Winners And Losers In AT&T’s Acquisition Of DirecTV

After a few weeks of rumors, on Sunday AT&T (T) confirmed its $95/share offer for DirecTV (DTV). The deal will be part stock and part cash, and is expected to close within 12 months if the deal meets regulatory approval.

Such a large acquisition should have a significant impact on both of these companies as well as their competitors. Though it will likely take years to measure the complete impact of this acquisition, here are my thoughts on the winners and losers from this deal.

Winner: DirecTV Shareholders

I recommended investors buy DirecTV back in September when the stock was trading at ~$59/share. At ~$95/share, shareholders are getting a good price for the stock, and a great return if they bought last fall. While DTV generates great free cash flow and has strong growth opportunities in Latin America, satellite TV subscribers in the U.S. have been in decline. For DTV to grow profits significantly in the future, it needs to be able to bundle its services with broadband internet, which T can deliver.

T is paying a 22% premium to where DTV stock was before the first news of the merger broke. That’s a fairly significant premium, and while I think DTV might end up justifying that investment (more on that soon enough), $95/share is probably higher than the stock would reasonably be valued at on its own, as evidenced by the fact that the stock currently trades ~$10 lower than that price on fears that the merger won’t be approved or that T’s stock will drop to in reaction to the overpayment.

Specifically, $95/share implies that the company will grow after-tax profit (NOPAT) by 4% compounded annually for eight years. 4% NOPAT growth for eight years is not an especially high expectation, but considering the increasing number of people abandoning TV services altogether it might have been difficult for DTV to hit on its own. DTV shareholders should cash in on the opportunity to get such a good price for their shares.

Winner: M&A Bankers

Investment bank Lazard Ltd. (LAZ) has been hired by T to advise on this acquisition and looks to be in line for a $40-$60 million payday, reports Reuters. Whoever advises DTV could earn between $50-$75 million. These are just advisory fees. Whoever finances the debt portion of the acquisition should receive a nice payday as well.

Just as many speculate this deal was prompted, or at least encouraged, by the Time Warner (TWC) and Comcast (CMCSA) merger, it should encourage other acquisitions as well. For starters, Dish Network (DISH) now looks increasingly like it needs its own partner to succeed, with Verizon (VZ), Sprint (S), and T-Mobile (TMUS) all being discussed as potential options. Meanwhile, the deal might also enhance the chances of an S and TMUS merger passing regulatory scrutiny.

Loser: Comcast

With the acquisition of DTV, T would become a much more substantial competitor to CMCSA. The acquisition would give it inroads to market its U-Verse broadband service to DTV’s 20 million U.S. subscribers. DTV’s services, especially its exclusive channels like NFL Sunday Ticket, also allow T to present a much more attractive bundle to consumers.

T has shown its commitment to competing in broadband by announcing its intention to expand its services to an additional 15 million homes in rural locations, on top of the 8.5 million new locations and speed upgrades it had already committed to.

I put CMCSA in the Danger Zone in February soon after the TWC deal was announced. This deal reaffirms my belief that CMCSA is in trouble long-term. The cable giant has been operating with near monopoly power in many markets for years, but the combined T and DTV should be a viable competitor now in many areas.

Still A Loser: AT&T

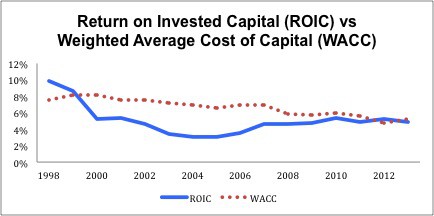

There’s a lot about this merger that I like for T, but also there are some significant concerns. I think this acquisition is a good strategic move for the company, but it will require great execution, and T’s management has given investors little reason to be confident in its ability to allocate capital efficiently over the years. Figure 1 shows how T’s inability to earn a healthy return on invested capital (ROIC) over the past 15 years. Investors hoping that some day this underwhelming performance may end are naive. The M&A in the telecom space this year strongly suggests that companies like CMCSA, T and VZ will never be the value creators investors once believed them to be. None of the deals widens the moats of any of these businesses. Though these companies are not heavily regulated like utilities, I believe that advances in technology have greatly diminished their once formidable competitive advantages and their ROIC potential. They are more like dinosaurs from a bygone era hoping to delay their entropy by increasing their size via M&A.

