US Industrial Output Slumps In October

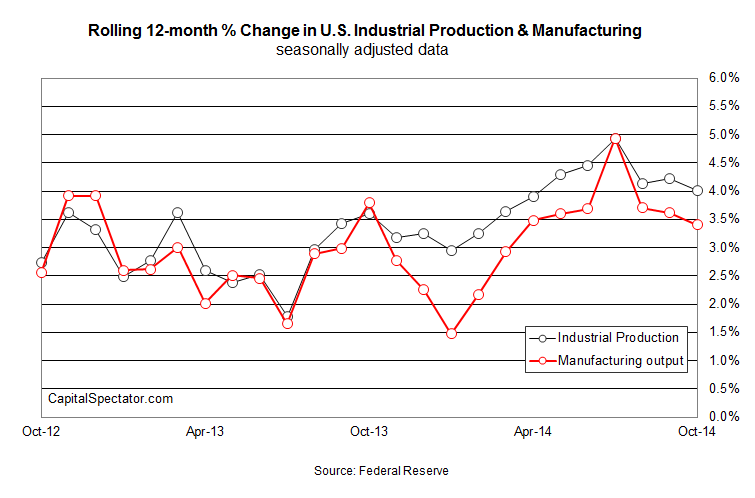

Industrial activity dipped 0.1 percent last month, clawing back a portion of the 0.8 percent rise in the previous month, the Federal Reserve reports. The slump surprised analysts, who were expecting a 0.3% gain, according to Econoday.com’s consensus forecast. The manufacturing component, however, posted a modest 0.2% rise, which tells us that last month’s weakness wasn’t broadly based. Nonetheless, the soft numbers in October weighed on the year-over-year trend, leaving industrial production rising 4.0% — the slowest pace in six months.

“With the big print in September, you need a little bit of payback,” reasoned Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott. It’s unclear if additional rounds of “payback” are coming, but for now it’s fair to say that the trend in industrial output is decelerating.

The summer peak that witnessed a 4.9% expansion rate now looks like ancient history. It’s debatable if the heightened worries about the global economy represent a serious threat to the US business cycle, but today’s report on industrial output will sharpen the focus on the potential for trouble.

One reason for thinking that the October slide in the headline data may be noise: the upbeat outlook via recent business surveys. The Markit US Manufacturing Purchasing Managers Index for last month, at 55.9, was well above the neutral 50.0 mark. Although this benchmark slipped to a nine-month low, the overall message in the PMI data is that moderate growth prevails.

“The latest figures indicate that the [manufacturing] recovery has lost some intensity at the start of the fourth quarter, reflecting subdued export demand from the euro area and key emerging markets,” said Markit’s chief economist, Tim Moore, in a Nov. 3 press release. “Meanwhile, a solid rate of manufacturing job creation was sustained in October, which provides an early indication that domestic labour market conditions have continued to strengthen through the final quarter of the year.”

Moore’s analysis is generally supported in today’s hard-data update on industrial activity, which reflects modest growth in the core manufacturing sector with weakness otherwise. Nonetheless, the wobbly state of economics elsewhere in the world, including today’s news that “Japan’s economy unexpectedly shrank for the second consecutive quarter,” creates headwinds for the US. For now, however, the fallout is limited to slower growth relative to the past several months.

If there’s a darker future lurking in the distance, we’ll see the evidence in the next batch of reports, starting with Wednesday’s monthly update on US housing starts. The crowd’s looking for a slight gain in new residential construction for October. Of course, that was also the now-defunct assumption for today’s numbers.

Disclosure: None.