USDCAD: Trading The Move Higher

On November 3 2021 I posted on social media @AidanFX “ USDCAD can still push higher as long as price stays above 1.2351. Will be looking for buying opportunities. “

Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Candlestick patterns, etc.), price action analysis (Support & Resistance, Supply & Demand Zones, Fibonacci retracements, etc.) and indicators (RSI, Moving Average, Stochastic, etc.) are technical strategies/techniques used when trading a confluence setup. The charts below show a confluence trade setup that signals a trader on which side to take the trade.

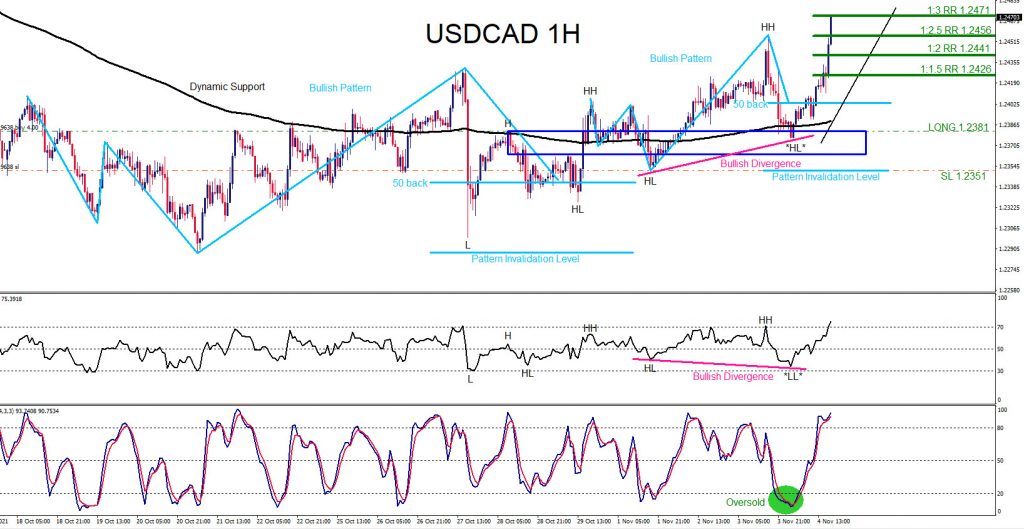

USDCAD 1 Hour Chart Nov 3, 2021

(Click on image to enlarge)

BUY Trade Setup

- Bullish harmonic pattern triggered BUY at the 0.50% Fib. retracement level (Light Blue)

- Price entered the Support/Resistance Zone (Dark Blue)

- Dynamic Support 200 MA (Black)

- RSI Bullish Trend Continuation Divergence (Pink)

- Stochastic (Oversold)

Entered the BUY trade at 1.2381 with Stop Loss at 1.2351 and Targets at the 1:1.5 RR minimum with full target at the 1:3 RR. USDCAD moves higher and on November 4 2021 price hits 1:3 RR target at 1.2471 from 1.2381 for +90 pips (+3% gain risking 1% on every trade)

USDCAD 1 Hour Chart Nov. 4, 2021

(Click on image to enlarge)

Like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade.

Disclaimer: Riki nema disclaimer.

Comments

No Thumbs up yet!

No Thumbs up yet!