Figure 1: Failing To Create Economic Value For Shareholders

Sources: New Constructs, LLC and company filings

That said, there are a few things to like about this particular deal.

Including DTV’s debt and cash on hand, T is paying roughly $68.5 billion for DTV. In 2013, DTV generated $3.6 billion in NOPAT, which equates to an ROIC of 5.3% for AT&T’s $68.5 billion investment. 5.3% is slight improvement over T’s current ROIC of 4.9%. However, neither ROIC is very good.

Too often companies make acquisitions that are accretive to reported earnings but dilutive to economic earnings, so it’s encouraging to see T make a deal that, at least at first, should increase ROIC.

Management is guiding to $1.6 billion in cost synergies based on increased scale in video. Since this estimate is coming from the company itself as it’s trying to sell shareholders on the acquisition I would expect it to be on the high end, but significant savings based on the increased video scale do seem likely.

I also like, as I mentioned above, the strategic opportunity for T to market its broadband (and mobile) services to existing DTV subscribers. The expansion of T’s broadband to 15 million new customer locations in rural areas should present a good opportunity, as many DTV subscribers live in rural areas where neither cable nor internet services are available.

Finally, I like the foothold in Latin America this deal gives T, as DTV has nearly 18 million subscribers in the region through its various subsidiaries. DTV continues to grow rapidly in the region, and T could leverage these subscribers to expand its own broadband and mobile services.

So, there’s a lot to like in this merger. Unfortunately, there is the elephant in the room: a track record of inability to earn adequate returns on invested capital. The DTV deal is a major outlay of capital.

In addition, T has the 15 million home expansion of its broadband services into rural areas, sure to be expensive, and the already planned expansion and upgrades of its broadband services. On top of all this, T plans to spend up to $9 billion at the low-frequency spectrum auction next year, and it also will spend a significant amount in a higher frequency AWS spectrum auction. This amount of capex is rather large a company with very little excess cash, $100 billion in total debt, $35 billion in deferred tax liabilities, and $33 billion in underfunded pension plans.

One also has to worry that the increased focus on broadband and video might harm the company’s efforts in its wireless segment, which still accounted for 76% of segment operating income in 2013.

Finally, there are major strategic concerns due to the fact that pay TV services are under threat from low-cost services/substitutes like Netflix (NFLX), Hulu, and others. T is sinking a great deal of money into what looks to be a declining business. For this deal to create value, T needs its service packages to make inroads against CMCSA and TWC while keeping costs to a minimum and exploiting the growth potential in Latin America.

Simply put, I don’t have much faith in T’s management to execute on such a monumental task. As mentioned above, management’s capital allocation track record as evidenced by the firm’s ROIC (Figure 1) is poor. In the 21st century, T has never earned an ROIC above 5.4%. Competitor VZ, on the other hand, earned a 9% ROIC in 2013. If AT&T does not generate better returns on the huge amount of capital they are deploying now and in the foreseeable future, shareholders will not be happy.

Moreover, AT&T’s stock is not cheap after this deal. Factoring in the impact of the increase in shares and debt, T will need to grow NOPAT by 6% compounded annually for 11 years to justify its ~$36/share valuation. The DTV acquisition should provide a nearly 30% bump to NOPAT in year 1, but the question is whether T can follow that up with consistent growth for the next decade.

This deal adds to the risk in T while the expensive valuation of the stock presents little upside reward. DTV shareholders should sell now, take the money, and run. AT&T investors should do the same. There are better values in this market, and this deal could just as easily prove disastrous for T as it could be beneficial.

Disclosure: David Trainer, André Rouillard, and Sam McBride receive no compensation to write about any specific stock, sector or theme.