at upscale Macy's may have looked good but downscale WMT only managed to grow sales 1.6% but grew earnings 2.8% by keeping the squeeze on suppliers and, of coruse, workers. They did such a good job of not compensating their workers that US same-store sales were off 0.3% as their own employees can no longer afford to shop at Wal-Mart.

An MSM-ignored Congressional Report this year noted that just one, single WMT "Super-Center" in Wisconsin required $900,000 in Government assistance as their "employees" (technically not slaves if you pay them), although working full-time, were paid so little that they still needed school lunch programs to feed their children and low-income energy assistance to pay their utility bills and food stamps to feed the family and various forms of housing and health assistance - just enough to keep them alive enough to show up at Wal-Mart the next day and stock the shelves.

On a chain-wide basis, it requires an estimated $1.7Bn per year to subsidize WMT's strategy of finding every possible way to pay their workers as little as humanly possible and still call it a job. $1.7Bn is, by the way, less than 1/3 of the $5.4Bn in dividends WMT pays to it's sharholders who, coincidentally, are most popularly named "Walton" - the same name as the richest family on Earth - what a coincidence!

That's YOUR tax Dollars, being taken out of YOUR wallet to subsidize a transfer of wealth to the Walton family while the 2M+ people who work for them have the lowerst standard of living of all the "working" people in America. The other $500Bn Americans spend shopping at WMT is mostly shipped out of the country to support foreign manufacturing at the expense of millions of other US jobs. THIS is what is wrong with America - it's very simple.

The other thing that's wrong with America is what is being celebrated by the markets today and the actions of Central Banksters around the World are nothing more than a stealth-bailout for their Bankster Masters although, as you can tell from Financial Earnings Reports, they no longer need the bailouts - but who ever wants to stop getting free money once it starts?

Hans-Werner Sinn of the IFO Institute has come down hard on the shenanigans going on in Europe and Acting Man does a nice job of outlining the incrediible risks we are taking with Global Finances:

Hans-Werner Sinn is perfectly correct in pointing out that the ECB's attempts to restore the 'monetary policy transmission mechanism' by suppressing interest rates in the periphery is going to perpetuate capital malinvestment and delay the necessary reforms. He is also correct when he states that these interventions have actually scared private capital away, as investors require adequate compensation for the risks they are taking. Meanwhile, savers are ultimately paying for this ongoing waste of scarce capital.

It is high time that central banking is recognized for the disease it is. Without central banks aiding and abetting credit expansion, this situation would never have arisen. Even a free banking system practicing fractional reserve banking could not possibly have created such a gigantic boom-bust scenario. Money needs to be fully privatized – the State cannot be trusted with it.

We'll see today if our own Senators are as critical of Central Banking policy but I doubt it - the goose that's laying these golden eggs for the top 10% is a fragile creature and easily spooked. This has been our shorting premise of the last two weeks. It's now crunch time with the markets at new highs in anticipation of even more malinvestment as another year's worth of would-be savers are forced to gamble on runaway markets to keep up with the inflation that the Government is denying.

Should be fun!

The material presented in this commentary is provided for informational purposes only and is based upon information that is considered to be reliable. However, neither Philstockworld, LLC (PSW) nor ...

more