U.S. Stocks Fall On Risk-Off Mood; Russell 2000 Dives As Small Caps Take A Tumble

U.S. stocks stalled near record highs and declined Wednesday amid risk-off sentiment on fears that red-hot CPI readings triggered by supply chain snags could complicate the recovery and force the Federal Reserve to withdraw stimulus much more quickly.

At the market close, the S&P 500 slipped 0.26% to 4,688, while the Dow Jones Industrials fell 0.58% to 35,931, weighed down by a 4.7% drop in Visa shares after Amazon said it will stop accepting UK-issued Visa cards as a form of payment starting early next year. For its part, the Nasdaq 100 wobbled for much of the day, but when it was all said and done, the tech index managed to eke out a small 0.06% gain to end the session at 16,310. Meanwhile, the Russell 2000 plunged 1.16% to 2,377 on concerns that persistent inflation will hurt margins for small caps, which generally tend to have less pricing power (SPX, DJI, NDX, IWM).

Image Source: Unsplash

Although the market mood has been positive of late, many investors are increasingly worried about elevated price pressures and their impact on the economy. The concern was compounded this morning following feeble home construction data. According to the U.S. Census Bureau, October housing starts fell 0.7% on a seasonally adjusted basis to 1.52 million, disappointing consensus forecasts as builders delayed new projects amid rising material costs, difficulties to source supplies and continued labor shortages.

Although residential investment accounts for only a small fraction of GDP, softness in this category suggests that the recovery is becoming more uneven.

In any case, despite the pullback, the bullish narrative hasn’t changed materially heading into year’s end. Solid corporate earnings, constructive profit guidance, dovish outlook for monetary policy, negative real interest rates, and strong institutional/retail flows amid FOMO mentality are all tailwinds for the equity market. For this reason, it wouldn’t surprise if dip-buyers took this opportunity to add to positions in coming sessions, fueling a solid rebound, and propelling stocks to fresh highs in the near term.

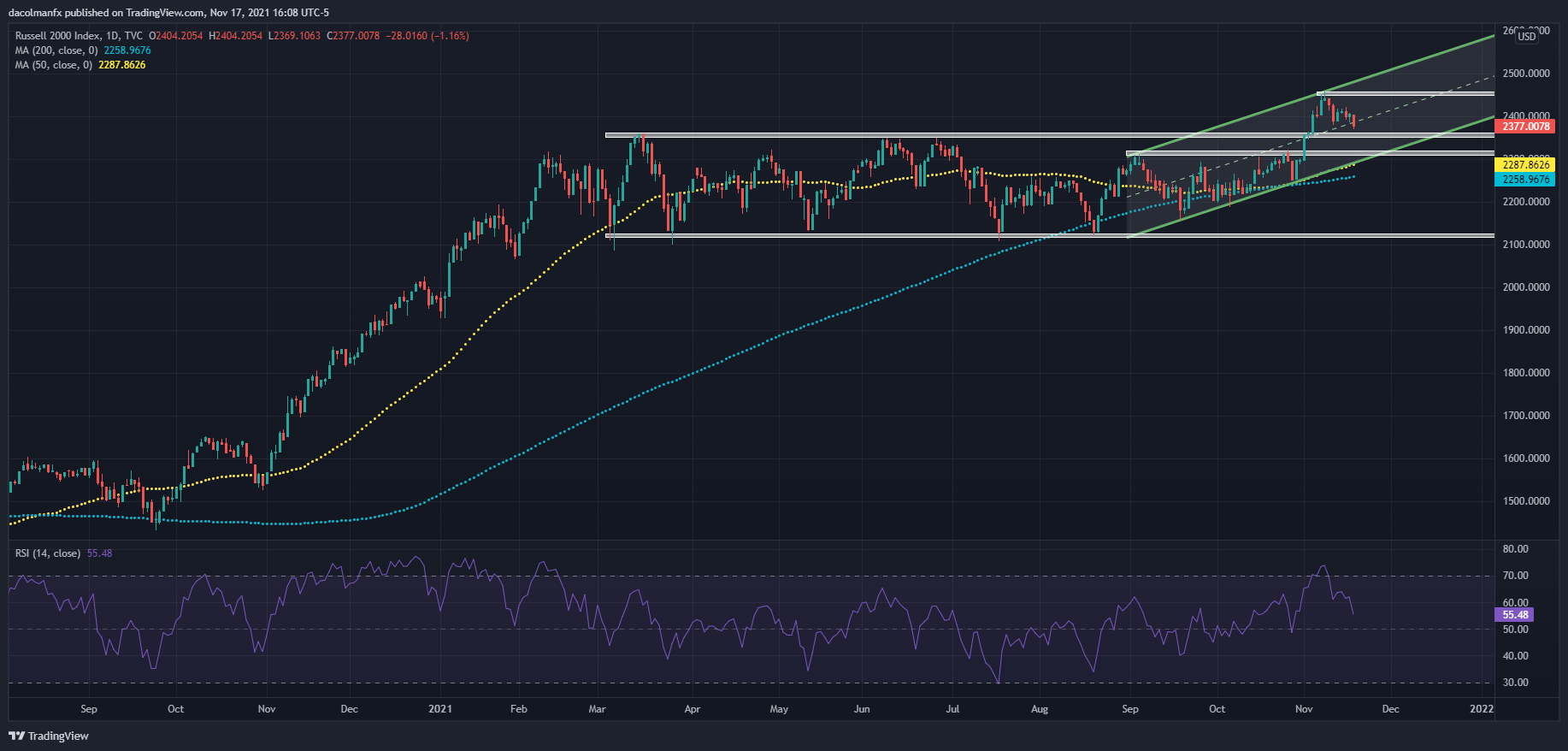

RUSSELL 2000 Technical Outlook

Russell 2000 has failed to sustain upside momentum after finally breaking out of consolidation and breaching the March high earlier this month. As the daily chart shows, the small and mid-cap index briefly rallied to a new all-time last week but stalled at channel resistance prior to retracing some of its November gains. Despite this pull-back, the near-term bias points higher, but for the bullish scenario to play out, the price must remain about the 2,350 area. If the range breakout holds, the Russell 2000 could soon be on its way to retest its record near 2,459, before aiming towards the 2,500 psychological level.

On the flip side, if selling pressure accelerates and the Russell 2000 falls below 2,350 on a daily closing basis, sentiment could sour in the blink of an eye, allowing sellers to retake control of the market and trigger a move towards cluster support near 2,310, where the lower boundary of a short-term ascending channel converges with the 50 day-moving average.

RUSSELL 2000 Technical Chart

(Click on image to enlarge)

Disclaimer: Riki nema disclaimer.

Comments

No Thumbs up yet!

No Thumbs up yet!