What Bears Want To See Friday

Market’s Reaction Matters Most

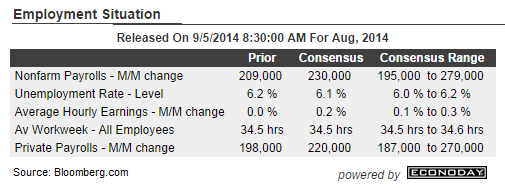

If someone gave us Friday’s labor figures during Thursday’s trading session, they may not be that helpful. Even if we had the numbers, it would be very difficult to predict how the market would react to them during Friday’s session. Therefore, it is best to take a wait and see approach when it comes to non-farm payrolls. For the record, the Bloomberg consensus forecast is for 230,000 jobs.

Hurdles For Stock Bears

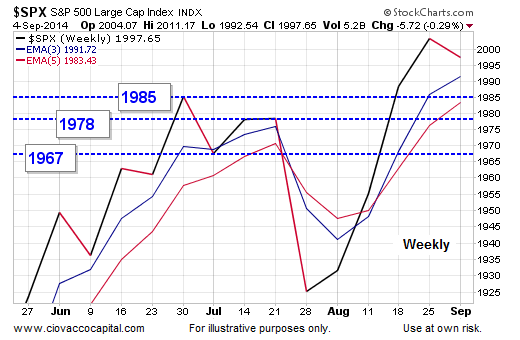

For the economic and equity bears to make some meaningful progress after Friday’s payroll report, the S&P 500 would have to close below one of the three weekly levels shown below. Therefore, the minimum decline needed by the bears Friday would be for the S&P 500 to drop 13 points. A decline of 12 points would allow the S&P 500 to close above the June weekly closing high of 1985 and change (see below).

ECB Expands Stimulative Measures

With the Fed reducing stimulus and the European Central Bank (ECB) increasing their deflation-fighting measures, we will be keeping a closer eye on the impact of the euro’s value in the coming months. The ECB got the attention of the currency markets Thursday. From The Wall Street Journal:

In an effort to keep too-low inflation from derailing the eurozone’s weak economy, the European Central Bank surprised financial markets with a cut in interest rates and new stimulus plans, despite opposition from Germany’s powerful central bank. The ECB lowered its main lending rate by 0.10 percentage point to 0.05%. It cut a separate rate on bank deposits deeper into negative territory, to -0.2% from -0.1%…The central bank also announced it will purchase covered bank bonds and bundled loans known as asset-backed securities and said further details will be released in October. Mr. Draghi didn’t indicate a size for the program, but said the ECB’s aim was to get its balance sheet, currently around €2 trillion, back to its size at the beginning of 2012, when it was €2.7 trillion.

Investment Implications – The Weight Of The Evidence

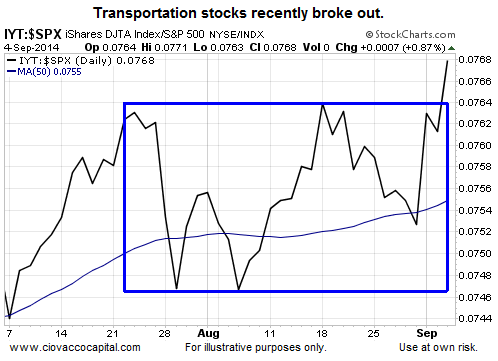

With the S&P 500 down 5 points this week as of Thursday’s closing bell, the reaction to Friday morning’s payroll numbers could decide if the final weekly tally is green or red. We have not learned much since Labor Day. Therefore, we have been patient and continue to hold U.S. stocks (SPY), leading sectors, such as transportation stocks (IYT), and a small stake in bonds (TLT).